Bhagwati Autocast Share Price Target Tomorrow 2025 To 2030

Bhagwati Autocast Limited, established in 1981 and based near Ahmedabad, India, is a prominent manufacturer of cast iron (CI) and spheroidal graphite iron (SGI) castings. The company operates a modern machine molding unit equipped with a Disa Flex-70 high-pressure line, boasting an annual production capacity of 18,000 tons. Bhagwati Autocast supplies a diverse range of castings, including cylinder blocks, crankcases, hydraulic lift housings, gearbox and clutch housings, and front axle supports, catering to industries such as automotive, agriculture, general engineering, and energy. Bhagwati Autocast Share Price on BOM as of 5 May 2025 is 332.05 INR.

Bhagwati Autocast Share Market Overview

- Open: 324.00

- High: 349.00

- Low: 324.00

- Previous Close: 332.75

- Volume: 1,104

- Value (Lacs): 3.67

- VWAP: 330.84

- 52 Week High: 596.30

- 52 Week Low: 319.95

- Mkt Cap (Rs. Cr.): 95

- Face Value: 10

Bhagwati Autocast Share Price Chart

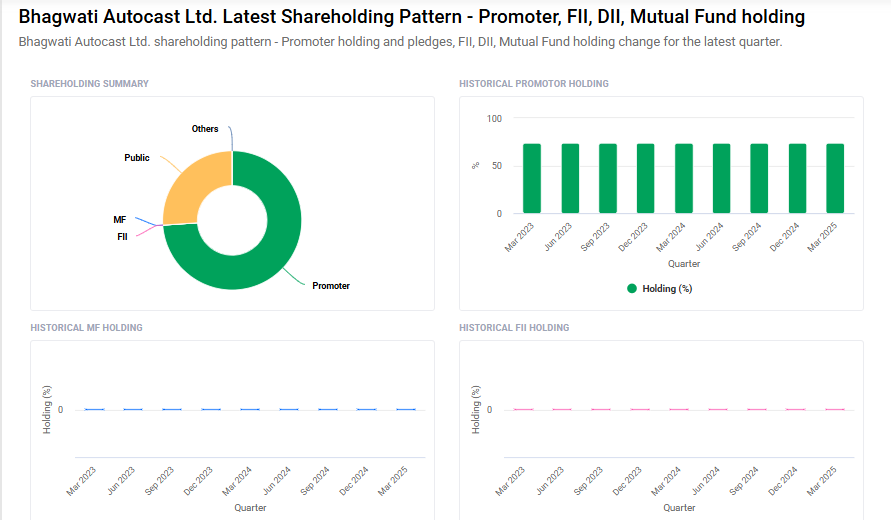

Bhagwati Autocast Shareholding Pattern

- Promoters: 73.9%

- FII: 0%

- DII: 0%

- Public: 26.1%

Bhagwati Autocast Share Price Target Tomorrow 2025 To 2030

| Bhagwati Autocast Share Price Target Years | Bhagwati Autocast Share Price |

| 2025 | ₹600 |

| 2026 | ₹650 |

| 2027 | ₹700 |

| 2028 | ₹750 |

| 2029 | ₹800 |

| 2030 | ₹850 |

Bhagwati Autocast Share Price Target 2025

Bhagwati Autocast share price target 2025 Expected target could ₹600. Here are four key factors that could influence the growth of Bhagwati Autocast Ltd:

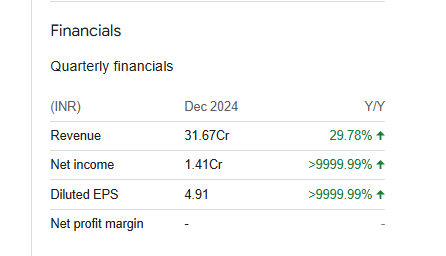

1. Strong Profit Growth

In Q3 FY2024-25, Bhagwati Autocast reported a remarkable 14,000% year-over-year increase in net profit, reaching ₹1.41 crore. This substantial growth indicates improved operational efficiency and profitability, which could positively impact investor sentiment and share price.

2. Improved Financial Metrics

The company has demonstrated strong financial health, with a Return on Equity (ROE) of 18.41% and a Return on Capital Employed (ROCE) of 22.56%. These metrics suggest effective utilization of capital and robust financial performance, enhancing its attractiveness to investors.

3. Promoter Confidence

As of March 2025, the promoter holding in Bhagwati Autocast remains high at 73.92%. This significant stake indicates strong promoter confidence in the company’s future prospects, which can be reassuring for potential investors.

4. Positive Stock Forecast

Analysts project a positive trend for Bhagwati Autocast’s stock, with forecasts suggesting a long-term increase in share price. Such optimistic projections can attract investor interest and contribute to share price appreciation.

Bhagwati Autocast Share Price Target 2030

Bhagwati Autocast share price target 2030 Expected target could ₹850. Here are four key risks and challenges that could impact Bhagwati Autocast Ltd:

1. Dependence on Automotive Sector

Bhagwati Autocast primarily serves the automobile industry. Any slowdown in auto manufacturing or changes in consumer demand for vehicles could directly affect the company’s order flow and revenue.

2. Raw Material Price Volatility

The company relies heavily on raw materials like pig iron and steel. Fluctuations in commodity prices can lead to increased production costs, which may not always be passed on to customers, potentially affecting profit margins.

3. Limited Market Diversification

Compared to larger players, Bhagwati Autocast has a relatively small scale and may be more vulnerable to regional or sector-specific economic changes. A lack of diversification in both products and clients can expose the company to higher operational risk.

4. Technological Disruption and Competition

Advancements in casting technologies or shifts toward alternative manufacturing methods could reduce demand for traditional cast components. Additionally, increased competition from domestic and international players may pressure prices and market share.

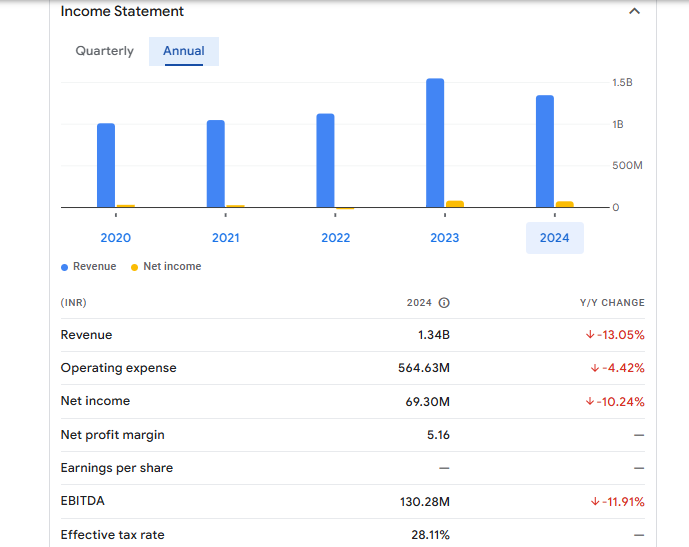

Bhagwati Autocast Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 1.34B | -13.05% |

| Operating expense | 564.63M | -4.42% |

| Net income | 69.30M | -10.24% |

| Net profit margin | 5.16 | — |

| Earnings per share | — | — |

| EBITDA | 130.28M | -11.91% |

| Effective tax rate | 28.11% | — |

Read Also:- International Travel House Share Price Target Tomorrow 2025 To 2030