Aeron Composites Share Price Target Tomorrow 2025 To 2030

Aeron Composite Limited, established in 2011 and headquartered in Ahmedabad, is a leading manufacturer and supplier of Fiber Reinforced Polymer (FRP) products. The company offers a comprehensive range of FRP solutions, including pultruded products, molded gratings, and rods, tailored for various industrial applications. These products are known for their corrosion resistance, lightweight properties, and durability, making them suitable for industries such as telecommunications, oil and gas, renewable energy, and chemicals. Aeron’s state-of-the-art manufacturing facility spans approximately 26,320 square meters and is ISO 9001:2015 certified, ensuring high-quality production standards. Aeron Composites Share Price on BOM as of 7 May 2025 is 127 INR.

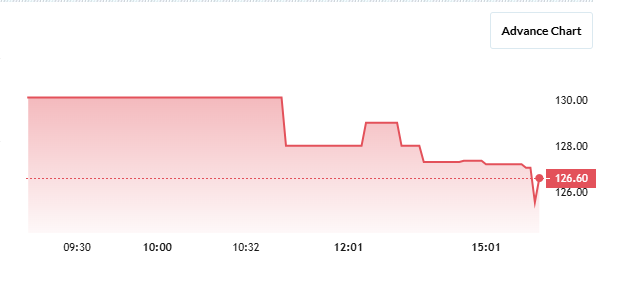

Aeron Composites Share Market Overview

- Open: 130.10

- High: 130.10

- Low: 125.55

- Previous Close: 130.70

- Volume: 40,000

- Value (Lacs): 50.64

- 52 Week High: 202.20

- 52 Week Low: 112.70

- Mkt Cap (Rs. Cr.): 215

- Face Value: 10

Aeron Composites Share Price Chart

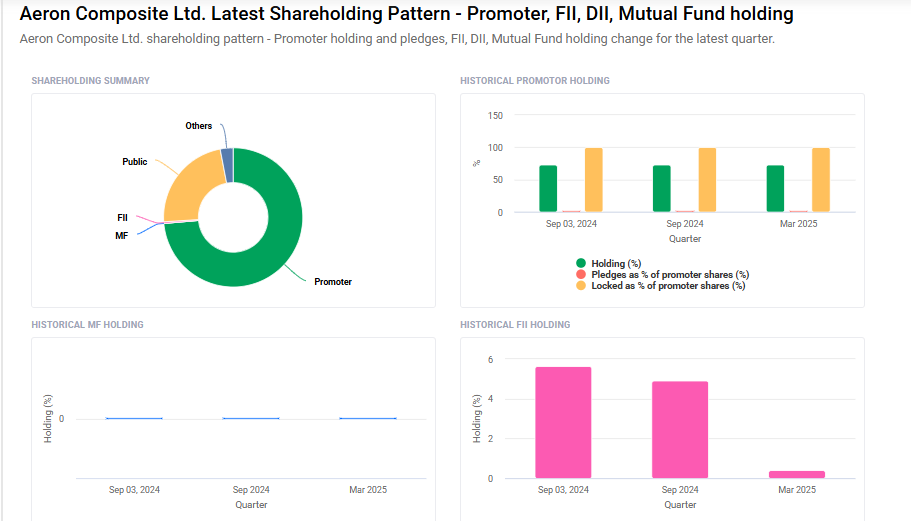

Aeron Composites Shareholding Pattern

- Promoters: 73.6%

- FII: 0.4%

- DII: 3%

- Public: 23%

Aeron Composites Share Price Target Tomorrow 2025 To 2030

| Aeron Composites Share Price Target Years | Aeron Composites Share Price |

| 2025 | ₹205 |

| 2026 | ₹250 |

| 2027 | ₹300 |

| 2028 | ₹350 |

| 2029 | ₹400 |

| 2030 | ₹450 |

Aeron Composites Share Price Target 2025

Aeron Composites share price target 2025 Expected target could ₹205. Here are 4 Key Factors Affecting Growth for Aeron Composites’ Share Price Target by 2025:

-

Rising Demand for Lightweight Materials

As industries like aerospace, defense, automotive, and renewable energy increasingly adopt lightweight and high-strength composite materials, Aeron Composites stands to benefit from growing market demand. -

Expansion into Global Markets

Growth in exports and entry into international markets can significantly boost revenue and visibility, positively influencing investor sentiment and share price. -

Government Policies and Infrastructure Projects

Supportive government initiatives promoting indigenous manufacturing and infrastructure development can drive demand for composite products in sectors such as railways, construction, and smart cities. -

Technological Innovation and Product Diversification

Continued investment in R&D and the launch of advanced or customized composite solutions can enhance the company’s competitive edge, attracting long-term investors and improving profitability.

Aeron Composites Share Price Target 2030

Aeron Composites share price target 2030 Expected target could ₹450. Here are 4 Risks and Challenges that could impact Aeron Composites’ share price target by 2030:

-

Raw Material Price Volatility

Fluctuations in the prices of key raw materials like carbon fiber and resins can increase production costs, reducing profit margins and affecting overall financial stability. -

Intense Industry Competition

The composites industry is becoming highly competitive with the entry of global players offering similar or lower-priced products, which may pressure Aeron Composites to lower prices or lose market share. -

Dependence on Specific Sectors

Heavy reliance on sectors like aerospace, defense, or infrastructure may expose the company to sector-specific slowdowns, regulatory changes, or budget cuts that could hurt revenues. -

Technological Obsolescence

Rapid innovation in materials science means that existing products could become outdated. Failing to keep up with evolving technology trends may result in lost opportunities and reduced market relevance.

Read Also:- Quest Laboratories Share Price Target Tomorrow 2025 To 2030