Berger Paints Share Price Target From 2025 to 2030

Berger Paints Share Price Target From 2025 to 2030: Investment in the stock market requires right knowledge about a company’s fundamentals, technicals, ownership pattern, and growth opportunities in the future. An industrial company like Berger Paints (India) Ltd., which has always remained in the focus of investors in the Indian stock market, is a market leader in the paint and coating industry.

As Indian urbanization, real estate, and home renovations swell with it, demand for premium decorative and industrial coatings has seen a massive leap. Relying on its well-rooted market base and equity, this type of demand would most certainly propel Berger Paints leaps and bounds ahead. A close review of Berger Paints’ recent past, technical and fundamental analysis values, institutional trading, and expected share price objectives in 2025-2030 is elaborated hereinbelow.

Company Overview and Market Position

Berger Paints India Ltd. is a leading paint firm in India, second only to Asian Paints in market share. It has national presence in decorative and industrial coating business as well as expanding international presence.

Key Strengths:

- Very good brand image and extensive distribution network

- Increased focus on eco-friendly and green paint products

- Upgradation of technology and strategic alliances

- Increasing rural and semi-urban consumption with increasing disposable incomes

With infrastructure and housing development on the increase in India, particularly with the government’s affordable housing scheme, Berger Paints is well placed to benefit from these trends.

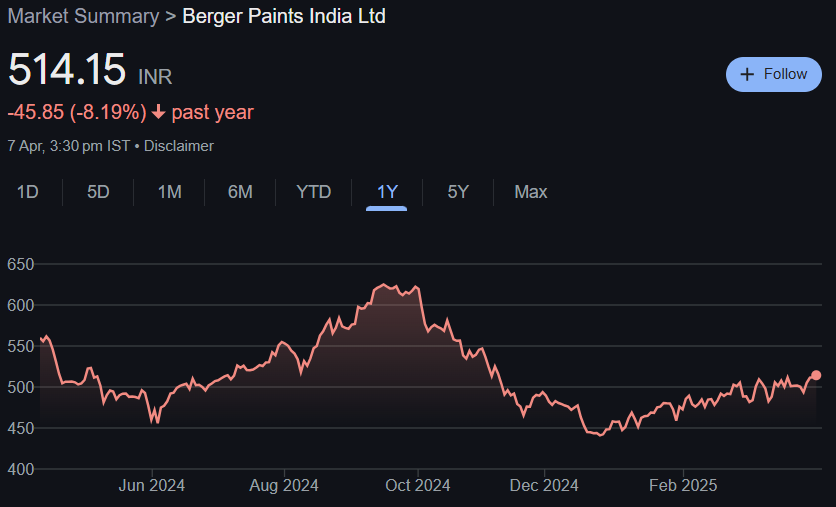

Recent Financial Performance on the Stock Market

Below is a brief summary of Berger Paints’ recent and latest financial performance on the stock market:

- Open Price: ₹499.95

- High: ₹515.25

- Low: ₹494.50

- Current Market Price: ₹514.15

- Market Cap: ₹59,540 Cr

- P/E Ratio: 52.59

- Dividend Yield: 0.68%

- 52-week High: ₹629.50

- 52-week Low: ₹437.75

- Volume: 12,63,089

- Total Traded Value: ₹64.86 Cr

The stock has lost 8.19% in the last one year, a correct correction owing to sectoral winds, FII sentiments change, and general market volatility. Fundamentals, nevertheless, have a strong base to invest in the long term.

