Apollo Tyres Share Price Target Tomorrow 2025 To 2030

Apollo Tyres is a well-known Indian tyre manufacturing company that has been serving customers since 1972. Headquartered in Gurgaon, the company produces tyres for cars, bikes, trucks, and buses. It has built a strong presence not only in India but also in international markets like Europe and the United States. Apollo Tyres is known for its focus on innovation, safety, and quality. Recently, it has taken steps to develop tyres specially designed for electric vehicles, showing its commitment to future mobility. Apollo Tyres Share Price on NSE as of 16 May 2025 is 479.15 INR.

Apollo Tyres Share Market Overview

- Open: 474.00

- High: 490.85

- Low: 474.00

- Previous Close: 475.35

- Volume: 3,830,238

- Value (Lacs): 18,402.38

- 52 Week High: 584.90

- 52 Week Low: 370.90

- Mkt Cap (Rs. Cr.): 30,513

- Face Value: 1

Apollo Tyres Share Price Chart

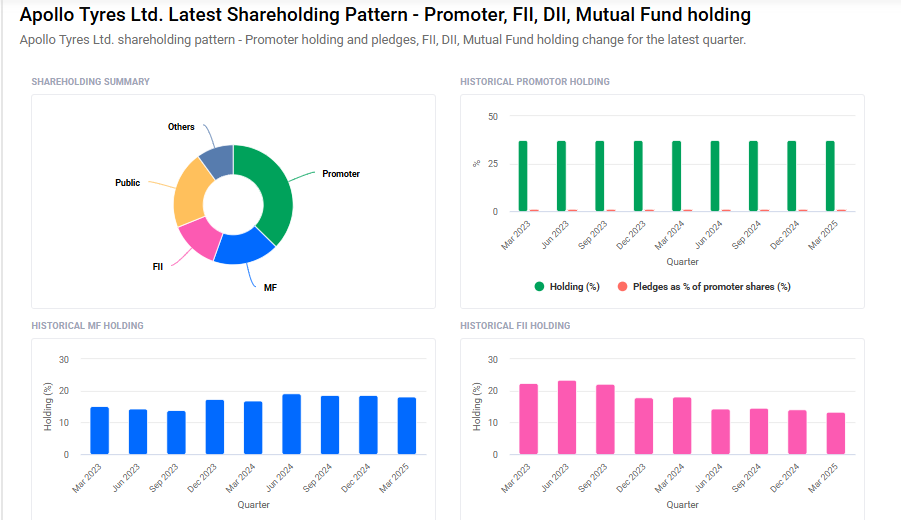

Apollo Tyres Shareholding Pattern

- Promoters: 37.4%

- FII: 13.4%

- DII: 28.1%

- Public: 21.1%

Apollo Tyres Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹590 |

| 2026 | ₹630 |

| 2027 | ₹670 |

| 2028 | ₹710 |

| 2029 | ₹750 |

| 2030 | ₹790 |

Apollo Tyres Share Price Target 2025

Apollo Tyres share price target 2025 Expected target could ₹590. Here are five key factors that could influence the growth of Apollo Tyres Ltd.’s share price target for 2025:

-

Expansion into Electric Vehicle (EV) Segment: Apollo Tyres is actively developing specialized tyres for electric vehicles, including the Apollo Amperion for passenger EVs and the Apollo WAV for electric scooters. This strategic move positions the company to capitalize on the growing EV market in India and globally.

-

Global Market Expansion: The company is pursuing aggressive growth in international markets, particularly in the United States, aiming to increase sales from $120–130 million to $500 million in the coming years. This expansion could significantly boost revenue and global brand recognition.

-

Advancements in Research and Development: Apollo Tyres has established research and development centers in India and Europe, focusing on innovation and digital technologies like artificial intelligence and machine learning. These advancements aim to improve manufacturing processes and product quality, enhancing competitiveness.

-

Strong Distribution Network: With approximately 4,500 distributors across India and a presence in 19 state offices, Apollo Tyres has a robust distribution network. This extensive reach facilitates efficient product availability and customer service, supporting sales growth.

-

Positive Financial Performance: The company has reported strong year-on-year growth in key segments, including a 45% increase in Vredestein volumes and gains in the passenger car radial (PCR) replacement segment. These positive trends indicate healthy demand and operational efficiency.

Apollo Tyres Share Price Target 2030

Apollo Tyres share price target 2030 Expected target could ₹790. Here are five key risks and challenges that could impact Apollo Tyres Ltd.’s share price target by 2030:

-

Volatility in Raw Material Prices: The tyre industry is highly sensitive to fluctuations in raw material costs, especially natural rubber. Rising prices can increase production expenses, potentially squeezing profit margins and affecting the company’s financial performance.

-

High Capital Expenditure and Debt Levels: Apollo Tyres has reported an increase in consolidated net debt, reaching ₹2,990 crore as of September 2024, up from ₹2,530 crore in March. This rise is primarily due to elevated working capital requirements. High debt levels can limit financial flexibility and increase vulnerability to economic downturns.

-

Intense Market Competition: The global tyre market is highly competitive, with major players like Bridgestone, Michelin, and Continental continually innovating and expanding. Apollo Tyres faces the challenge of differentiating its products and maintaining market share amidst this intense competition.

-

Regulatory and Legal Challenges: In April 2022, the Competition Commission of India fined Apollo Tyres ₹425.53 crore for alleged cartelization practices. Such legal issues can damage the company’s reputation and lead to financial penalties, impacting investor confidence.

-

Challenges in Sustainable Material Adoption: Apollo Tyres aims to source 40% of its materials from renewable or recycled sources by 2030. While this is a commendable goal, the transition involves challenges such as high initial production costs and variability in performance metrics compared to traditional tyres. These factors could affect product acceptance and profitability.

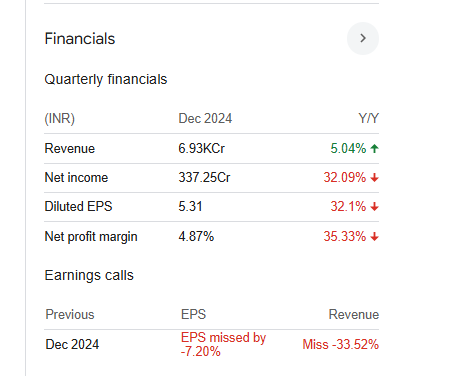

Apollo Tyres Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 250.20B | 3.72% |

| Operating expense | 79.44B | 10.24% |

| Net income | 17.22B | 64.64% |

| Net profit margin | 6.88 | 58.53% |

| Earnings per share | 27.94 | 63.25% |

| EBITDA | 40.64B | 37.01% |

| Effective tax rate | 32.22% | — |

Read Also:- Hindustan Motors Share Price Target Tomorrow 2025 To 2030