Arihant Capital Share Price Target Tomorrow 2025 To 2030

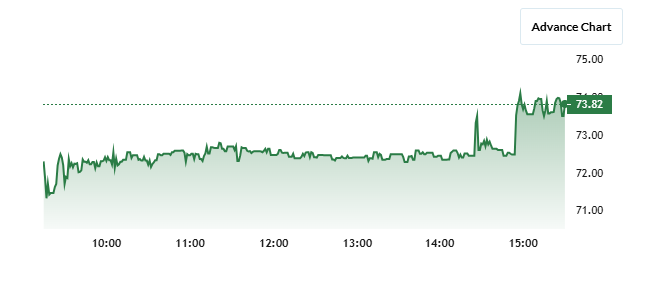

Arihant Capital Markets Limited is a well-established financial services company in India, founded in 1992 by Mr. Ashok Jain, a Chartered Accountant. Headquartered in Indore, the company offers a wide range of services including stock and commodity broking, wealth management, mutual funds, insurance, and portfolio management. With over 800 investment centers across more than 185 cities, Arihant Capital serves a diverse clientele comprising retail investors, high-net-worth individuals, corporates, and institutions. Arihant Capital Share Price on NSE as of 16 April 2025 is 73.82 INR.

Arihant Capital Share Market Overview

- Open 71.70

- High 74.10

- Low 71.32

- Previous Close 70.80

- Volume 293,588

- Value (Lacs) 216.73

- UC Limit 0.00

- LC Limit 0.00

- 52 Week High 124.80

- 52 Week Low 53.20

- Mkt Cap (Rs. Cr.) 768

- Face Value 1

Arihant Capital Share Price Chart

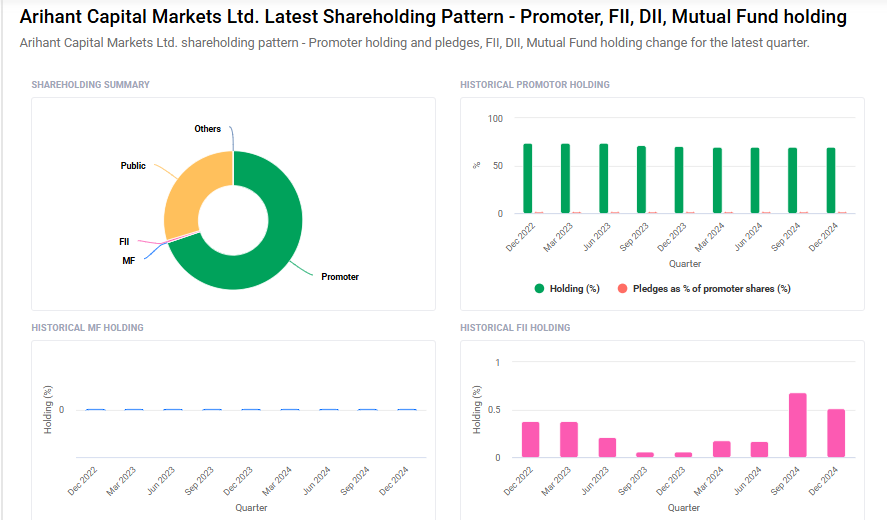

Arihant Capital Shareholding Pattern

- Promoters: 69.8%

- FII: 0.5%

- DII: 0%

- Public: 29.7%

Arihant Capital Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹770

- 2026 – ₹900

- 2027 – ₹1000

- 2028 – ₹1100

- 2030 – ₹1200

Major Factors Affecting Arihant Capital Share Price

Here are six major factors that influence the share price of Arihant Capital Markets Ltd:

1. Earnings Growth and Profitability

Arihant Capital Markets has demonstrated strong earnings growth, with a 135% increase in earnings per share (EPS) over the past year. This impressive performance has positively impacted investor confidence and contributed to the stock’s valuation.

2. Valuation Metrics

The company currently trades at a price-to-earnings (P/E) ratio of approximately 10.5, which is considered low compared to the broader market. This suggests that the stock may be undervalued, potentially attracting value investors seeking growth opportunities.

3. Insider Transactions

Insider selling activities, such as the sale of ₹72 million worth of shares by the Founder & Chairman, can raise concerns among investors. While insider transactions are not always indicative of a company’s prospects, they can influence market sentiment and affect the stock price.

4. Market Conditions and Sentiment

Broader market trends and investor sentiment play a significant role in determining the stock price. Factors such as economic conditions, interest rates, and market volatility can impact investor behavior and influence the demand for Arihant Capital Markets’ shares.

5. Dividend Policy

The company’s dividend yield of approximately 0.68% provides income to shareholders and reflects its commitment to returning value to investors. Changes in dividend policies can affect investor perceptions and influence the stock price.

6. Regulatory Environment

As a financial services company, Arihant Capital Markets is subject to regulatory oversight. Changes in regulations or compliance requirements can impact the company’s operations and profitability, thereby affecting its stock price.

Risks and Challenges for Arihant Capital Share Price

Here are six key risks and challenges that could influence the share price of Arihant Capital Markets Ltd:

1. Significant Revenue and Profit Decline

In the December 2024 quarter, Arihant Capital experienced a notable decrease in financial performance, with revenue dropping by 32.02% and net profit falling by 38.54% compared to the previous quarter. Such declines can raise concerns among investors about the company’s growth prospects and financial health.

2. Underperformance Relative to Market Benchmarks

Over the past three years, the company’s stock has delivered a return of -21.68%, significantly lagging behind the Nifty Smallcap 100 index, which returned 46.17% during the same period. This underperformance may affect investor confidence and interest in the stock.

3. High Volatility and Market Sensitivity

Arihant Capital’s stock exhibits a beta coefficient of 1.69, indicating higher volatility compared to the broader market. Such volatility means the stock is more susceptible to market fluctuations, which can lead to unpredictable price movements.

4. Elevated Operational Costs

The company allocates 13.61% of its operating revenues to employee costs and 5.35% to interest expenses. These substantial expenditures can impact profitability, especially during periods of declining revenue.

5. Insider Share Sales

There have been instances of insider selling, including a ₹72 million share sale by the Founder & Chairman. While insider transactions are not uncommon, significant sales by top executives can sometimes be perceived negatively by the market.

6. Technological Infrastructure Risks

Arihant Capital previously faced challenges with its trading platform’s performance, leading to potential delays in trade execution. Although measures have been taken to improve the system, any future technological issues could affect customer satisfaction and the company’s reputation.

Read Also:- Gennex Laboratories Share Price Target Tomorrow 2025 To 2030