Canara Bank Share Price Target Tomorrow 2025 To 2030

Canara Bank is one of the oldest and most trusted public sector banks in India. It was founded in 1906 and has its headquarters in Bengaluru, Karnataka. Over the years, the bank has grown steadily and now has a strong presence across the country with thousands of branches and ATMs. Canara Bank offers a wide range of financial services, including savings and current accounts, loans, credit cards, and digital banking. It is known for its customer-friendly approach and focus on rural as well as urban development. Canara Bank Share Price on NSE as of 26 May 2025 is 107.20 INR.

Canara Bank Share Market Overview

- Open: 107.15

- High: 107.99

- Low: 106.41

- Previous Close: 106.84

- Volume: 16,155,459

- Value (Lacs): 17,320.27

- 52 Week High: 128.90

- 52 Week Low: 78.60

- Mkt Cap (Rs. Cr.): 97,246

- Face Value: 10

Canara Bank Share Price Chart

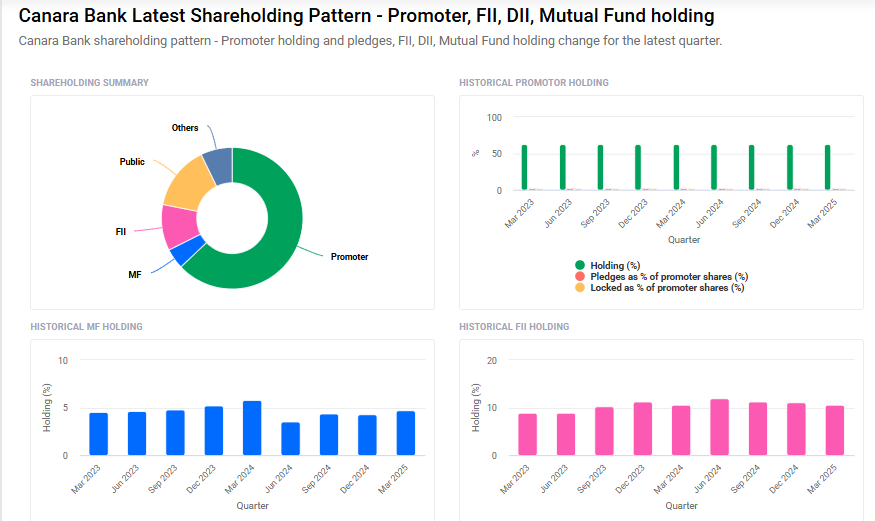

Canara Bank Shareholding Pattern

- Promoters: 62.9%

- FII: 10.5%

- DII: 11.9%

- Public: 14.7%

Canara Bank Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹130 |

| 2026 | ₹150 |

| 2027 | ₹170 |

| 2028 | ₹180 |

| 2029 | ₹200 |

| 2030 | ₹220 |

Canara Bank Share Price Target 2025

Canara Bank share price target 2025 Expected target could ₹130. Here are 5 key factors affecting the growth of Canara Bank’s share price target for 2025:

-

Asset Quality and NPAs

The level of Non-Performing Assets (NPAs) is a critical indicator. A continued decline in NPAs or strong provisioning coverage can improve investor confidence and drive the share price upward. -

Credit Growth and Loan Book Expansion

Growth in advances, especially in retail, MSME, and corporate segments, will positively influence revenue. Strong loan growth reflects higher demand and better utilization of capital. -

Interest Rate Environment

Changes in RBI policy rates impact Canara Bank’s Net Interest Margin (NIM). A favorable interest rate environment can improve profitability and hence positively affect the share price. -

Government Policies and PSU Banking Reforms

As a public sector bank, Canara Bank is heavily influenced by government decisions on recapitalization, privatization, or mergers. Any reformative move can significantly impact valuation. -

Technological Advancements and Digital Transformation

Investments in digital banking infrastructure and improved customer experience through tech adoption can enhance operational efficiency and attract younger customer segments, supporting long-term growth.

Canara Bank Share Price Target 2030

Canara Bank share price target 2030 Expected target could ₹220. Here are 5 key risks and challenges that could impact Canara Bank’s share price target by 2030:

-

High Exposure to Economic Cycles

As a PSU bank, Canara Bank is highly sensitive to macroeconomic conditions. Any prolonged economic slowdown, inflationary pressure, or recession could lead to reduced credit demand and higher default risk. -

Asset Quality Deterioration

Although NPAs have improved in recent years, future shocks—like defaults in corporate or MSME segments—could reverse progress, affecting profitability and investor confidence. -

Regulatory and Policy Uncertainty

Frequent changes in RBI regulations, monetary policy, or government directives for public sector banks may create compliance burdens or limit operational flexibility. -

Stiff Competition from Private Banks and Fintechs

Private banks and digital-first fintech companies offer faster services and better user experience. Failure to innovate and match pace could lead to market share erosion for Canara Bank. -

Capital Adequacy and Fundraising Challenges

Sustained growth requires maintaining strong capital adequacy ratios. If Canara Bank faces challenges in raising fresh capital or receives limited government support, it could constrain future expansion.

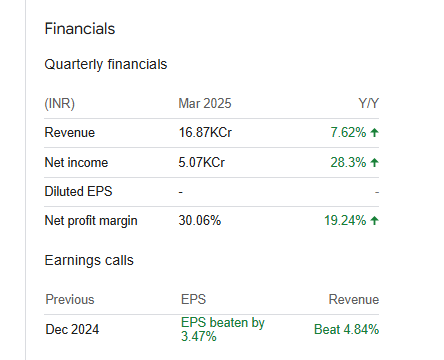

Canara Bank Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 612.14B | 6.76% |

| Operating expense | 381.89B | 2.28% |

| Net income | 175.40B | 14.80% |

| Net profit margin | 28.65 | 7.50% |

| Earnings per share | 18.77 | 16.98% |

| EBITDA | — | — |

| Effective tax rate | 24.33% | — |

Read Also:- RVNL Share Price Target Tomorrow 2025 To 2030