AFFLE India Share Price Target Tomorrow 2025 To 2030

Affle (India) Ltd is a global technology company specializing in mobile advertising and marketing. Founded in 2005, it offers a consumer intelligence platform that helps businesses reach and engage users through personalized ads on mobile devices. By using advanced technologies like artificial intelligence and machine learning, Affle ensures that ads are relevant to users’ interests, enhancing the chances of conversions. The company operates on a cost-per-converted-user model, meaning clients pay when users take desired actions, such as app downloads or purchases. AFFLE India Share Price on NSE as of 21 May 2025 is 1,693.00 INR.

AFFLE India Share Market Overview

- Open: 1,700.40

- High: 1,707.20

- Low: 1,674.00

- Previous Close: 1,692.60

- Volume: 132,811

- Value (Lacs): 2,243.18

- 52 Week High: 1,884.00

- 52 Week Low: 1,060.00

- Mkt Cap (Rs. Cr.): 23,729

- Face Value: 2

AFFLE India Share Price Chart

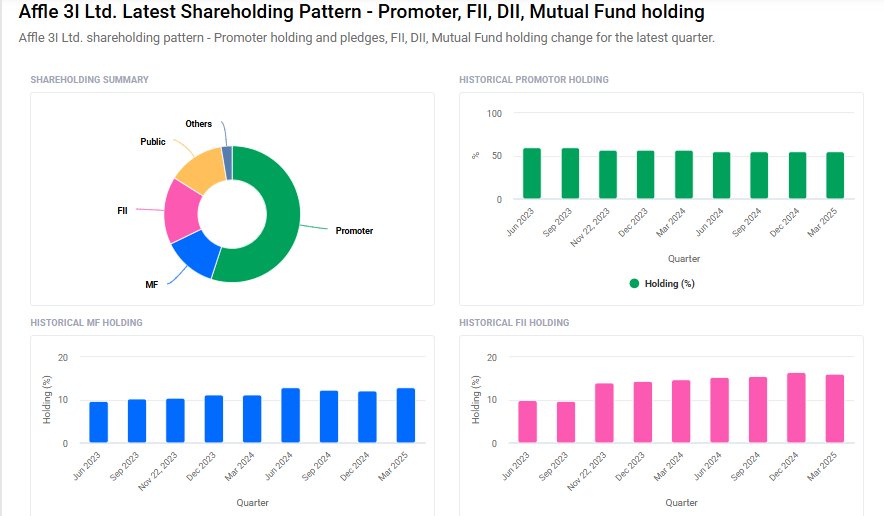

AFFLE India Shareholding Pattern

- Promoters: 55%

- FII: 16.1%

- DII: 15.3%

- Public: 13.6%

AFFLE India Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹1890 |

| 2026 | ₹2350 |

| 2027 | ₹2847 |

| 2028 | ₹3355 |

| 2029 | ₹3863 |

| 2030 | ₹4250 |

AFFLE India Share Price Target 2025

AFFLE India share price target 2025 Expected target could ₹1890. Here are 5 key factors influencing the growth of Affle (India) Ltd’s share price target for 2025:

-

Robust Revenue and Earnings Growth: Affle (India) is projected to achieve an annual revenue growth of approximately 17.1% and earnings growth of around 20.9%. This strong financial performance is underpinned by the increasing demand for mobile advertising and digital marketing solutions.

-

Expansion of Digital Advertising Market: The shift of advertising budgets towards digital platforms is a significant growth driver. With India’s digital user base expected to grow substantially, Affle stands to benefit from the rising mobile ad spend, which is anticipated to increase at a compound annual growth rate (CAGR) of 32.4% from FY20 to FY25.

-

Technological Innovations and Patent Portfolio: Affle has been granted a U.S. patent for a method to detect fraud in digital advertising, enhancing its intellectual property portfolio to 36 patents. Such innovations bolster the company’s competitive edge and credibility in delivering reliable advertising solutions.

-

Strategic Acquisitions and Global Expansion: Affle’s strategic acquisitions and its presence in international markets, including the U.S., UK, Japan, and Malaysia, contribute to its diversified revenue streams and global footprint, supporting sustained growth.

-

Positive Analyst Outlook and Investor Confidence: Analysts have maintained a positive outlook on Affle’s stock, with price targets reflecting confidence in its growth trajectory. For instance, Sharekhan has a ‘BUY’ rating with a target price of ₹1,880, citing the company’s robust financial performance and growth prospects.

AFFLE India Share Price Target 2030

AFFLE India share price target 2030 Expected target could ₹4250. Here are 5 key risks and challenges that could impact Affle (India) Ltd’s share price target by 2030:

-

Intensifying Competition in the Digital Advertising Space: The digital advertising industry is highly competitive, with numerous players vying for market share. Affle faces competition from both established global companies and emerging startups, which could pressure its margins and growth prospects.

-

Regulatory and Compliance Risks: Changes in data privacy laws and advertising regulations can significantly affect Affle’s operations. Compliance with varying international regulations requires continuous monitoring and adaptation, which can increase operational costs and complexity.

-

Technological Disruptions and Rapid Innovation: The digital advertising landscape is subject to rapid technological changes. Failure to keep pace with innovations or shifts in consumer behavior could render Affle’s offerings less competitive, impacting its market position.

-

Economic Slowdowns Affecting Advertising Budgets: Economic downturns can lead to reduced advertising budgets as companies cut costs. Such reductions can directly impact Affle’s revenue, given its reliance on advertising expenditures.

-

Dependence on Key Clients and Markets: A significant portion of Affle’s revenue may come from key clients or specific markets. Any loss of major clients or adverse market conditions in these regions could materially affect the company’s financial performance.

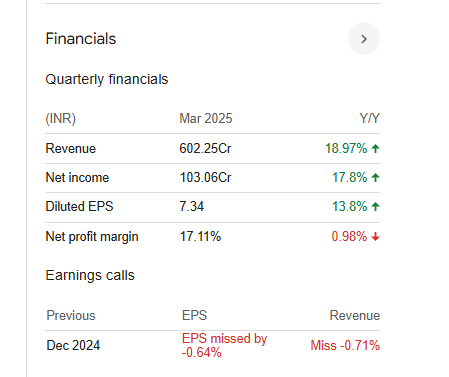

AFFLE India Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 22.66B | 22.98% |

| Operating expense | 2.69B | 40.02% |

| Net income | 3.82B | 28.46% |

| Net profit margin | 16.85 | 4.46% |

| Earnings per share | 27.19 | 24.10% |

| EBITDA | 4.83B | 62.06% |

| Effective tax rate | 18.34% | — |

Read Also:- BSE Ltd Share Price Target Tomorrow 2025 To 2030