Chennai Petroleum Share Price Target Tomorrow 2025 To 2030

Chennai Petroleum Corporation Limited (CPCL) is a prominent Indian oil refining company headquartered in Chennai, Tamil Nadu. Established in 1965 as Madras Refineries Limited, it became a subsidiary of Indian Oil Corporation in 2001. CPCL operates two refineries: the Manali Refinery in Chennai, with a capacity of 10.5 million metric tonnes per annum (MMTPA), and the Cauvery Basin Refinery in Nagapattinam, which is undergoing expansion to increase its capacity from 1.0 to 9.0 MMTPA. Chennai Petroleum Share Price on NSE as of 2 May 2025 is 603.00 INR.

Chennai Petroleum Share Market Overview

- Open: 620.00

- High: 624.90

- Low: 603.00

- Previous Close: 619.55

- Volume: 885,486

- Value (Lacs): 5,421.83

- 52 Week High: 1,275.00

- 52 Week Low: 433.10

- Mkt Cap (Rs. Cr.): 9,117

- Face Value: 10

Chennai Petroleum Share Price Chart

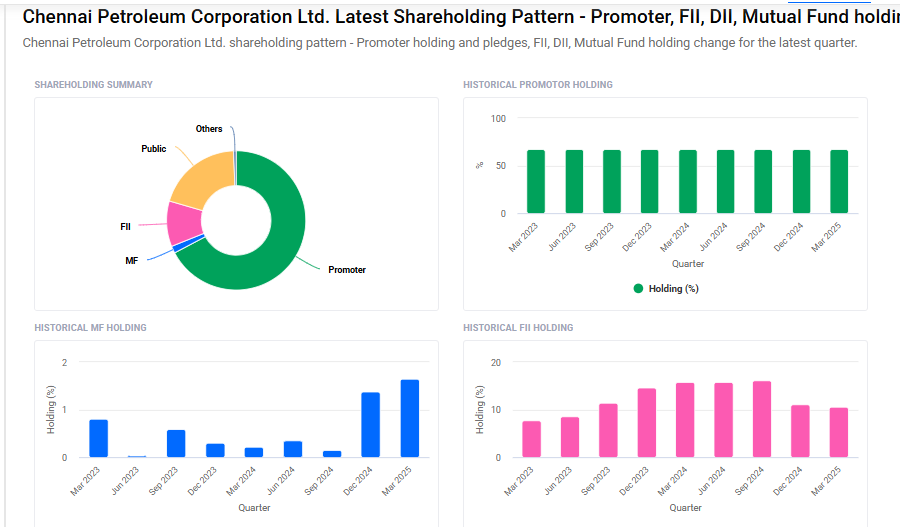

Chennai Petroleum Shareholding Pattern

- Promoters: 67.3%

- FII: 10.6%

- DII: 2.2%

- Public: 19.9%

Chennai Petroleum Share Price Target Tomorrow 2025 To 2030

| Chennai Petroleum Share Price Target Years | Chennai Petroleum Share Price |

| 2025 | ₹1280 |

| 2026 | ₹1400 |

| 2027 | ₹1500 |

| 2028 | ₹1600 |

| 2029 | ₹1700 |

| 2030 | ₹1800 |

Chennai Petroleum Share Price Target 2025

Chennai Petroleum share price target 2025 Expected target could ₹1280. Here are four key factors influencing the growth of Chennai Petroleum Corporation Ltd. (CPCL):

1. Revenue Growth Amidst Profit Margin Challenges

In the fiscal year 2025, CPCL reported a revenue increase of 6.7%, reaching ₹710.8 billion. However, net income declined by 92% compared to the previous year, primarily due to higher expenses, leading to a reduced profit margin of 0.3% from 4.1% in FY 2024.

2. Delay in New Refinery Project

The planned 180,000 barrels per day refinery at Nagapattinam, Tamil Nadu, initially slated for completion by 2025, has been delayed by two years. This postponement is due to changes in the capital structure of the joint venture with Indian Oil Corporation and pending government approvals.

3. Fluctuating Gross Refining Margins (GRMs)

CPCL’s average gross refining margin for April to December 2024 was $3.40 per barrel, a significant decrease from $8.98 per barrel during the same period in 2023. This decline reflects challenges in maintaining profitability amidst volatile market conditions.

4. Analyst Price Targets and Market Sentiment

Analysts have set a 12-month average price target of ₹653.82 for CPCL, with forecasts ranging between ₹618.12 and ₹703.50. These projections indicate cautious optimism regarding the company’s performance in the near term.

Chennai Petroleum Share Price Target 2030

Chennai Petroleum share price target 2030 Expected target could ₹1800. Here are four key Risks and Challenges that could affect Chennai Petroleum Corporation Ltd. (CPCL):

1. Delay in Nagapattinam Refinery Project

CPCL’s planned 180,000 barrels per day refinery at Nagapattinam has been delayed by two years, now expected to be completed by the end of 2027 instead of 2025. This delay is due to changes in the capital structure of the joint venture with Indian Oil Corporation and pending government approvals. The project cost has been revised to approximately ₹364 billion, primarily financed through debt.

2. Volatility in Refining Margins

CPCL’s average gross refining margin for April to December 2024 was $3.40 per barrel, a significant decrease from $8.98 per barrel during the same period in 2023. Such fluctuations in refining margins can impact profitability and investor confidence.

3. Environmental and Regulatory Challenges

The global refining industry faces challenges from slowing oil demand growth and the rise in alternative fuels like natural gas liquids and biofuels. These trends, along with increasing environmental regulations, could affect CPCL’s operations and profitability.

4. Operational Risks Due to Climate Change

CPCL’s facilities are vulnerable to climate-related risks, such as extreme weather events that can disrupt operations. While the company has implemented risk management practices, unplanned shutdowns due to climate disruptions remain a significant risk.

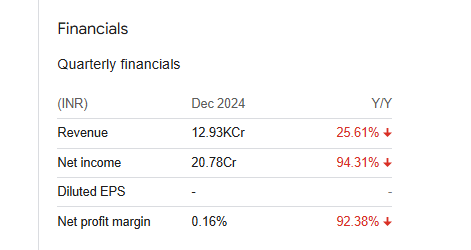

Chennai Petroleum Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 666.36B | -13.13% |

| Operating expense | 20.69B | -7.59% |

| Net income | 27.45B | -22.27% |

| Net profit margin | 4.12 | -10.43% |

| Earnings per share | 182.07 | -23.28% |

| EBITDA | 45.44B | -26.97% |

| Effective tax rate | 25.68% | — |

Read Also:- Motherson Sumi Share Price Target Tomorrow 2025 To 2030