Apollo Hospital Share Price Target Tomorrow 2025 To 2030

Apollo Hospitals is one of the most trusted and leading healthcare groups in India. Founded in 1983, it was the country’s first corporate hospital and has since grown into a large network of hospitals, clinics, pharmacies, and diagnostic centers across India. Apollo is known for offering world-class medical care in areas like heart surgery, cancer treatment, and organ transplants. The hospital group also invests in digital health services and advanced technologies like Artificial Intelligence to improve patient care. Apollo Hospital Share Price on NSE as of 24 May 2025 is 7,062.00 INR.

Apollo Hospital Share Market Overview

- Open: 6,987.50

- High: 7,088.00

- Low: 6,930.00

- Previous Close: 6,954.50

- Volume: 321,466

- Value (Lacs): 22,709.97

- UC Limit: 7,649.50

- LC Limit: 6,259.50

- 52 Week High: 7,545.35

- 52 Week Low: 5,693.20

- Mkt Cap (Rs. Cr.): 101,576

- Face Value: 5

Apollo Hospital Share Price Chart

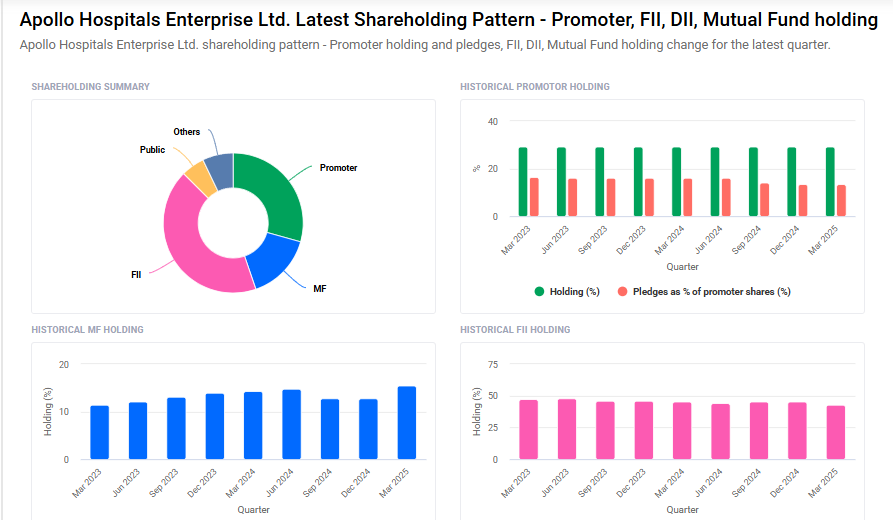

Apollo Hospital Shareholding Pattern

- Promoters: 29.3%

- FII: 42.7%

- DII: 22.5%

- Public: 5.4%

Apollo Hospital Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹7550 |

| 2026 | ₹8600 |

| 2027 | ₹9700 |

| 2028 | ₹10,745 |

| 2029 | ₹11,667 |

| 2030 | ₹12,755 |

Apollo Hospital Share Price Target 2025

Apollo Hospital share price target 2025 Expected target could ₹7550. Here are five key factors likely to influence Apollo Hospitals Enterprise Ltd. (NSE: APOLLOHOSP) and its share price growth by 2025:

1. Strong Financial Performance and Profitability

Apollo Hospitals reported a 15% year-on-year revenue growth, reaching ₹16,202 crore in the first nine months of FY25. The consolidated net profit rose by 64% to ₹1,056 crore, driven by increased patient volumes and improved operational efficiency.

2. Expansion of High-End Specialties

The company is focusing on high-growth specialties such as Cardiac Sciences, Oncology, Neurosciences, Gastroenterology, Orthopedics, and Transplants. This strategic emphasis is enhancing revenue realization and strengthening Apollo’s leadership in tertiary care.

3. Digital Health and Pharmacy Growth

Apollo’s digital platform, Apollo 24/7, along with its pharmacy segment, has shown significant growth. In Q3 FY25, the digital health and pharmacy segment, including Apollo 24/7, saw a 14.8% rise in revenue, contributing to overall revenue growth.

4. Capacity Expansion Plans

Apollo plans to add 3,512 beds across 11 locations over the next three to four years, starting from FY26. This expansion aims to meet the growing demand for healthcare services and is expected to drive future revenue growth.

5. Integration of Artificial Intelligence (AI)

The company is investing in AI to automate routine tasks, such as medical documentation, aiming to reduce the workload of medical staff and improve efficiency. Apollo has allocated 3.5% of its digital budget to AI over the past two years and plans to increase this spending.

Apollo Hospital Share Price Target 2030

Apollo Hospital share price target 2030 Expected target could ₹12,755. Here are five key risks and challenges that could impact Apollo Hospitals Enterprise Ltd. and its share price target by 2030:

1. Regulatory and Legal Challenges

Apollo Hospitals has faced legal issues, including allegations of medical negligence and involvement in unethical practices. For instance, in 2023, the Delhi State Consumer Disputes Redressal Commission directed Indraprastha Apollo Hospital to pay ₹10 lakh as compensation for medical negligence. Additionally, the hospital was implicated in a “cash-for-kidney” racket, leading to investigations by the Delhi Government. Such incidents can tarnish the company’s reputation and lead to increased regulatory scrutiny.

2. Intensifying Competition

The Indian healthcare sector is witnessing increased competition from both domestic and international players. Emerging hospitals and healthcare chains are expanding their presence, offering advanced medical services at competitive prices. This heightened competition could pressure Apollo Hospitals to innovate continuously and maintain its market share.

3. Economic Slowdowns

Economic downturns can impact patients’ ability to afford private healthcare services. During such periods, individuals may postpone elective procedures or opt for public healthcare facilities, leading to reduced revenues for private hospitals like Apollo. An economic slowdown could thus adversely affect the company’s profitability and share price.

4. Operational and Infrastructure Costs

The healthcare industry requires significant investments in medical technology, infrastructure, and skilled personnel. Rising costs in these areas can strain Apollo Hospitals’ financial resources. Managing these expenses while ensuring quality care is crucial to maintain profitability and investor confidence.

5. Environmental, Social, and Governance (ESG) Risks

Apollo Hospitals has an ESG Risk Rating of 25, categorized as “Medium” risk. While the company has strong management of ESG material risks, any lapses in environmental sustainability, social responsibilities, or governance practices could impact its reputation and financial performance.

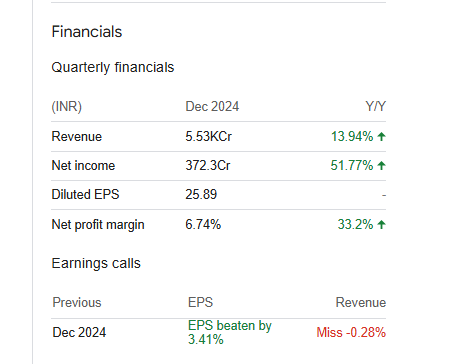

Apollo Hospital Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 190.59B | 14.73% |

| Operating expense | 48.62B | 15.25% |

| Net income | 8.99B | 9.71% |

| Net profit margin | 4.71 | -4.46% |

| Earnings per share | 62.41 | 9.55% |

| EBITDA | 22.12B | 15.75% |

| Effective tax rate | 32.27% | — |

Read Also:- JP Associates Share Price Target Tomorrow 2025 To 2030