Campus Share Price Target Tomorrow 2025 To 2030

Campus Activewear Ltd, founded in 2005, is one of India’s leading sports and athleisure footwear brands. The company offers a wide range of products for men, women, and children, including running shoes, casual sneakers, sandals, and flip-flops, catering to diverse style preferences and budgets. With a strong presence across India, Campus has established an extensive retail and wholesale network, complemented by a growing online platform. Campus Share Price on NSE as of 22 May 2025 is 265.50 INR.

Campus Share Market Overview

- Open: 256.00

- High: 266.50

- Low: 254.67

- Previous Close: 255.43

- Volume: 712,710

- Value (Lacs): 1,887.61

- 52 Week High: 371.90

- 52 Week Low: 210.00

- Mkt Cap (Rs. Cr.): 8,088

- Face Value: 5

Campus Share Price Chart

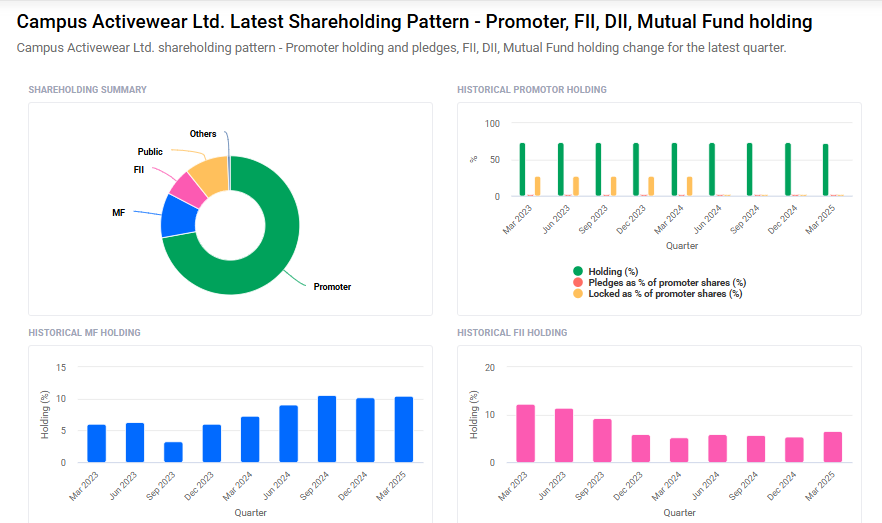

Campus Shareholding Pattern

- Promoters: 72.1%

- FII: 6.6%

- DII: 11.1%

- Public: 10.1%

Campus Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹380 |

| 2026 | ₹410 |

| 2027 | ₹440 |

| 2028 | ₹470 |

| 2029 | ₹500 |

| 2030 | ₹530 |

Campus Share Price Target 2025

Campus share price target 2025 Expected target could ₹380. Here are five key factors influencing the growth of Campus Activewear Ltd’s share price target for 2025:

-

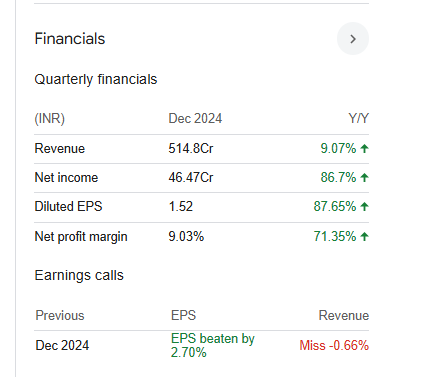

Strong Financial Performance: In Q3 FY25, Campus Activewear reported record revenues of ₹514.8 crore, driven by a robust distribution strategy and a notable increase in online sales. Net income for the quarter was ₹46.47 crore, reflecting significant growth compared to the previous year.

-

Expansion into New Markets: The company is actively expanding its presence in southern and western regions of India, aiming to tap into new customer bases and increase market share.

-

Product Portfolio Diversification: Campus Activewear is broadening its product offerings, particularly in the women’s and children’s segments, to cater to a wider audience and meet diverse consumer preferences.

-

Digital Transformation and Online Sales Growth: The company has enhanced its online presence, leading to increased digital sales. This shift aligns with changing consumer behaviors and contributes to overall revenue growth.

-

Analyst Confidence and Positive Forecasts: Analysts have set a 12-month average price target of ₹306.87 for Campus Activewear, indicating a positive outlook and potential upside in the share price.

Campus Share Price Target 2030

Campus share price target 2030 Expected target could ₹530. Here are five key risks and challenges that could impact Campus Activewear Ltd’s share price target by 2030:

-

Intensifying Market Competition: The Indian footwear industry is highly competitive, with established players like Bata India, Relaxo Footwear, and Redtape. This intense competition can pressure Campus Activewear’s market share and profitability.

-

Regulatory Compliance Risks: Campus Activewear must ensure its advertising and marketing practices comply with the Advertising Standards Council of India (ASCI) guidelines. Non-compliance can lead to penalties ranging from ₹1 lakh to ₹5 lakhs, affecting the company’s reputation and financials.

-

Stock Price Volatility: The company’s stock has experienced significant fluctuations, with a notable decline of over 13% between September and December 2024. Such volatility can impact investor confidence and the company’s market valuation.

-

Operational Efficiency Challenges: While reducing current liabilities to 28% of total assets has decreased financial risk, it may also indicate reduced efficiency in generating returns on capital employed (ROCE). This could affect the company’s profitability and attractiveness to investors.

-

Macroeconomic Factors: Economic slowdowns, inflation, and changes in consumer spending habits can adversely affect the demand for discretionary products like footwear. Such macroeconomic challenges could impact Campus Activewear’s sales and revenue growth.

Campus Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 14.48B | -2.42% |

| Operating expense | 5.95B | 10.59% |

| Net income | 894.40M | -23.63% |

| Net profit margin | 6.18 | -21.67% |

| Earnings per share | 2.93 | -23.70% |

| EBITDA | 1.82B | -19.31% |

| Effective tax rate | 25.49% | — |

Read Also:- RAMA Steel Share Price Target Tomorrow 2025 To 2030