Atul Share Price Target Tomorrow 2025 To 2030

Atul Ltd is a renowned Indian chemical company founded in 1947 by Kasturbhai Lalbhai. Headquartered in Valsad, Gujarat, it was one of the first private-sector enterprises established after India’s independence. Over the decades, Atul has grown into a diversified chemical conglomerate, manufacturing over 900 products and 400 formulations. The company serves more than 4,000 customers across 30 industries in 90 countries, with subsidiaries in the USA, UK, UAE, China, and Brazil. Atul’s product portfolio includes specialty chemicals, crop protection products, pharmaceuticals, and polymers. Atul Share Price on NSE as of 30 May 2025 is 7,071.00 INR.

Atul Share Market Overview

- Open: 7,177.00

- High: 7,200.00

- Low: 7,035.00

- Previous Close: 7,129.50

- Volume: 18,457

- Value (Lacs): 1,307.22

- 52 Week High: 8,180.00

- 52 Week Low: 4,752.00

- Mkt Cap (Rs. Cr.): 20,852

- Face Value: 10

Atul Share Price Chart

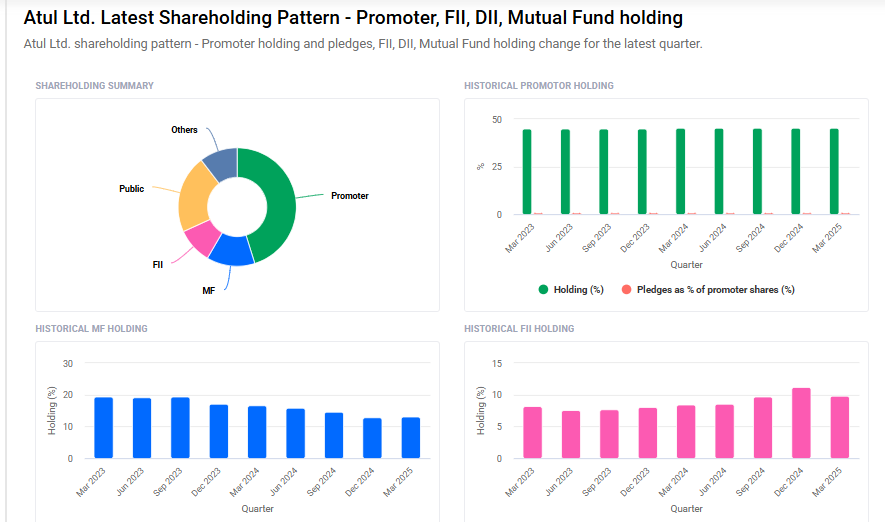

Atul Shareholding Pattern

- Promoters: 45.2%

- FII: 9.8%

- DII: 23.6%

- Public: 21.4%

Atul Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹8,180 |

| 2026 | ₹10,534 |

| 2027 | ₹12,673 |

| 2028 | ₹14,515 |

| 2029 | ₹16,650 |

| 2030 | ₹18,590 |

Atul Share Price Target 2025

Atul share price target 2025 Expected target could ₹8,180. Here are five key factors influencing the growth of Atul Ltd’s share price target for 2025:

-

Strong Financial Performance

In the fiscal year ending March 2025, Atul Ltd reported a consolidated net profit of ₹483.93 crore, up from ₹323.02 crore the previous year, marking a 49.81% increase. Total income also rose to ₹5,692.38 crore from ₹4,783.87 crore, reflecting an 18.15% growth. This robust financial performance underscores the company’s operational efficiency and market resilience. -

Expansion in Specialty Chemicals

Atul Ltd is focusing on expanding its specialty chemicals segment, particularly in life science chemicals like herbicides and resorcinol. The company has introduced a new patented herbicide to control post-emergence weeds, enhancing its position in the retail crop-protection market in India. Such innovations are expected to drive growth and profitability. -

Capital Expenditure and Capacity Expansion

The company has planned a capital expenditure of ₹487 crore, targeting expansions in subsidiaries like Atul Bioscience, Anaven, Amal, and DPD. These investments are projected to increase the company’s sales potential to ₹5,400 crore, indicating a strategic move to boost production capacity and revenue streams. -

Positive Analyst Forecasts

Analysts forecast Atul Ltd’s earnings to grow by 20.9% per annum, with revenue expected to increase by 11.6% annually. The return on equity is projected to be 12.6% over the next three years, reflecting strong financial health and investor confidence in the company’s growth trajectory. -

Global Market Expansion

Atul Ltd has expanded its market reach, with international markets contributing to 30% of total sales. This diversification reduces dependency on domestic markets and opens avenues for growth in global markets, enhancing the company’s revenue base and mitigating regional market risks.

Atul Share Price Target 2030

Atul share price target 2030 Expected target could ₹18,590. Here are five key risks and challenges that could impact Atul Ltd’s share price target by 2030:

-

Cyclical Nature of the Chemical Industry

Atul Ltd operates in the chemical sector, which is inherently cyclical. Demand and pricing for chemical products can fluctuate based on global economic conditions, leading to potential volatility in the company’s revenues and profitability. -

Raw Material Price Volatility

The company’s operations are sensitive to the prices of raw materials, many of which are derivatives of crude oil. Fluctuations in crude oil prices can impact production costs and margins. -

Regulatory and Environmental Compliance

Stricter environmental regulations and compliance requirements can lead to increased operational costs. Non-compliance or delays in adapting to new regulations may result in penalties or operational disruptions. -

Product Concentration Risk

A significant portion of Atul Ltd’s revenue comes from specific products. Over-reliance on a limited product portfolio can pose risks if demand for these products declines or if they face regulatory challenges. -

Global Competition and Market Dynamics

The chemical industry is highly competitive, with global players vying for market share. Changes in global supply-demand dynamics, trade policies, or competitive pricing strategies can impact Atul Ltd’s market position and profitability.

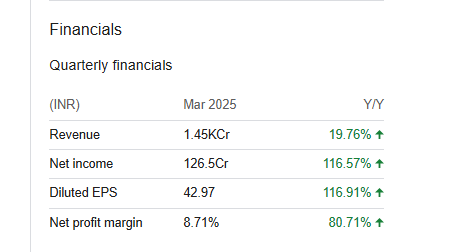

Atul Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 55.83B | 18.15% |

| Operating expense | 15.89B | -5.08% |

| Net income | 4.84B | 49.81% |

| Net profit margin | 8.67 | 26.75% |

| Earnings per share | 164.37 | 50.05% |

| EBITDA | 9.13B | 43.54% |

| Effective tax rate | 27.97% | — |

Read Also:- Zodiac Energy Share Price Target Tomorrow 2025 To 2030