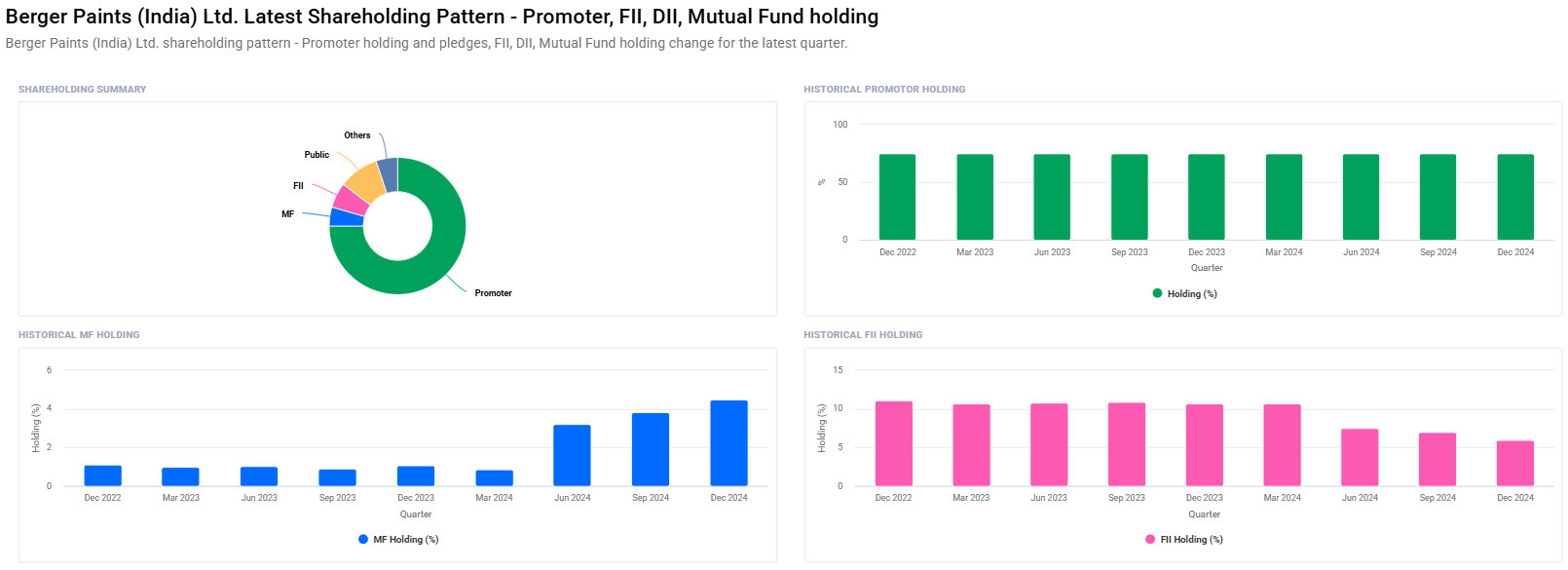

Ownership and Institutional Sentiment

The Berger Paints shareholding pattern shows an indicator of great confidence of promoters and moderate confidence of institutions.

- Promoters: 74.99%

- Foreign Institutional Investors (FII): 5.94%

- Mutual Funds: 4.47%

- Other Domestic Institutions: 5.14%

- Retail and Others: 9.47%

Key Observations:

- Promoter holding remained the same at 74.99%, which marks long-term confidence.

- FIIs have trimmed their holding from 6.98% to 5.94% in the previous quarter.

- Mutual Funds have increased their holding, showing increased domestic institutional confidence.

This pattern shows a balanced outlook: foreign investors have trimmed holdings, but the domestic investors are increasing their interest.

Fundamental Analysis

Following is an analysis of key financial figures for Berger Paints:

- P/E Ratio (TTM): 52.48 (industry’s higher P/E of 48.41, indicates premium valuation)

- EPS (TTM): ₹9.78

- Book Value: ₹47.95

- Return on Capital (ROC): 20.48%

- Debt-to-Equity Ratio: 0.14 (low leverage and financially healthy)

- Dividend Yield: 0.88%

The high ROC, low debt, and consistent dividend payout of Berger Paints signify a balanced and good working capital utilization through its balance sheet, although the high P/E over the mean might be the sign of overvaluation of shares.

