Akme Fintrade Share Price Target Tomorrow 2025 To 2030

Akme Fintrade (India) Limited is a non-banking financial company (NBFC) established in 1996, dedicated to providing financial services to underserved populations in India. With over 25 years of experience, the company operates primarily in rural and semi-urban areas across Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat, maintaining 15 physical branches and more than 25 points of presence . Akme Fintrade offers a range of loan products under the “Aasaan Loans” brand, including vehicle loans, business loans, loans against property, and specialized loans for women entrepreneurs and solar energy projects. Akme Fintrade Share Price on NSE as of 9 May 2025 is 6.86 INR.

Akme Fintrade Share Market Overview

- Open: 6.95

- High: 7.22

- Low: 6.80

- Previous Close: 6.86

- Volume: 838,489

- Value (Lacs): 57.69

- 52 Week High: 13.40

- 52 Week Low: 6.42

- Mkt Cap (Rs. Cr.): 293

- Face Value: 10

Akme Fintrade Share Price Chart

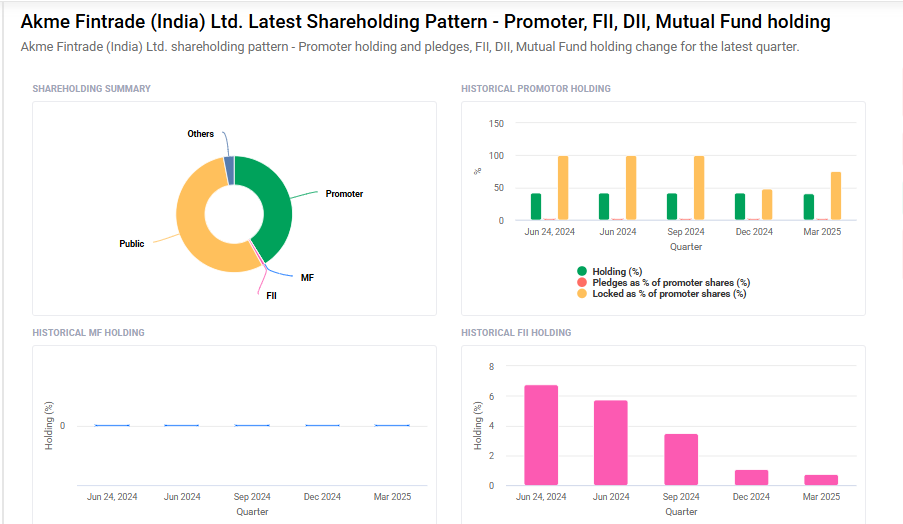

Akme Fintrade Shareholding Pattern

- Promoters: 41.2%

- FII: 0.8%

- DII: 3%

- Public: 55%

Akme Fintrade Share Price Target Tomorrow 2025 To 2030

| Akme Fintrade Share Price Target Years | Akme Fintrade Share Price |

| 2025 | ₹14 |

| 2026 | ₹17 |

| 2027 | ₹20 |

| 2028 | ₹23 |

| 2029 | ₹26 |

| 2030 | ₹30 |

Akme Fintrade Share Price Target 2025

Akme Fintrade share price target 2025 Expected target could ₹14. Here are four key factors that could influence Akme Fintrade’s share price target for 2025:

-

Strong Financial Performance: In Q3 FY2024–25, Akme Fintrade reported a net profit of ₹8.93 crore, marking a 59.46% increase compared to the same period the previous year. Revenue also grew by 41.06% year-over-year to ₹28.10 crore, with a healthy net profit margin of 31.78%.

-

Focus on Underserved Markets: As a Non-Banking Financial Company (NBFC) concentrating on rural and semi-urban areas, Akme Fintrade taps into underbanked regions, offering loans for vehicles, businesses, and solar projects. This niche positioning can drive growth as financial inclusion initiatives expand in India.

-

Efficient Operational Management: The company has improved its working capital cycle, reducing it from 47.6 days to 31.9 days. Such operational efficiency can enhance liquidity and profitability.

-

Attractive Valuation Metrics: With a Price-to-Earnings (P/E) ratio of 7.18, Akme Fintrade is trading below the sector average P/E of 31.53, suggesting potential undervaluation and room for stock appreciation.

Akme Fintrade Share Price Target 2030

Akme Fintrade share price target 2030 Expected target could ₹30. Here are four key risks and challenges that could impact Akme Fintrade’s share price target by 2030:

-

Elevated Non-Performing Assets (NPAs)

Akme Fintrade has reported higher levels of NPAs compared to some of its peers. This indicates potential issues in loan recovery and credit risk management, which could adversely affect profitability and investor confidence. -

Regulatory Compliance Concerns

The company has previously faced compliance issues, including non-adherence to certain Reserve Bank of India (RBI) norms and guidelines. Such lapses may lead to penalties or restrictions, impacting operations and reputation. -

Geographical Concentration Risk

Akme Fintrade’s operations are predominantly concentrated in Rajasthan. This regional focus exposes the company to localized economic downturns or policy changes, potentially affecting its overall performance. -

Competitive Industry Landscape

Operating in a highly competitive NBFC sector, Akme Fintrade faces challenges from numerous banks and financial institutions. Without significant differentiation or expansion, maintaining market share and profitability could be difficult.

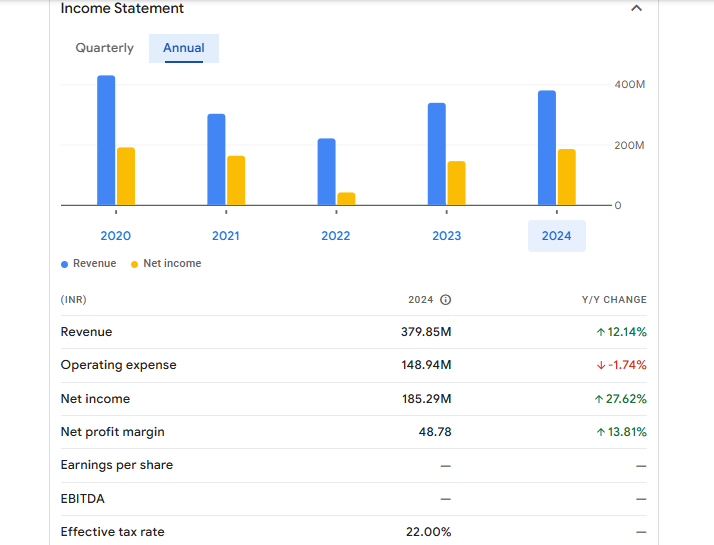

Akme Fintrade Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 379.85M | 12.14% |

| Operating expense | 148.94M | -1.74% |

| Net income | 185.29M | 27.62% |

| Net profit margin | 48.78 | 13.81% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 22.00% | — |

Read Also:- Force Motors Share Price Target Tomorrow 2025 To 2030