Cummins India Share Price Target Tomorrow 2025 To 2030

Cummins India Limited, established in 1962, is a leading manufacturer of diesel and natural gas engines in India. As a subsidiary of Cummins Inc., a global power leader, the company operates through four key business units: Engine, Power Systems, Components, and Distribution. The Engine Business produces engines ranging from 60 HP for various on-highway and off-highway applications. The Power Systems Business designs high-horsepower engines from 700 HP to 4500 HP, catering to sectors like marine, railways, defense, and mining. Cummins India Share Price on NSE as of 8 May 2025 is 2,844.10 INR.

Cummins India Share Market Overview

- Open: 2,760.00

- High: 2,862.50

- Low: 2,759.80

- Previous Close: 2,790.30

- Volume: 681,942

- Value (Lacs): 19,391.02

- 52 Week High: 4,171.90

- 52 Week Low: 2,580.00

- Mkt Cap (Rs. Cr.): 78,821

- Face Value: 2

Cummins India Share Price Chart

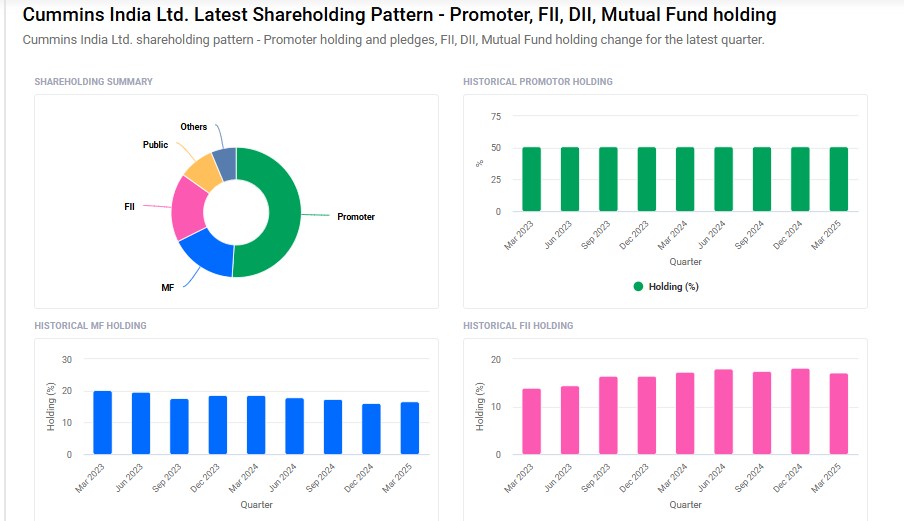

Cummins India Shareholding Pattern

- Promoters: 51%

- FII: 17.2%

- DII: 22.9%

- Public: 8.9%

Cummins India Share Price Target Tomorrow 2025 To 2030

| Cummins India Share Price Target Years | Cummins India Share Price |

| 2025 | ₹4175 |

| 2026 | ₹4700 |

| 2027 | ₹5200 |

| 2028 | ₹5700 |

| 2029 | ₹6200 |

| 2030 | ₹6700 |

Cummins India Share Price Target 2025

Cummins India share price target 2025 Expected target could ₹4175. Here are four key factors that could influence Cummins India’s share price target by 2025:

1. Strong Financial Performance and Market Demand

Cummins India reported a 12% increase in third-quarter profit to ₹5.58 billion, driven by steady demand for its power generators. Overall sales rose 22% to ₹30.52 billion during the three months ending December 31, 2024, indicating robust market demand for its products.

2. Launch of Advanced Engine Platforms

In January 2025, Cummins India introduced the innovative HELM™ engine platforms, including the BSVI-ready L10 engine and the B6.7N natural gas engine. These advancements demonstrate the company’s commitment to cleaner and more efficient power solutions, aligning with evolving environmental standards.

3. Growth in Diesel Generator Market

The Indian diesel genset market is projected to grow at a CAGR of 5.85% from 2025 to 2033, driven by increased power demand, industrial growth, and infrastructure development. As a key player in this sector, Cummins India stands to benefit from this expanding market.

4. Analyst Price Targets Reflecting Positive Outlook

Analysts have set an average price target of ₹3,829 for Cummins India, suggesting a potential upside of over 34% from its current price. This reflects confidence in the company’s growth prospects and financial stability.

Cummins India Share Price Target 2030

Cummins India share price target 2030 Expected target could ₹6700. Here are four key Risks and Challenges that could impact Cummins India’s share price target by 2030:

1. Geopolitical Uncertainties and Trade Policies

Cummins India’s performance is closely tied to global trade dynamics. In May 2025, the company’s stock declined by over 5% after its U.S.-based parent, Cummins Inc., withdrew its full-year guidance due to uncertainties arising from potential trade tariffs introduced by the Trump administration. Such geopolitical tensions and policy changes can disrupt supply chains and affect international sales, posing risks to Cummins India’s growth.

2. Transition to Renewable Energy Sources

The global shift towards renewable energy and stricter emission norms present challenges for companies like Cummins India, traditionally known for diesel and internal combustion engine products. While the company is investing in cleaner technologies, including hydrogen and electric solutions, the pace of this transition and adoption in key markets will be crucial. Delays or setbacks in this transition could impact the company’s market share and profitability.

3. Supply Chain Disruptions

Cummins India’s operations rely on a complex global supply chain. Any disruptions, whether due to geopolitical tensions, pandemics, or logistical challenges, can affect the timely procurement of raw materials and components. Such disruptions can lead to production delays, increased costs, and potential loss of revenue.

4. Economic Slowdowns in Key Markets

Economic downturns in major markets, such as China and Europe, can lead to reduced demand for industrial equipment and power solutions. For instance, in 2024, Cummins anticipated challenges due to a projected decline in global construction and mining sectors, primarily driven by weak property investments and shrinking export demand in China. Such slowdowns can adversely affect Cummins India’s export revenues and overall financial performance.

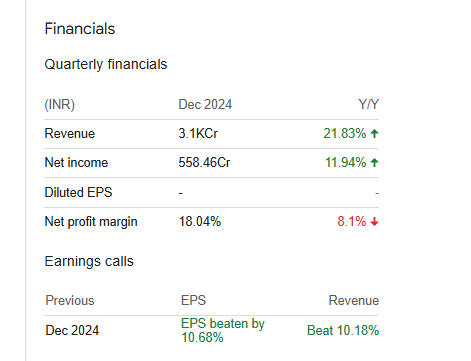

Cummins India Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 90.00B | 15.80% |

| Operating expense | 13.66B | 12.05% |

| Net income | 17.21B | 40.10% |

| Net profit margin | 19.12 | 21.01% |

| Earnings per share | 62.12 | 50.95% |

| EBITDA | 19.57B | 38.43% |

| Effective tax rate | 21.96% | — |

Read Also:- Senores Pharmaceuticals Share Price Target Tomorrow 2025 To 2030