Technical Indicators

Now, let us consider the Berger Paints’ short-term technical indicators:

- RSI (14-day): 58.1, Neutral

- MACD: 4.8, Bullish

- MACD Signal Line: 4.4, Bullish

- ADX: 14.2, Weak Trend

- ROC (21): 5.8, Positive Momentum

- MFI: 45.3, Neutral

- ATR: 14.5, Moderate Volatility

- ROC (125): -9.8, Negative Medium-Term Momentum

In spite of MACD indicating a probable bullish crossover, the ADX indicates that the present trend is weak and RSI suggests neutrality, i.e., the share can still move range-bound in the short term before gaining momentum.

Berger Paints Share Price Target (2025 to 2030)

Given Berger Paints’ historical performance, inherent strength, and its placement in a fast-growing industry, the following are the share price targets for future years:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹650 |

| 2026 | ₹850 |

| 2027 | ₹1050 |

| 2028 | ₹1250 |

| 2029 | ₹1450 |

| 2030 | ₹1650 |

These estimates are on the assumption of a flat CAGR of 15-20% driven by economy growth, infrastructure and housing spending, and growth in the building industry.

Investment Strategy

Short-Term Investors (1-2 Years)

- Strategy: Build on dips between ₹480-490 levels; be careful of breakout above ₹530.

- Exit Zone: ₹650 to ₹700

- Risk Level: Moderate from market sentiment as well as overseas cues

Medium-Term Investors (3-5 Years)

- Strategy: SIP route; get stable dividend returns and valuation appreciation

- Exit Zone: ₹1050 to ₹1250

- Risk Level: Low to Moderate

Long-Term Investors (5+ Years)

- Strategy: Buy-and-hold for compounding benefit; the best for wealth creation

- Exit Zone: ₹1450 to ₹1650 or more

- Risk Level: Low

Risks and Challenges

Despite its strengths, Berger Paints is not free from some market and business risks:

- High Valuation: P/E of more than 50 acts as a deterrent to value.

- Raw Material Costs: Paint company margins are sensitive to crude oil prices.

- FII selling: FII reduction in holding can result in short-term share pressure.

- Competitive Landscape: Competition from Asian Paints, Kansai Nerolac, and JSW Paints can hold back margin growth.

- Currency Risk: Since the export business of the company is growing, fluctuations in foreign exchange rates can impact the earnings.

Final Verdict – Is Berger Paints a Good Investment?

Berger Paints is a relatively well-balanced investment option for investors wishing to take exposure of the India consumption and infrastructure theme. It has demonstrated resilience, stable growth, and product innovation. It has been volatile short-term but has a better long-term outlook.

For day traders, the momentum must go above ₹530 for a rise. For long-term investors, however, shares can be purchased on a correction since the next decade up to 2030 should be good with a target price of ₹1650.

FAQs on Berger Paints Share Price Target

Q1: Is Berger Paints a good stock for long-term investment?

A: Yes, with low debt, steady growth, strong brand equity, and new geography expansion, Berger Paints is a good long-term bet.

Q2: Why did the share price fall recently?

A: Recent decline due to market corrections, FII holding decline, and valuation concerns. However, the company’s fundamentals are solid.

Q3: What is the Berger Paints’ share price target in 2025?

A: The estimated share price of 2025 is about ₹650, considering sector recovery and recovery in demand.

Q4: What are the key risks in investing in Berger Paints?

A: Valuation risk, fluctuations in raw material prices, and intense competition from other paint companies are significant risks.

Q5: What are the key technical indicators which investors need to watch out in Berger Paints?

A: Significant indicators are RSI (58.1), MACD (Bullish), and ADX (Weak trend). A breakout at ₹530 may show a bull rally.

Q6: Is Berger Paints a dividend-paying firm?

A: Yes, the dividend yield of Berger Paints is around 0.88% and is suitable for investors who wish to invest for dividend returns.

Q7: In what ways is Berger Paints unique compared to other players?

A: Even though it falls behind Asian Paints in market capitalization, Berger Paints is lower on a per-share basis and shares the same pattern of growth.