Baazar Style Retail Share Price Target Tomorrow 2025 To 2030

Baazar Style Retail Limited, operating under the brand name Style Baazar, is a prominent value fashion retailer in India, established in 2013 and headquartered in Kolkata, West Bengal. The company offers a diverse range of apparel for men, women, and children, along with general merchandise such as home furnishings and accessories. With over 200 stores spread across nine Indian states, Style Baazar is committed to providing quality and affordable fashion to its customers. Baazar Style Retail Share Price on NSE as of 19 April 2025 is 320.75 INR.

Baazar Style Retail Share Market Overview

- Open: 329.15

- High: 331.00

- Low: 319.97

- Previous Close: 328.40

- Volume: 338,558

- Value (Lacs): 1,086.74

- VWAP: 324.52

- UC Limit: 361.24

- LC Limit: 295.56

- 52 Week High: 431.15

- 52 Week Low: 181.00

- Mkt Cap (Rs. Cr.): 2,395

- Face Value: 5

Baazar Style Retail Share Price Chart

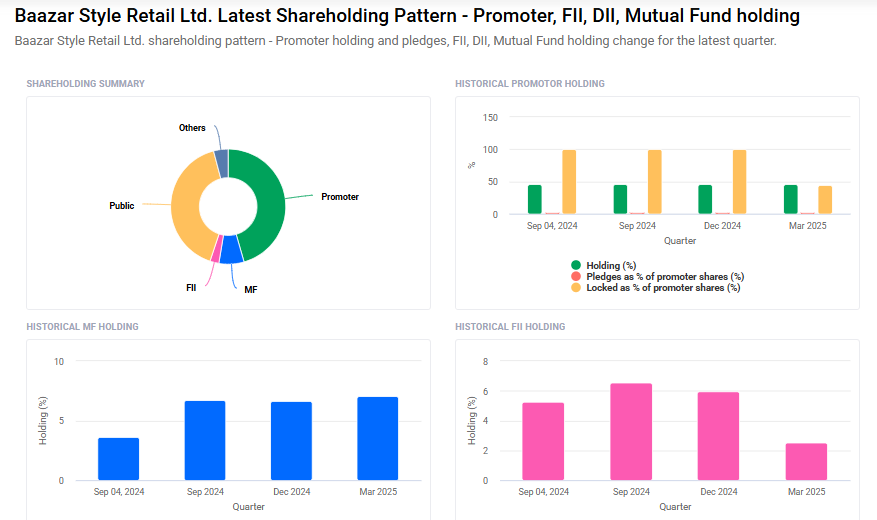

Baazar Style Retail Shareholding Pattern

- Promoters: 45.6%

- FII: 2.5%

- DII: 11.2%

- Public: 40.8%

Baazar Style Retail Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹440

- 2026 – ₹470

- 2027 – ₹500

- 2028 – ₹530

- 2030 – ₹560

Major Factors Affecting Baazar Style Retail Share Price

-

Strong Revenue Growth

Baazar Style Retail has shown impressive financial performance, with its revenue increasing by 38% year-over-year to ₹1,343.8 crore in FY25. Such consistent growth often boosts investor confidence, positively impacting the company’s share price. -

Improving Profitability

The company has turned around its profitability, reporting a net profit of ₹219 million in FY24, a significant improvement from previous losses. This positive shift indicates better financial health, which can attract investors and support share price appreciation. -

Expansion of Retail Network

Baazar Style Retail has been expanding its store network, increasing its presence across various regions. A broader retail footprint can lead to higher sales and market share, contributing to revenue growth and potentially enhancing the stock’s value. -

Analyst Recommendations and Price Targets

Financial analysts have shown optimism about the company’s prospects. For instance, JM Financial has given a ‘buy’ rating with a target price of ₹400, suggesting potential upside from current levels. Such endorsements can influence investor sentiment and drive share prices higher. -

Market Valuation Metrics

The company’s stock is trading at a Price-to-Earnings (P/E) ratio of approximately 6.30 times its book value. While this indicates a premium valuation, it also reflects investor expectations of future growth. However, if the company doesn’t meet these expectations, it could lead to stock price adjustments. -

Macroeconomic Factors and Consumer Spending

As a retail company, Baazar Style Retail’s performance is closely tied to consumer spending patterns. Economic factors such as inflation, interest rates, and overall consumer confidence can impact sales. Positive economic conditions may boost sales and share price, while downturns could have the opposite effect.

Risks and Challenges for Baazar Style Retail Share Price

-

High Revenue Concentration in Specific Regions

A significant portion of Baazar Style Retail’s revenue comes from core markets like West Bengal and Odisha. This heavy reliance on a few regions means that any economic downturns or increased competition in these areas could adversely affect the company’s sales and, consequently, its share price. -

Intense Competition in the Value Retail Segment

The value retail sector is highly competitive, with numerous players vying for market share. Baazar Style Retail faces stiff competition from both organized and unorganized retailers. This intense competition can lead to pricing pressures, affecting profit margins and potentially impacting the company’s stock performance. -

Dependence on Apparel Sales

Approximately 84% of the company’s revenue is derived from apparel sales. Such a heavy dependence on a single product category makes the company vulnerable to shifts in consumer preferences or fashion trends. A decline in apparel demand could significantly impact revenues and investor sentiment. -

Limited Supplier Base Without Definitive Agreements

Baazar Style Retail relies on a limited number of suppliers and does not have long-term agreements with them. This lack of definitive contracts can pose procurement challenges, especially if suppliers face disruptions or choose to alter terms, potentially affecting inventory levels and sales. -

High Inventory Holding Period

The company has a high inventory holding period, with inventory days standing at 212 as of FY24, the highest among its peers. High inventory levels can tie up capital and increase the risk of obsolescence, which may affect profitability and, in turn, the share price. -

Technological Adaptation and E-commerce Implementation

In an era where online shopping is gaining prominence, Baazar Style Retail’s success depends on its ability to effectively implement and manage e-commerce initiatives. Failure to adapt to technological advancements or to establish a robust online presence could limit growth opportunities and affect competitiveness.

Read Also:- Aditya Vision Share Price Target Tomorrow 2025 To 2030