BOI Share Price Target Tomorrow 2025 To 2030

Bank of India (BOI) is one of India’s oldest and most trusted public sector banks, with a strong presence both in India and abroad. The BOI share represents ownership in this established banking institution, which provides a wide range of financial services including retail banking, corporate banking, loans, and investment products. The bank has been actively working on improving its financial health by reducing non-performing assets and focusing on digital transformation. BOI shares can be influenced by factors like economic growth, interest rate changes, government policies, and the bank’s quarterly financial performance. BOI Share Price on NSE as of 23 April 2025 is 118.82 INR.

BOI Share Market Overview

- Open: 120.65

- High: 121.65

- Low: 118.54

- Previous Close: 119.87

- Volume: 9,232,904

- Value (Lacs): 10,971.46

- 52 Week High: 157.95

- 52 Week Low: 90.05

- Mkt Cap (Rs. Cr.): 54,099

- Face Value: 10

BOI Share Price Chart

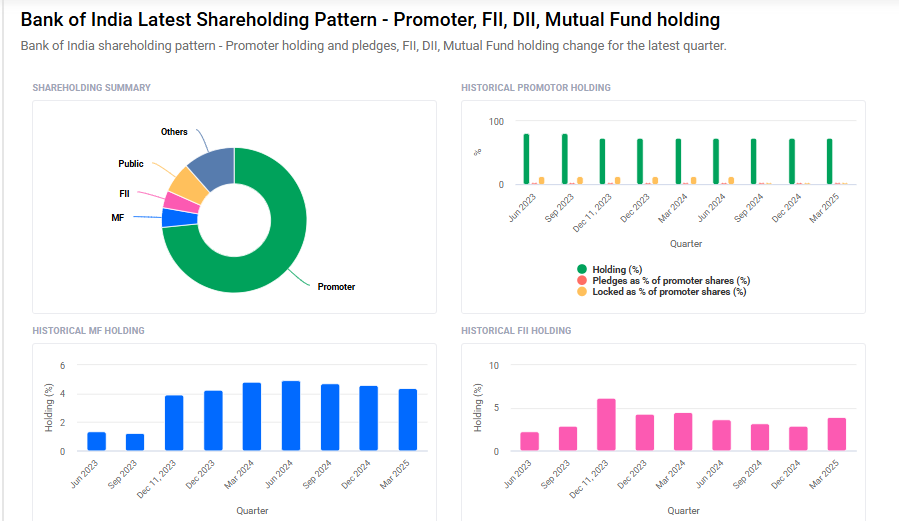

BOI Shareholding Pattern

- Promoters: 73.4%

- FII: 3.9%

- DII: 15.9%

- Public: 6.8%

BOI Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹160

- 2026 – ₹170

- 2027 – ₹180

- 2028 – ₹90

- 2030 – ₹200

Major Factors Affecting BOI Share Price

Here are six key factors that influence the share price of Bank of India (BOI):

1. Financial Performance and Profitability

BOI’s financial health significantly impacts its stock price. For instance, despite reporting a 35% year-on-year profit growth in Q3 FY25, the bank’s share price declined by 14% in February 2025. This suggests that investors may have had concerns beyond just profit figures, such as asset quality or market sentiment.

2. Asset Quality and Non-Performing Assets (NPAs)

The level of NPAs is a critical indicator of a bank’s financial stability. A rise in NPAs can signal potential defaults and affect the bank’s profitability. Investors closely monitor these metrics, as deteriorating asset quality can lead to a decline in share price.

3. Market Sentiment and Economic Conditions

Overall market sentiment and macroeconomic factors, such as inflation, interest rates, and GDP growth, influence BOI’s stock performance. For example, a 14% drop in BOI’s share price in February 2025 occurred despite strong profit growth, indicating that broader economic concerns or investor sentiment may have played a role.

4. Government Policies and Regulatory Environment

As a public sector bank, BOI is subject to government policies and regulatory changes. Modifications in interest rates, capital requirements, or other banking regulations can impact the bank’s operations and profitability, thereby affecting its share price.

5. Competitive Landscape and Market Position

BOI faces competition from other public and private sector banks. Its market share and ability to attract and retain customers influence its revenue and profitability. A strong competitive position can positively impact the bank’s stock price, while challenges in this area may have the opposite effect.

6. Investor Perception and Analyst Ratings

Analyst recommendations and investor perceptions play a significant role in BOI’s share price movements. For instance, despite strong financial results, a 14% decline in share price in February 2025 suggests that investor sentiment or analyst outlooks may have been less favorable.

Risks and Challenges for BOI Share Price

Here are six key risks and challenges that could influence the share price of Bank of India (BOI):

1. Economic Slowdown and Market Volatility

The Indian economy faces challenges such as global trade tensions and inflationary pressures. These factors can lead to market volatility, affecting investor sentiment and potentially impacting BOI’s stock performance. For instance, despite strong profit growth, BOI’s share price declined by 14% in February 2025, possibly due to broader economic concerns.

2. Asset Quality and Non-Performing Assets (NPAs)

While BOI has made progress in reducing its NPAs, any future increase in bad loans could raise concerns about the bank’s financial health. A higher NPA ratio might lead to increased provisioning, affecting profitability and potentially lowering the stock price.

3. Government Ownership and Policy Changes

As a public sector bank, BOI is subject to government policies and regulatory changes. Adjustments in capital requirements, lending norms, or other regulations can impact the bank’s operations and profitability, influencing its share price.

4. Competitive Pressure from Other Banks

The banking sector is highly competitive, with both public and private banks vying for market share. If BOI fails to innovate or maintain its customer base, it could lose market share, affecting revenue and stock performance.

5. Interest Rate Fluctuations

Changes in interest rates set by the Reserve Bank of India can influence BOI’s net interest margin. An unfavorable interest rate environment could compress margins, impacting profitability and potentially leading to a decline in share price.

6. Liquidity and Capital Adequacy Concerns

Regulatory changes affecting liquidity coverage ratios and capital adequacy norms could pose challenges for BOI. Stricter requirements might necessitate additional capital raising or adjustments in lending practices, impacting the bank’s operations and investor perception.

Read Also:- SBI Share Price Target Tomorrow 2025 To 2030