Asian Paints Share Price Target Tomorrow 2025 To 2030

Asian Paints is one of the most well-known and trusted paint companies in India. It started in 1942 and has grown to become a leading brand in decorative paints, not only in India but also in many other countries. The company offers a wide range of products, including wall paints, wood finishes, waterproofing solutions, and even home décor services. People like Asian Paints because of its bright color options, good quality, and long-lasting finish. Over the years, it has also focused on innovation and customer satisfaction. Asian Paints Share Price on NSE as of 17 May 2025 is 2,353.00 INR.

Asian Paints Share Market Overview

- Open: 2,333.90

- High: 2,355.00

- Low: 2,315.00

- Previous Close: 2,329.90

- Volume: 785,113

- Value (Lacs): 18,478.42

- VWAP: 2,340.13

- UC Limit: 2,562.80

- LC Limit: 2,097.00

- 52 Week High: 3,394.90

- 52 Week Low: 2,124.75

- Mkt Cap (Rs. Cr.): 225,756

- Face Value: 1

Asian Paints Share Price Chart

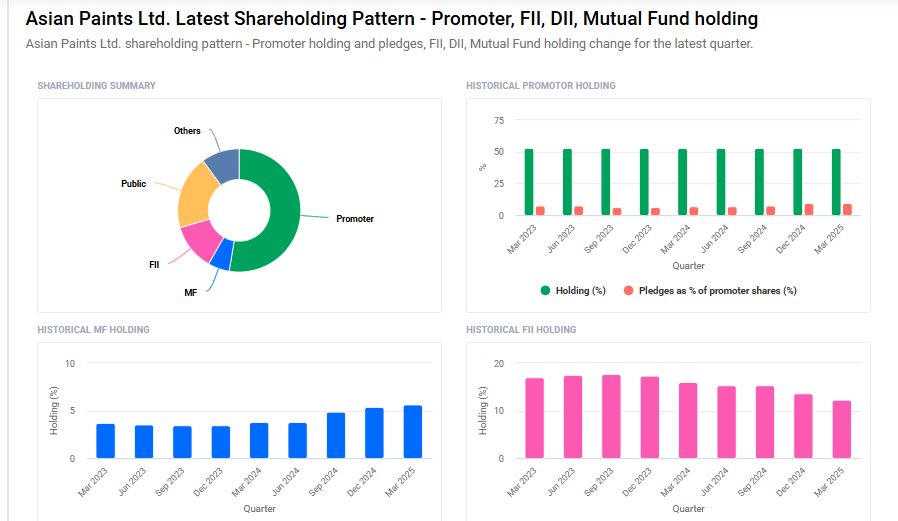

Asian Paints Shareholding Pattern

- Promoters: 52.6%

- FII: 12.2%

- DII: 15.6%

- Public: 19.6%

Asian Paints Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹3400 |

| 2026 | ₹3800 |

| 2027 | ₹4200 |

| 2028 | ₹4600 |

| 2029 | ₹5200 |

| 2030 | ₹5600 |

Asian Paints Share Price Target 2025

Asian Paints share price target 2025 Expected target could ₹3400. Here are five key factors influencing the growth outlook and share price target of Asian Paints for 2025:

1. Rising Competition in the Paint Industry

Asian Paints is facing stiff competition, especially from Grasim Industries’ Birla Opus, which quickly gained market share after entering the market. This competitive pressure may affect Asian Paints’ pricing power, profit margins, and long-term growth prospects.

2. Pressure on Profit Margins

To maintain market share, Asian Paints has reduced prices in some product segments. While this may support volume growth, it also leads to lower profit margins, especially in a high-inflation environment with rising input costs.

3. Weak Consumer Demand and Macroeconomic Factors

Economic uncertainty, inflation, and slower housing demand have impacted discretionary spending. Events like heatwaves and the 2024 general elections have further dampened seasonal demand, affecting the company’s short-term sales performance.

4. Strategic Expansion into Home Décor and Services

Asian Paints is diversifying beyond paints into home décor, waterproofing, and interior solutions. These efforts may drive long-term revenue growth if executed well, but also involve higher investment and execution risks.

5. Global and Raw Material Price Volatility

Asian Paints relies on raw materials like crude oil derivatives and titanium dioxide. Fluctuations in global commodity prices or currency exchange rates can increase costs and impact earnings, especially if the company is unable to pass these costs on to consumers.

Asian Paints Share Price Target 2030

Asian Paints share price target 2030 Expected target could ₹5600. Here are 5 key risks and challenges that could affect Asian Paints’ share price target for 2030:

1. Intensifying Industry Competition

By 2030, Asian Paints may face stronger competition from both domestic players (like Grasim’s Birla Opus) and international entrants. Aggressive pricing, brand building, and capacity expansion by rivals could erode its market share and pressure margins.

2. Raw Material Price Volatility

Asian Paints depends heavily on crude oil-based raw materials. Any long-term volatility in global crude oil prices or supply chain disruptions could increase production costs and hurt profitability if not managed efficiently.

3. Regulatory and Environmental Compliance

Stricter environmental regulations related to emissions, waste disposal, and chemical usage in paints may increase compliance costs. Failure to adapt to sustainable practices could also affect the company’s brand and investor sentiment.

4. Demand Cyclicality and Economic Slowdowns

The paints and coatings industry is closely tied to the housing and construction sectors. An economic slowdown or reduced consumer spending by 2030 could directly impact demand for decorative paints and related products.

5. Execution Risks in Diversification Plans

Asian Paints is expanding into home décor, waterproofing, and services. While these new segments offer growth potential, they also bring risks related to integration, execution, and competition from established players in those fields.

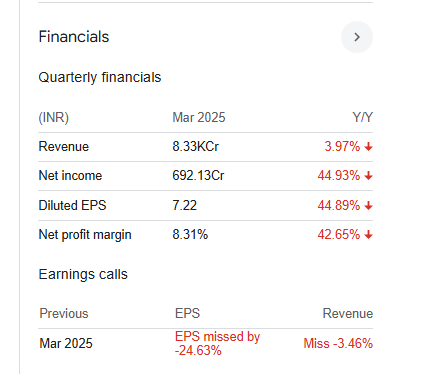

Asian Paints Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 339.06B | -4.32% |

| Operating expense | 94.10B | 11.57% |

| Net income | 36.67B | -32.84% |

| Net profit margin | 10.82 | -29.79% |

| Earnings per share | 41.00 | -27.99% |

| EBITDA | 60.06B | -16.91% |

| Effective tax rate | 27.30% | — |

Read Also:- Indus Towers Share Price Target Tomorrow 2025 To 2030