Bajaj Auto Share Price Target From 2025 to 2030

Bajaj Auto Share Price Target From 2025 to 2030: Investment in the stock market involves a clear understanding of an organization’s finances, its industry’s position, market size, and growth pattern in the long term. One of such blue-chip stocks which has drawn tremendous investor interest is Bajaj Auto Ltd., India’s dominant two-wheeler and three-wheeler auto firm.

Its great heritage, incessant innovation, global presence, and quality brand image status, Bajaj Auto remains one of the pillars of India’s auto sector. In this article here, we analyze Bajaj Auto share price target for 2025 to 2030 in some detail, including its stock movement analysis, technicals, fundamentals, shareholders composition, and growth estimates which will allow the investor to make the best possible decision.

Company Overview: Bajaj Auto Ltd.

Bajaj Auto Ltd. is a leading two-wheeler and three-wheeler brand in India belonging to the Bajaj Group. Bajaj Auto has a dominant presence in 70+ countries around the globe and boasts an extensive portfolio of diversified products. Bajaj Auto is a leader in global mobility solutions.

The company has innovated with models such as Pulsar, Dominar, and Chetak EV (electric vehicle), spanning the budget and premium segment of the market. As India’s middle class expands and demand for fuel-efficient and electric vehicles increases, Bajaj Auto stands to gain.

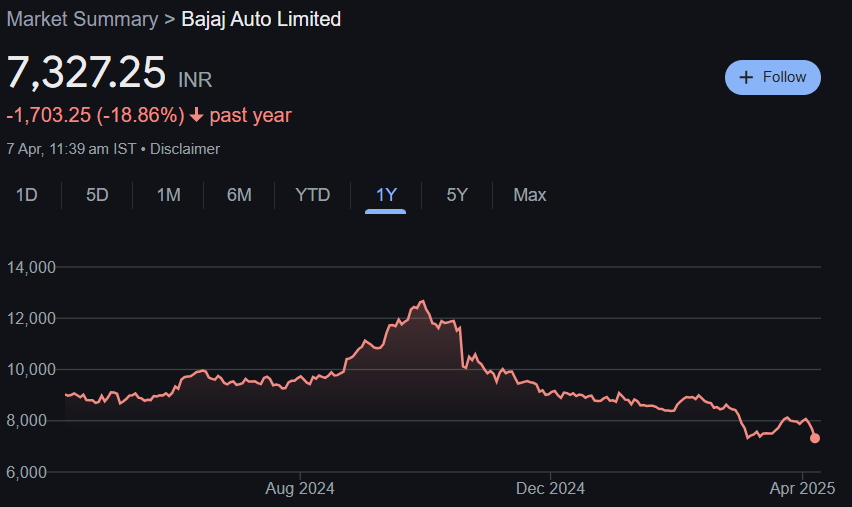

Latest Stock Market Performance & Key Facts

- Open Price: ₹7,300.00

- Previous Close: ₹7,885.10

- 52-Week High: ₹12,774.00

- 52-Week Low: ₹7,089.35

- Market Cap: ₹2.05 Lakh Crore

- P/E Ratio: 27.25

- Dividend Yield: 1.09%

- Upper Circuit: ₹8,453.80

- Lower Circuit: ₹6,916.80

The stock has been highly volatile in the past one year with a sharp decline of 18.94%, possibly due to profit booking, sector rotation, or foreign sentiment. However, Bajaj Auto is well placed fundamentally with stable top line, bottom line, and innovation in the EV segment.

Technical Analysis – Momentum & Indicators

It is important to know the market mood in order to time your investment. Let us see Bajaj Auto’s daily technical indicators:

- Day Momentum Score: 35.4 (Neutral)

- MACD: -58.4 (Bearish)

- ADX: 23.0 (Weak trend)

- RSI (14): 40.8 (Neutral to Slightly Oversold)

- MFI: 46.6 (Neutral)

- ATR (Average True Range): 207.6 (Indicates high volatility)

- ROC (125-day): -34.7 (Negative long-term momentum)

Interpretation

Bajaj Auto is neutral to slightly bearish at the moment. MACD and ADX are indicating losing momentum but neither RSI nor MFI is indicating extreme reading. The stock can consolidate short term until it gets direction and is therefore a good time to buy dips for long-term investors.

Fundamentals & Financial Health

Following are some of the key financial indicators of Bajaj Auto:

- EPS (TTM): ₹289.80

- P/E Ratio (TTM): 28.50

- Industry P/E: 19.88

- Debt-to-Equity: 0.17 (Less debt = healthy finances)

- Book Value: ₹1,109.33

- Return on Capital (ROC): 23.79%

- P/B Ratio: 6.93

Less debt, high return on capital, and good earnings per share of Bajaj Auto indicate a healthy and robust balance sheet. The stable dividend offered by the company is also generating value for long-term investors.

