Bsoft Share Price Target Tomorrow 2025 To 2030

Birlasoft Limited is a global information technology services company headquartered in Pune, India. Established in 1990, it is part of the diversified CK Birla Group. The company specializes in digital transformation, enterprise application services, and IT consulting, serving industries such as manufacturing, banking, financial services, insurance, life sciences, and energy. Bsoft Share Price on NSE as of 29 May 2025 is 423.00 INR.

Bsoft Share Market Overview

- Open: 416.10

- High: 424.85

- Low: 415.25

- Previous Close: 415.50

- Volume: 1,731,127

- Value (Lacs): 7,327.86

- 52 Week High: 760.45

- 52 Week Low: 331.00

- Mkt Cap (Rs. Cr.): 11,762

- Face Value: 2

Bsoft Share Price Chart

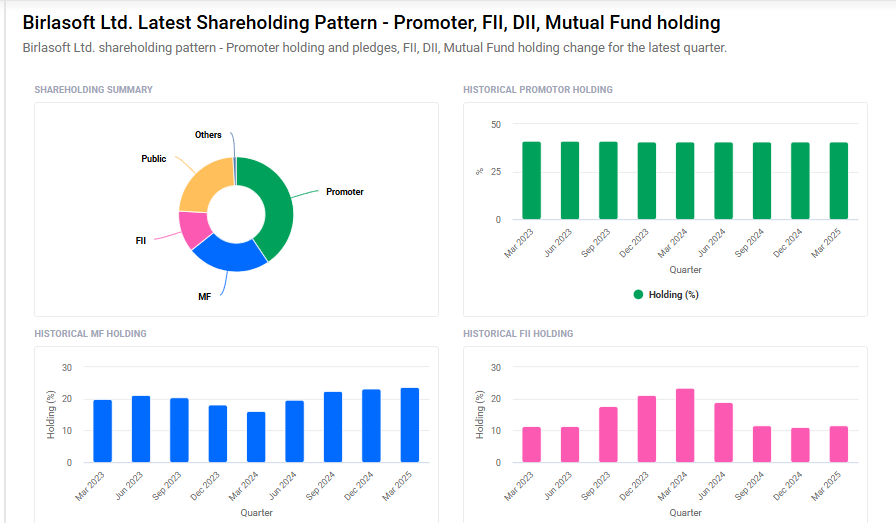

Bsoft Shareholding Pattern

- Promoters: 40.6%

- FII: 11.7%

- DII: 24.5%

- Public: 23.2%

Bsoft Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹770 |

| 2026 | ₹830 |

| 2027 | ₹890 |

| 2028 | ₹950 |

| 2029 | ₹1010 |

| 2030 | ₹1070 |

Bsoft Share Price Target 2025

Bsoft share price target 2025 Expected target could ₹770. Here are five key factors that could influence Birlasoft’s (BSOFT) share price target by 2025:

-

Expansion in Digital Transformation Services

Birlasoft is actively investing in digital transformation offerings, including AI, cloud computing, and data analytics. The company has been recognized for its innovative digital solutions, positioning it as a strong player in the IT services sector. -

Strategic Focus on Cloud Services

The company aims to significantly grow its Microsoft Azure-related revenues over the next three years. This strategic focus on cloud services is expected to drive substantial growth in the near future. -

Improving Financial Metrics

Despite some recent revenue challenges, Birlasoft reported a 4.4% quarter-on-quarter increase in profit after tax (PAT) in Q4 FY25. Additionally, the company’s cash and cash equivalents rose by 27.1% year-on-year, indicating strong financial health. -

Positive Analyst Outlook

Analysts have forecasted an average 1-year price target of ₹538.9 for Birlasoft, with some estimates going as high as ₹803.25. This reflects a positive market sentiment and confidence in the company’s growth prospects. -

Growth in Deal Signings

In Q4 FY25, Birlasoft’s total contract value (TCV) of new deal signings increased by 75% quarter-on-quarter, reaching $236 million. This surge in deal signings indicates a strong pipeline and potential for future revenue growth.

Bsoft Share Price Target 2030

Bsoft share price target 2030 Expected target could ₹1070. Here are five key risks and challenges that could impact Birlasoft’s (BSOFT) share price target by 2030:

-

Intensifying Competition in the IT Services Sector

The IT industry is highly competitive, with numerous global and domestic players offering similar services. Birlasoft faces challenges in differentiating its offerings and maintaining market share, especially as larger competitors invest heavily in emerging technologies and digital transformation services. -

Dependence on Key Clients and Geographies

A significant portion of Birlasoft’s revenue comes from a few major clients and specific geographic regions. Any loss of key clients or adverse economic conditions in these regions could materially affect the company’s financial performance. -

Rapid Technological Changes

The technology landscape is evolving rapidly, with advancements in areas like artificial intelligence, machine learning, and cloud computing. Birlasoft must continuously invest in research and development to keep pace with these changes. Failure to do so could render its services obsolete. -

Talent Acquisition and Retention

Attracting and retaining skilled professionals is crucial for Birlasoft’s success. The IT industry faces high attrition rates, and a shortage of qualified talent could hinder the company’s ability to deliver projects on time and maintain service quality. -

Regulatory and Compliance Risks

Operating in multiple countries exposes Birlasoft to various regulatory and compliance requirements. Changes in data protection laws, taxation policies, or trade regulations could increase operational complexities and costs, potentially impacting profitability.

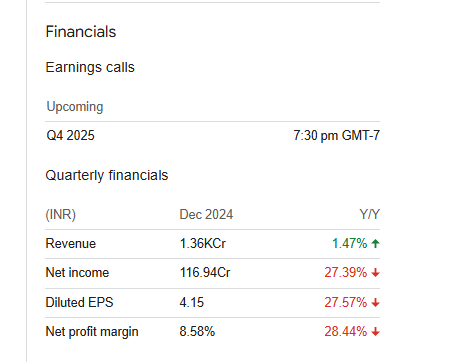

Bsoft Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 52.78B | 10.08% |

| Operating expense | 14.45B | -4.52% |

| Net income | 6.24B | 88.12% |

| Net profit margin | 11.82 | 70.81% |

| Earnings per share | 22.25 | 86.66% |

| EBITDA | 7.99B | 64.42% |

| Effective tax rate | 25.28% | — |

Read Also:- Orchid Pharma Share Price Target Tomorrow 2025 To 2030