Birla Soft Share Price Target Tomorrow 2025 To 2030

Birlasoft is a global information technology services and consulting company headquartered in Pune, India. Founded in 1990, it is part of the CK Birla Group, a diversified conglomerate with a rich legacy spanning over 170 years. Birlasoft specializes in delivering digital transformation solutions, enterprise application services, and IT consulting across various industries, including banking and financial services, manufacturing, life sciences, and energy. Birla Soft Share Price on NSE as of 27 May 2025 is 418.00 INR.

Birla Soft Share Market Overview

- Open: 425.25

- High: 427.35

- Low: 415.45

- Previous Close: 424.80

- Volume: 1,343,961

- Value (Lacs): 5,625.15

- 52 Week High: 760.45

- 52 Week Low: 331.00

- Mkt Cap (Rs. Cr.): 11,630

- Face Value: 2

Birla Soft Share Price Chart

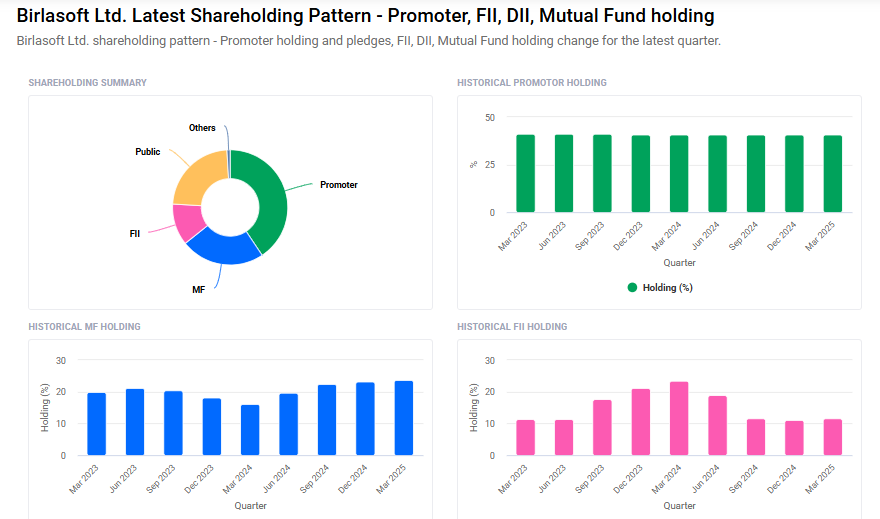

Birla Soft Shareholding Pattern

- Promoters: 40.6%

- FII: 11.7%

- DII: 24.5%

- Public: 23.2%

Birla Soft Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹765 |

| 2026 | ₹950 |

| 2027 | ₹1070 |

| 2028 | ₹1256 |

| 2029 | ₹1463 |

| 2030 | ₹1670 |

Birla Soft Share Price Target 2025

Birla Soft share price target 2025 Expected target could ₹765. Here are five key factors that could influence Birlasoft’s share price target by 2025:

-

Strategic Focus on Digital Transformation and Cloud Services

Birlasoft is intensifying its emphasis on digital transformation, particularly in cloud services. The company has achieved Oracle Cloud Solutions Provider expertise and maintains partnerships with major cloud platforms like Microsoft Azure, Google Cloud, and AWS. This strategic alignment positions Birlasoft to capitalize on the growing demand for cloud-based solutions. -

Expansion in High-Growth Industry Verticals

The company is targeting growth in sectors such as BFSI (Banking, Financial Services, and Insurance), manufacturing, and life sciences. Notably, the BFSI vertical experienced a 1.8% quarter-on-quarter growth in Q3 FY25, indicating potential for sustained expansion in these areas. -

Strong Financial Position and Cash Reserves

Birlasoft reported a cash and bank balance of $221.8 million at the end of Q2 FY25, reflecting a 27.8% increase. This robust financial position provides the company with the flexibility to invest in growth initiatives and navigate market uncertainties. -

Commitment to Innovation and Sustainability

The company has invested ₹100 crore into research and development, focusing on sustainable technologies and practices. Additionally, Birlasoft has set a target to reduce its carbon footprint by 25% by 2025, aligning with global sustainability trends and potentially attracting environmentally conscious investors. -

Analyst Price Targets Indicate Potential Upside

Analysts have set a one-year price target for Birlasoft ranging from ₹370 to ₹640, with an average target of ₹485.08. This suggests a potential upside from current levels, reflecting optimism about the company’s growth prospects.

Birla Soft Share Price Target 2030

Birla Soft share price target 2030 Expected target could ₹1670. Here are five key risks and challenges that could influence Birlasoft’s share price target by 2030:

-

Intensifying Global Competition

The IT services sector is highly competitive, with numerous global players vying for market share. Birlasoft faces competition from both established multinational corporations and agile startups, which could pressure pricing and margins. -

Rapid Technological Changes

The pace of technological advancement necessitates continuous innovation. Birlasoft must invest in emerging technologies like artificial intelligence, machine learning, and cybersecurity to stay relevant. Failure to adapt could result in obsolescence of services. -

Talent Acquisition and Retention

Attracting and retaining skilled professionals is crucial in the IT industry. High attrition rates or a shortage of qualified personnel could impact project delivery and client satisfaction, potentially affecting the company’s reputation and financial performance. -

Regulatory and Compliance Risks

Operating across multiple jurisdictions exposes Birlasoft to varying regulatory environments. Changes in data protection laws, taxation policies, or trade regulations could increase compliance costs and operational complexities. -

Economic and Geopolitical Uncertainties

Global economic slowdowns or geopolitical tensions can lead to reduced IT spending by clients, especially in key markets like the US and Europe. Such macroeconomic factors could adversely affect Birlasoft’s revenue growth and profitability.

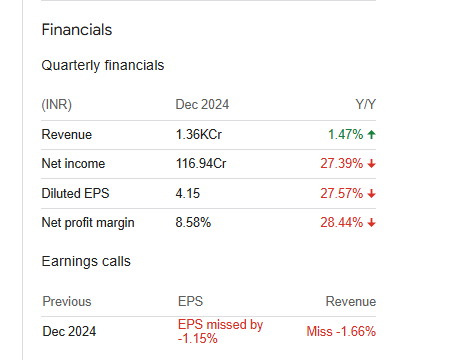

Birla Soft Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 52.78B | 10.08% |

| Operating expense | 14.45B | -4.52% |

| Net income | 6.24B | 88.12% |

| Net profit margin | 11.82 | 70.81% |

| Earnings per share | 22.25 | 86.66% |

| EBITDA | 7.99B | 64.42% |

| Effective tax rate | 25.28% | — |

Read Also:- Tata Chemicals Share Price Target Tomorrow 2025 To 2030