Ambuja Cements Share Price Target Tomorrow 2025 To 2030

Ambuja Cements is one of India’s leading cement companies, known for its high-quality products and strong presence in the construction industry. Founded in 1983, it has grown to become one of the most trusted brands in the country. Ambuja produces a wide range of cement products that are used in residential, commercial, and infrastructure projects. Ambuja Cements Share Price on NSE as of 1 May 2025 is 537.90 INR.

Ambuja Cements Share Market Overview

- Open: 540.00

- High: 546.20

- Low: 533.05

- Previous Close: 533.95

- Volume: 5,851,731

- Value (Lacs): 31,581.79

- VWAP: 541.25

- UC Limit: 587.30

- LC Limit: 480.55

- 52 Week High: 706.95

- 52 Week Low: 453.05

- Mkt Cap (Rs. Cr.): 132,934

- Face Value: 2

Ambuja Cements Share Price Chart

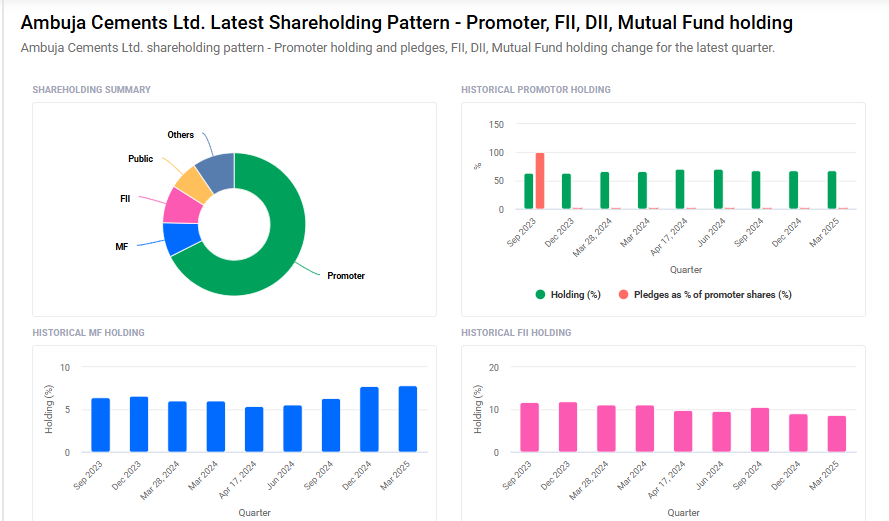

Ambuja Cements Shareholding Pattern

- Promoters: 67.6%

- FII: 8.6%

- DII: 17.3%

- Public: 6.5%

Ambuja Cements Share Price Target Tomorrow 2025 To 2030

| Ambuja Cements Share Price Target Years | Ambuja Cements Share Price |

| 2025 | ₹710 |

| 2026 | ₹750 |

| 2027 | ₹790 |

| 2028 | ₹830 |

| 2029 | ₹870 |

| 2030 | ₹910 |

Ambuja Cements Share Price Target 2025

Ambuja Cements share price target 2025 Expected target could ₹710. Here are four key factors influencing the growth of Ambuja Cements:

1. Strategic Capacity Expansion

Ambuja Cements is actively expanding its production capacity through both organic and inorganic means. The company has acquired Penna Cement Industries for ₹10,422 crore, adding 14 million tonnes per annum (MTPA) to its capacity. This acquisition strengthens its presence in southern India and supports its goal to increase total capacity to 140 MTPA by 2028.

2. Government Infrastructure Initiatives

The Indian government’s focus on infrastructure development is expected to drive demand for cement. Ambuja Cements is well-positioned to benefit from this trend, with projections indicating a 4–5% growth in cement demand for FY25, supported by increased government spending on housing and infrastructure projects.

