Bandhan Bank Share Price Target Tomorrow 2025 To 2030

Bandhan Bank is a fast-growing private sector bank in India that started its journey in 2015. It was originally a microfinance company that provided small loans to people in rural and semi-urban areas. Today, it has become a full-service bank offering savings accounts, loans, and other banking services to individuals and businesses. Bandhan Bank is known for its strong focus on helping the underbanked and supporting financial inclusion. Bandhan Bank Share Price on NSE as of 24 May 2025 is 165.25 INR.

Bandhan Bank Share Market Overview

- Open: 166.40

- High: 166.45

- Low: 164.43

- Previous Close: 165.60

- Volume: 3,239,902

- Value (Lacs): 5,360.74

- UC Limit: 182.16

- LC Limit: 149.04

- 52 Week High: 222.31

- 52 Week Low: 128.16

- Mkt Cap (Rs. Cr.): 26,655

- Face Value: 10

Bandhan Bank Share Price Chart

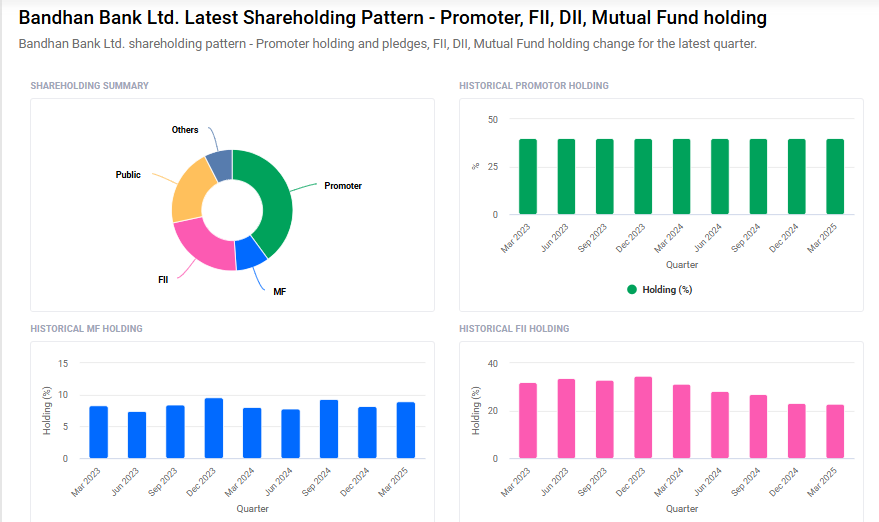

Bandhan Bank Shareholding Pattern

- Promoters: 40%

- FII: 22.7%

- DII: 16.4%

- Public: 20.9%

Bandhan Bank Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹230 |

| 2026 | ₹250 |

| 2027 | ₹280 |

| 2028 | ₹310 |

| 2029 | ₹340 |

| 2030 | ₹370 |

Bandhan Bank Share Price Target 2025

Bandhan Bank share price target 2025 Expected target could ₹230. Here are five key factors that could influence Bandhan Bank’s share price growth by 2025:

1. Strong Financial Performance

In FY25, Bandhan Bank reported a 23% year-on-year increase in Profit After Tax (PAT), reaching ₹2,745 crore. Deposits grew by 12% to ₹1.51 lakh crore, and gross advances rose by 10% to ₹1.37 lakh crore. Notably, secured advances grew by 32% year-on-year, now constituting over 50% of the total advances.

2. Strategic Shift Towards Secured Lending

The bank is transitioning its portfolio towards secured loans, aiming to increase the share from around 50% to 55-60% over the next two years. This move is expected to reduce business cyclicality and align better with regulatory expectations.

3. Expansion in Semi-Urban and Rural Areas

Bandhan Bank has been expanding its footprint by opening new branches in semi-urban and rural regions. Recently, it inaugurated 16 new branches across five states, enhancing accessibility to banking services in these areas.

4. Analyst Confidence and Share Price Targets

Analysts have shown confidence in Bandhan Bank’s growth prospects. For instance, Anand Rathi has set a 12-month target price of ₹207, while ICICI Securities has a target of ₹185, indicating potential upside from the current share price.

5. Leadership Stability

The appointment of Partha Pratim Sengupta as CEO has been viewed positively by the market. His leadership is expected to bring stability and drive the bank’s strategic initiatives forward.

Bandhan Bank Share Price Target 2030

Bandhan Bank share price target 2030 Expected target could ₹370. Here are five key risks and challenges that could impact Bandhan Bank’s share price and overall growth potential by 2030:

1. High Exposure to Microfinance Sector

Bandhan Bank has a significant portion of its loan book in microfinance, which is inherently risky due to the nature of unsecured lending. These loans are more vulnerable to defaults, especially during economic slowdowns, natural calamities, or political disruptions in rural and semi-urban areas.

2. Asset Quality Concerns

The bank has faced challenges in maintaining asset quality in the past, with elevated levels of Non-Performing Assets (NPAs). If the trend continues or worsens, it could hurt profitability and investor confidence, thereby affecting the share price.

3. Regulatory Risks

The banking sector in India is tightly regulated. Changes in RBI policies, interest rate fluctuations, or stricter norms around priority sector lending and capital adequacy could impact Bandhan Bank’s growth strategy and operations.

4. Management Transitions and Governance

Any instability in leadership or governance issues could negatively affect strategic decision-making. While the recent CEO appointment is a positive, future transitions or board-level disagreements could present uncertainties.

5. Increased Competition

With the rapid digitalization of financial services and the entry of new private banks, fintechs, and payment banks, Bandhan Bank faces growing competition. This could pressure margins and limit its market share, especially in the microfinance and rural lending space.

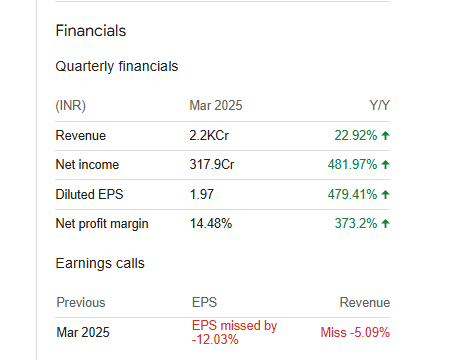

Bandhan Bank Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 106.92B | 21.58% |

| Operating expense | 70.68B | 20.81% |

| Net income | 27.45B | 23.13% |

| Net profit margin | 25.68 | 1.30% |

| Earnings per share | 17.04 | 23.12% |

| EBITDA | — | — |

| Effective tax rate | 24.23% | — |

Read Also:- Apollo Hospital Share Price Target Tomorrow 2025 To 2030