BSE Ltd Share Price Target Tomorrow 2025 To 2030

BSE Ltd, also known as the Bombay Stock Exchange, is one of the oldest and most respected stock exchanges in Asia. Based in Mumbai, it plays a key role in India’s financial market by helping companies raise money and providing a platform for investors to buy and sell shares. BSE offers services like equity trading, derivatives, mutual funds, and bonds. Over the years, it has adopted advanced technology to make trading faster and safer. BSE Ltd Share Price on NSE as of 21 May 2025 is 7,400.00 INR.

BSE Ltd Share Market Overview

- Open: 7,533.00

- High: 7,588.00

- Low: 7,362.00

- Previous Close: 7,459.00

- Volume: 3,276,806

- Value (Lacs): 242,008.51

- 52 Week High: 7,588.00

- 52 Week Low: 2,115.00

- Mkt Cap (Rs. Cr.): 99,982

- Face Value: 2

BSE Ltd Share Price Chart

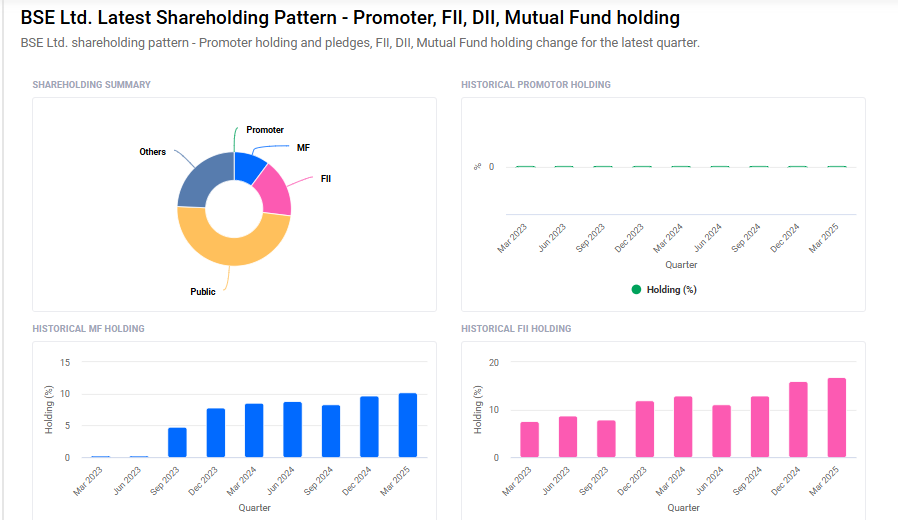

BSE Ltd Shareholding Pattern

- Promoters: 0%

- FII: 16.8%

- DII: 12.3%

- Public: 48.8%

- Other: 22.1%

BSE Ltd Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹7,590 |

| 2026 | ₹9,950 |

| 2027 | ₹12,845 |

| 2028 | ₹15,037 |

| 2029 | ₹18,153 |

| 2030 | ₹21,250 |

BSE Ltd Share Price Target 2025

BSE Ltd share price target 2025 Expected target could ₹7,590. Here are five key factors that could influence BSE Ltd.’s share price growth by 2025:

-

Surge in IPO Activity and Listing Revenues: BSE anticipates a continued high volume of initial public offerings (IPOs), with over 90 companies aiming to raise approximately ₹1 trillion in 2025. This robust pipeline is expected to bolster listing revenues and enhance the exchange’s financial performance.

-

Advancements in Technology and Product Innovation: Investments in technologies such as blockchain and artificial intelligence are enhancing BSE’s trading infrastructure. Additionally, the introduction of new financial instruments like derivatives and exchange-traded funds (ETFs) is expanding the exchange’s offerings, attracting a broader investor base.

-

Increased Retail Investor Participation: The rise in retail investor involvement in the Indian stock market is contributing to higher trading volumes. This trend is positively impacting BSE’s revenue streams and is a significant driver of share price growth.

-

Regulatory Developments Favoring Market Share: The Securities and Exchange Board of India’s (SEBI) proposal to standardize derivatives expiry days has allowed BSE to retain its Tuesday expiry, potentially increasing its market share in options trading. Analysts predict this could enhance BSE’s revenue from derivatives.

-

Strong Financial Performance and Profitability: BSE has demonstrated steady revenue growth and improved profitability, with revenues increasing from ₹850 crore in FY23 to ₹1,050 crore in FY24, and net profits rising from ₹250 crore to ₹320 crore during the same period. This financial strength supports investor confidence and share price appreciation.

BSE Ltd Share Price Target 2030

BSE Ltd share price target 2030 Expected target could ₹21,250. Here are 5 key risks and challenges that could impact BSE Ltd.’s share price target by 2030:

-

Regulatory and Legal Challenges: BSE faces ongoing scrutiny from regulatory bodies like SEBI. Proposed changes, such as adjustments to derivatives expiry rules, can influence trading volumes and revenue streams. Additionally, legal uncertainties and compliance requirements may pose operational challenges.

-

Market Volatility and Economic Downturns: The stock market is inherently volatile. Economic downturns, both domestic and global, can lead to reduced trading activity and investor confidence, adversely affecting BSE’s performance and share price.

-

Technological Disruptions and Cybersecurity Risks: As BSE continues to digitize its operations, it becomes more susceptible to technological disruptions and cybersecurity threats. Ensuring robust IT infrastructure and data protection measures is crucial to maintain investor trust and operational integrity.

-

Competition from Other Exchanges: BSE operates in a competitive environment, with rivals like the National Stock Exchange (NSE) capturing significant market share. Continuous innovation and service enhancement are necessary for BSE to maintain and grow its market position.

-

Investor Scams and Misinformation: The rise of deepfake technology and misinformation campaigns poses a threat to retail investors. Scams impersonating BSE officials can erode investor confidence and tarnish the exchange’s reputation.

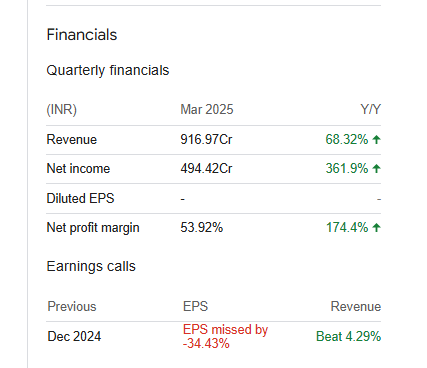

BSE Ltd Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 32.12B | 101.70% |

| Operating expense | 10.46B | -0.86% |

| Net income | 13.26B | 70.34% |

| Net profit margin | 41.28 | -15.55% |

| Earnings per share | 96.17 | 221.53% |

| EBITDA | 22.79B | 285.14% |

| Effective tax rate | 24.66% | — |

Read Also:- Thermax Ltd Share Price Target Tomorrow 2025 To 2030