BEL Share Price Target Tomorrow 2025 To 2030

Bharat Electronics Limited (BEL) is a leading Indian government-owned company that makes advanced electronic products mainly for the defense sector. Established in 1954, BEL plays a key role in supporting India’s military with systems like radars, communication equipment, and electronic warfare devices. Over the years, the company has also started working in other areas such as space, healthcare, and smart city solutions. BEL Share Price on NSE as of 30 April 2025 is 317.15 INR.

BEL Share Market Overview

- Open: 306.55

- High: 319.45

- Low: 305.80

- Previous Close: 305.05

- Volume: 57,883,471

- Value (Lacs): 183,548.49

- 52 Week High: 340.50

- 52 Week Low: 221.00

- Mkt Cap (Rs. Cr.): 231,793

- Face Value: 1

BEL Share Price Chart

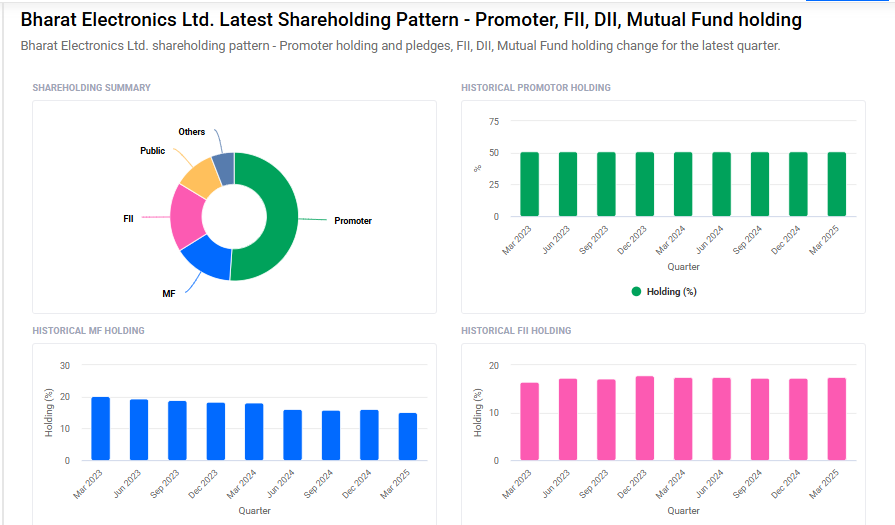

BEL Shareholding Pattern

- Promoters: 51.1%

- FII: 17.6%

- DII: 20.9%

- Public: 10.4%

BEL Share Price Target Tomorrow 2025 To 2030

| BEL Share Price Target Years | BEL Share Price |

| 2025 | ₹350 |

| 2026 | ₹450 |

| 2027 | ₹550 |

| 2028 | ₹650 |

| 2029 | ₹750 |

| 2030 | ₹850 |

BEL Share Price Target 2025

BEL share price target 2025 Expected target could be ₹350. Here are four key factors influencing the growth of Bharat Electronics Limited (BEL) and its share price target for 2025:

1. Robust Order Book and Revenue Visibility

BEL boasts a strong order backlog, equivalent to 3.7 times its trailing twelve-month revenues, providing excellent revenue visibility. The company anticipates receiving an order inflow of ₹25,000 crore in FY25 and between ₹25,000 crore and ₹50,000 crore in FY26, indicating a healthy pipeline of projects.

2. Diversification into Non-Defense Sectors

BEL is actively expanding into non-defense areas such as space, healthcare electronics, and smart cities. This diversification strategy aims to reduce dependence on defense contracts and tap into emerging markets, potentially boosting the company’s growth prospects.

3. Government Initiatives and Indigenization Efforts

The Indian government’s focus on indigenization and increased capital investment in domestically produced defense systems directly benefits BEL. The company’s alignment with government initiatives positions it favorably to secure significant orders from the Ministry of Defence.

4. Strong Financial Performance and R&D Investment

For FY25, BEL has set a revenue growth target of 15%, with a gross margin range of 42%-44% and an EBITDA margin range of 23%-25%. In FY24, the company invested ₹1,236 crore in research and development, underscoring its commitment to innovation and long-term growth.

BEL Share Price Target 2030

BEL share price target 2030 Expected target could be ₹850. Here are four key Risks and Challenges that could impact BEL’s (Bharat Electronics Limited) share price target by 2030:

-

Heavy Dependence on Government Contracts

BEL relies heavily on orders from the Indian government and defense sector. Any delay in policy decisions, budget cuts, or shift in procurement priorities could directly affect its order book and revenues. -

Geopolitical and Regulatory Risks

Changes in international relations, defense export policies, or geopolitical tensions could impact BEL’s global partnerships, especially as it aims to expand exports and joint ventures. -

Technological Disruption and Global Competition

The defense electronics industry is evolving rapidly. If BEL fails to keep pace with technological advancements or faces stiff competition from global players, it may lose market share. -

Limited Diversification Risk

Although BEL is trying to enter non-defense sectors like healthcare and smart cities, a slow or unsuccessful diversification strategy may make the company vulnerable to shifts in the defense sector alone.

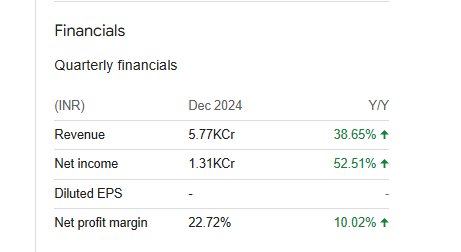

BEL Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 202.68B | 14.29% |

| Operating expense | 47.01B | 21.50% |

| Net income | 39.85B | 33.51% |

| Net profit margin | 19.66 | 16.82% |

| Earnings per share | 5.45 | 33.25% |

| EBITDA | 51.14B | 25.10% |

| Effective tax rate | 24.92% | — |

Read Also:- NMDC Steel Share Price Target Tomorrow 2025 To 2030