Central Bank Of India Share Price Target Tomorrow 2025 To 2030

Central Bank of India, established in 1911 by Sir Sorabji Pochkhanawala, holds the distinction of being the first Indian commercial bank wholly owned and managed by Indians. Headquartered in Mumbai, it has played a pivotal role in India’s banking sector, especially in promoting financial inclusion and supporting various government initiatives. Central Bank Of India Share Price on NSE as of 21 May 2025 is 36.98 INR.

Central Bank Of India Share Market Overview

- Open: 38.72

- High: 38.76

- Low: 36.42

- Previous Close: 38.21

- Volume: 15,799,544

- Value (Lacs): 5,815.81

- 52 Week High: 73.00

- 52 Week Low: 32.75

- Mkt Cap (Rs. Cr.): 33,318

- Face Value: 10

Central Bank Of India Share Price Chart

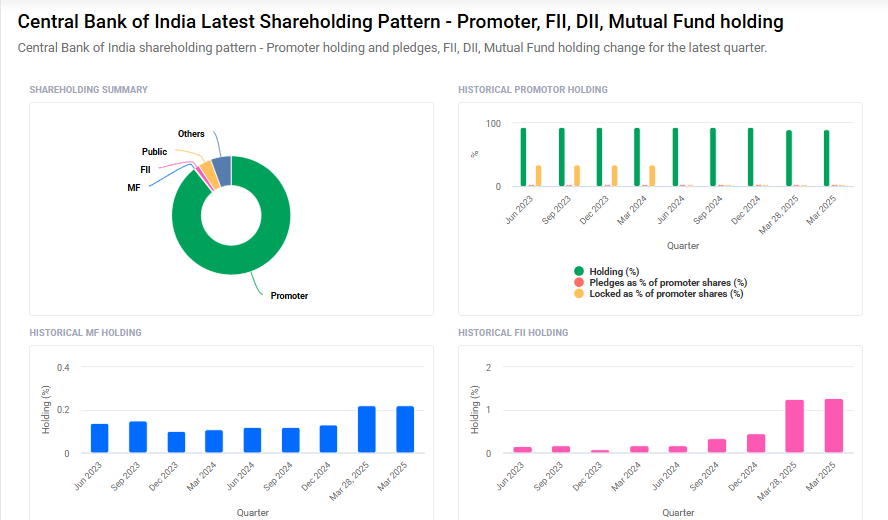

Central Bank Of India Shareholding Pattern

- Promoters: 89.3%

- FII: 1.3%

- DII: 5.9%

- Public: 3.6%

Central Bank Of India Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹75 |

| 2026 | ₹100 |

| 2027 | ₹130 |

| 2028 | ₹150 |

| 2029 | ₹170 |

| 2030 | ₹200 |

Central Bank Of India Share Price Target 2025

Central Bank Of India share price target 2025 Expected target could ₹75. Here are 5 key factors influencing the growth of Central Bank of India’s share price target for 2025:

-

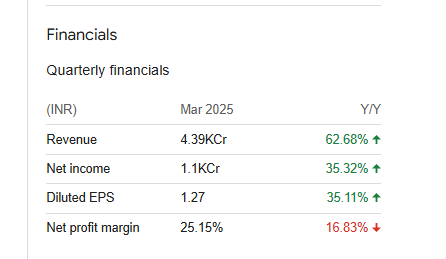

Strong Financial Performance: In the fourth quarter of FY2024–25, Central Bank of India reported a 35.32% year-on-year increase in net profit, reaching ₹1,104.58 crore. This robust growth reflects improved operational efficiency and asset quality, enhancing investor confidence.

-

Economic Growth and Credit Expansion: India’s GDP is projected to grow between 6.3% and 6.5% in FY2024–25. A growing economy typically boosts demand for credit, benefiting banks like Central Bank of India through increased lending opportunities.

-

Monetary Policy Easing: The Reserve Bank of India has adopted an accommodative stance, cutting the repo rate by 25 basis points to 6.00% in April 2025. Lower interest rates can stimulate borrowing and economic activity, positively impacting the bank’s lending business.

-

Increased Institutional Investment: As of May 2025, Domestic Institutional Investors (DIIs) increased their holdings in Central Bank of India from 2.82% to 5.87%, and Foreign Institutional Investors (FIIs) holdings rose by 0.9%. This uptick indicates growing institutional confidence in the bank’s prospects.

-

Digital Transformation Initiatives: Central Bank of India is focusing on digital banking services to enhance customer experience and operational efficiency. Embracing technology can lead to cost savings and attract a younger, tech-savvy customer base, supporting long-term growth.

Central Bank Of India Share Price Target 2030

Central Bank Of India share price target 2030 Expected target could ₹200. Here are five key risks and challenges that could impact Central Bank of India’s share price target by 2030:

-

Persistent Underperformance Relative to Market Benchmarks: Despite some positive financial indicators, Central Bank of India’s stock has consistently underperformed the broader market. As of May 2025, the stock experienced a year-to-date decline of 31.23%, contrasting with the Sensex’s 4.02% gain. This trend reflects investor concerns about the bank’s growth trajectory and competitiveness.

-

Macroeconomic Volatility and Policy Shifts: The bank’s performance is susceptible to broader economic fluctuations and policy changes. For instance, the Reserve Bank of India’s rate-cutting cycle in April 2025, aimed at addressing growth risks, indicates underlying economic uncertainties that could affect the banking sector’s stability and profitability.

-

Technological Disruptions and Digital Transformation Challenges: While the bank is investing in digital infrastructure, the rapid pace of technological change poses a risk. Failure to effectively implement and adapt to new technologies could result in operational inefficiencies and loss of market share to more agile competitors.

-

Regulatory Compliance and Governance Risks: As regulatory frameworks evolve, particularly concerning climate-related financial disclosures and risk management, the bank must ensure compliance to avoid penalties and reputational damage. The Reserve Bank of India’s emphasis on climate risk strategies underscores the increasing importance of robust governance practices.

-

Market Sentiment and Investor Confidence: Negative market sentiment, driven by factors such as declining stock performance and broader economic concerns, can erode investor confidence. This erosion may lead to reduced capital inflows and increased volatility in the bank’s share price, hindering long-term growth prospects.

Central Bank Of India Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 166.41B | 29.50% |

| Operating expense | 116.63B | 13.51% |

| Net income | 39.34B | 47.48% |

| Net profit margin | 23.64 | 13.87% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 22.73% | — |

Read Also:- AFFLE India Share Price Target Tomorrow 2025 To 2030