3. Improved Profitability Metrics

In Q4 FY25, Ambuja Cements reported a 74.5% increase in quarterly profit, reaching ₹9.29 billion, driven by a 13% growth in sales volumes. This performance reflects the company’s ability to capitalize on favorable market conditions and operational efficiencies.

4. Commitment to Sustainability

Ambuja Cements is advancing its sustainability goals, aiming for 60% green power usage and a 27% total shareholder return by 2028. The company achieved 12 times water positivity in FY25, demonstrating its commitment to environmental stewardship.

Ambuja Cements Share Price Target 2030

Ambuja Cements share price target 2030 Expected target could ₹910. Here are four key Risks and Challenges that could affect Ambuja Cements:

-

Fluctuations in Raw Material Prices

Ambuja Cements relies on key raw materials like limestone, coal, and gypsum for its production. Price volatility in these inputs, driven by factors such as supply disruptions or global demand fluctuations, could negatively impact the company’s margins and profitability. -

Competition in the Indian Cement Market

The Indian cement industry is highly competitive, with major players like UltraTech Cement, ACC, and Shree Cement. Intense competition could pressure Ambuja Cements’ market share, pricing power, and profitability, especially in a slow-growing economy. -

Environmental Regulations and Sustainability Costs

Increasing environmental concerns and stringent government regulations on emissions and carbon footprints may require Ambuja to invest heavily in cleaner technology and sustainable practices. These initiatives could increase operational costs and affect profit margins in the short term. -

Economic Slowdown and Demand Cycles

The cement industry is cyclical and highly dependent on infrastructure projects, construction activity, and economic growth. Any economic downturn or slowdown in government infrastructure spending could lead to a decline in cement demand, affecting revenue growth and stock performance.

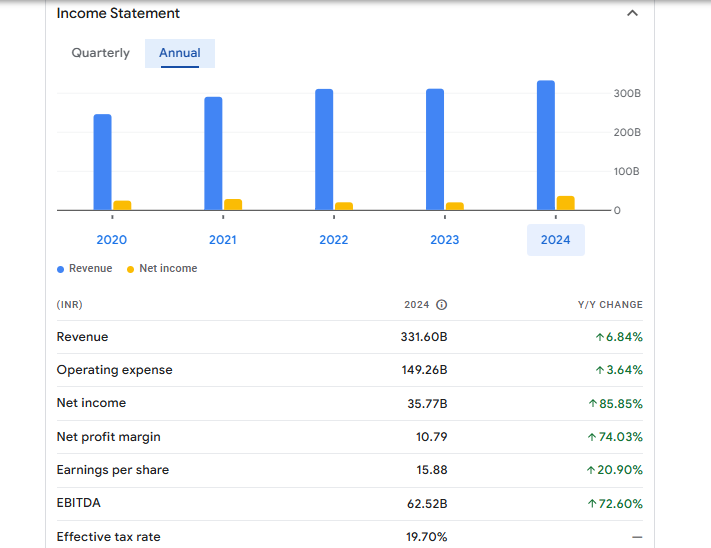

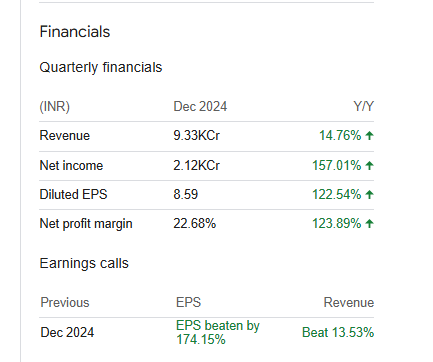

Ambuja Cements Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 331.60B | 6.84% |

| Operating expense | 149.26B | 3.64% |

| Net income | 35.77B | 85.85% |

| Net profit margin | 10.79 | 74.03% |

| Earnings per share | 15.88 | 20.90% |

| EBITDA | 62.52B | 72.60% |

| Effective tax rate | 19.70% | — |

Read Also:- Power Grid Share Price Target Tomorrow 2025 To 2030