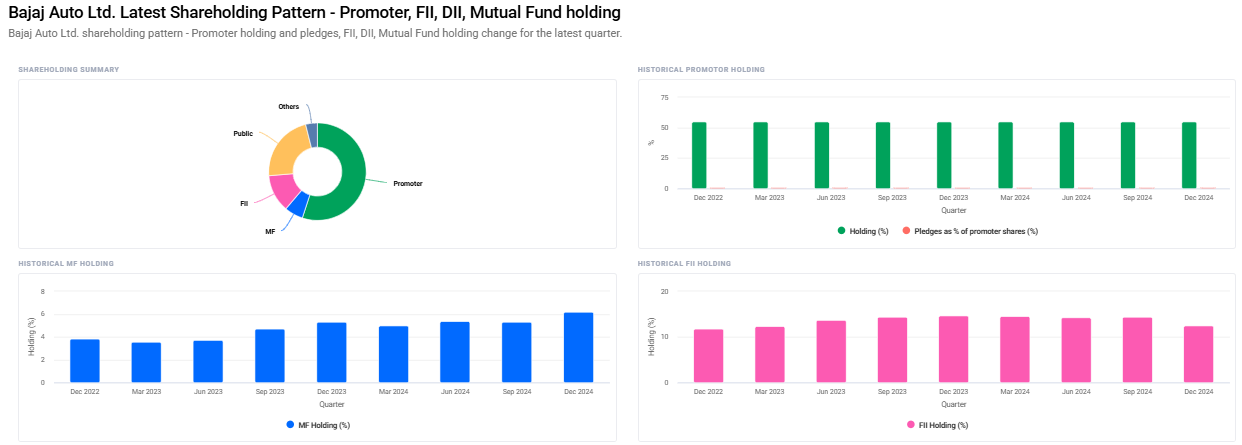

Ownership Structure

- Promoters: 55.04%

- Retail & Others: 22.45%

- Foreign Institutions (FII/FPI): 12.45%

- Mutual Funds: 6.19%

- Other Domestic Institutions: 3.87%

Institutional Confidence

- FIIs have risen their holding to 4.82% from 5.03%.

- FII/FPI investor base increased from 70 to 102 in the previous quarter.

- Mutual Funds holding also remained a constant 1.64%, although the schemes were reduced slightly.

- Holding by Institutional investors is now up at 7.99% from 9.02%.

This type of institutional buying is an indicator of a pointer towards new faith in the long-term future prospects of Bajaj Auto.

Bajaj Auto Share Price Target From 2025 to 2030

As per industry trends, financials, exports and EV growth, the following are the target share price estimates anticipated:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹13000 |

| 2026 | ₹19000 |

| 2027 | ₹25000 |

| 2028 | ₹31000 |

| 2029 | ₹37000 |

| 2030 | ₹43000 |

These targets make the assumption of stable earnings growth, EV space innovation, overseas expansion, and positive auto segment trends.

Investment Strategy

Short-Term Investors (1-2 Years)

- Risk: High (Volatility anticipated)

- Entry Point: Accumulate at ₹7,000-7,200

- Target: ₹13,000 by 2025

- Strategy: Apply stop-loss; be cautious of booking partially at resistance levels

Medium-Term Investors (3-5 Years)

- Risk: Moderate

- Target: ₹25,000

- Strategy: Tide through short-term volatility and keep quarterly performances, particularly from the EV segment, in sight

Long Term Investors (5+ Years)

- Risk: Low (Strong fundamentals)

- Target: ₹ 43,000+

- Strategy: Suitable for SIP-type or lump sum investment for a long term duration of time

Key challenges and risks

Although Bajaj Auto does have high upside, investors must watch out for:

- Market Volatility: Global interest rates, commodities, and macroeconomics can impact the stock.

- EV Competition: Domestic as well as international EV players such as Ola Electric, Ather, and Hero MotoCorp are creating competition.

- Regulatory Risks: Auto insurance, pollution control and EV incentives are susceptible to change, which will influence top line flows.

- Supply Chain Disruption: Geopolitical tensions or raw material shortages can influence cost of production.

FAQs Bajaj Auto Share Price Target

Q1. Is Bajaj Auto a good bet in the long run?

Yes, Bajaj Auto enjoys healthy financials, global market presence, and focused EV strategies. It’s a logical choice for long term investors who are looking for stable returns.

Q2. What will be the Bajaj Auto share price in 2025?

Share price target in 2025 is put at about ₹13,000, taking into account market revival and EV push.

Q3. Can Bajaj Auto ride the electric vehicle (EV) wave?

Yes. The Chetak EV launch and follow-up initiatives in the space place Bajaj Auto to take advantage of India and overseas-based growing EV business.

Q4. What should we watch out for in terms of risks?

Competition in the EV space, regulatory developments, and supply chain risk are possible risks to watch out for by investors.

Q5. Institutional demand has shifted in which direction?

FIIs and institutions have infused new to holdings, reflecting greater faith in Bajaj Auto’s fortunes.

Final Verdict – Should You Invest?

Bajaj Auto Ltd. is India’s best automobile player. Brand equity, leadership in innovation, and foreign ambitions despite recent mergers aside, the company’s underlying strength makes it a good long-term investment.

If you are interested in betting on a solid fundamentally stock with stable performance and betting on the future of mobility, Bajaj Auto is worth your attention.