Data Patterns Share Price Target Tomorrow 2025 To 2030

Data Patterns (India) Ltd., established in 1985 and headquartered in Chennai, is a prominent Indian company specializing in defense and aerospace electronics solutions. As a vertically integrated organization, it designs, develops, and manufactures a wide range of high-reliability products for various platforms, including space, air, land, and sea. The company’s product portfolio encompasses radar systems, electronic warfare solutions, avionics, rugged displays, and communication systems. Notably, Data Patterns has contributed to significant defense projects such as the LCA-Tejas and the BrahMos missile. Data Patterns Share Price on NSE as of 6 May 2025 is 2,278.00 INR.

Data Patterns Share Market Overview

- Open: 2,332.00

- High: 2,340.00

- Low: 2,205.00

- Previous Close: 2,310.30

- Volume: 1,316,590

- Value (Lacs): 30,089.35

- 52 Week High: 3,655.00

- 52 Week Low: 1,351.15

- Mkt Cap (Rs. Cr.): 12,794

- Face Value: 2

Data Patterns Share Price Chart

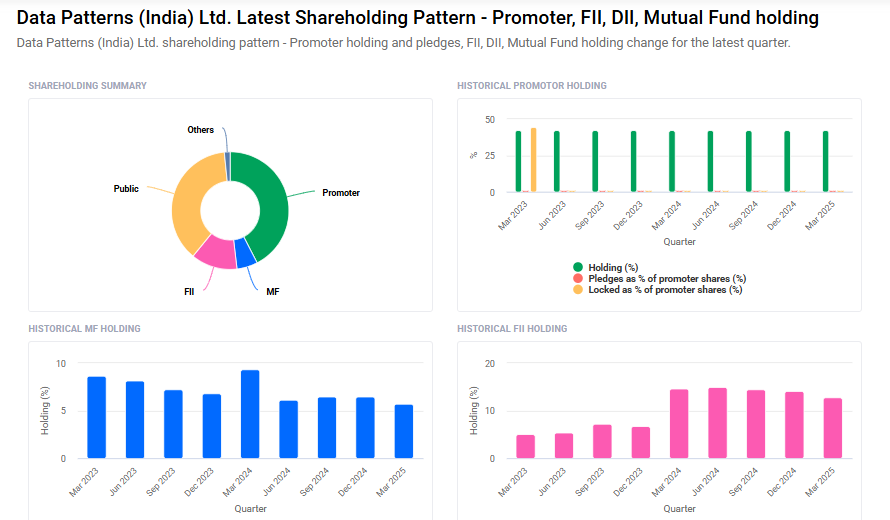

Data Patterns Shareholding Pattern

- Promoters: 42.4%

- FII: 12.8%

- DII: 7.4%

- Public: 37.5%

Data Patterns Share Price Target Tomorrow 2025 To 2030

| Data Patterns Share Price Target Years | Data Patterns Share Price |

| 2025 | ₹3,660 |

| 2026 | ₹3,900 |

| 2027 | ₹4,100 |

| 2028 | ₹4,300 |

| 2029 | ₹4,500 |

| 2030 | ₹4,700 |

Data Patterns Share Price Target 2025

Data Patterns share price target 2025 Expected target could ₹3,660. Here are four key factors that could influence the growth of Data Patterns (India) Ltd:

1. Robust Order Book and Revenue Growth

Data Patterns has demonstrated strong financial performance, with a revenue growth of 16% in Q1 FY2025 and an order book of ₹1,083 crore as of March 31, 2024. The company aims to maintain a revenue growth rate of 20-25% and EBITDA margins around 35-40% for the full year.

2. Government Support and Focus on Indigenization

India’s defense sector is experiencing significant growth, with the government targeting a turnover of ₹1.75 lakh crore by 2025, including ₹35,000 crore in exports. Data Patterns, with its expertise in defense electronics and emphasis on indigenization, is well-positioned to benefit from this trend.

3. Positive Analyst Outlook

Analysts have given Data Patterns a ‘Buy’ rating, with target prices ranging up to ₹3,400, indicating confidence in the company’s growth trajectory and strategic initiatives.

4. Operational Efficiency and Margin Improvement

The company has improved operational efficiencies, leading to enhanced profitability. This focus on efficiency supports its target EBITDA margins and contributes to overall financial health.

Data Patterns Share Price Target 2030

Data Patterns share price target 2030 Expected target could ₹4,700. Here are 4 key risks and challenges that could impact Data Patterns (India) Ltd. and its share price outlook toward 2030:

1. Heavy Dependence on Government Contracts

Data Patterns earns a significant portion of its revenue from defense and aerospace contracts with the Indian government. Any delays in government spending, policy shifts, or budget constraints could directly affect the company’s order flow and financial stability.

2. Technological Obsolescence

In the rapidly evolving defense electronics sector, staying updated with the latest technologies is crucial. Falling behind in innovation or failing to upgrade systems to meet modern defense needs could lead to loss of competitiveness.

3. Geopolitical and Regulatory Risks

As a defense-related company, Data Patterns operates under strict regulatory scrutiny. Export restrictions, geopolitical tensions, or international sanctions could limit market expansion and partnerships, especially in sensitive areas like aerospace and missile systems.

4. Execution and Supply Chain Challenges

Large-scale defense projects require precise execution and robust supply chains. Disruptions in global or domestic supply chains, raw material shortages, or manufacturing delays could impact timely delivery and profitability.

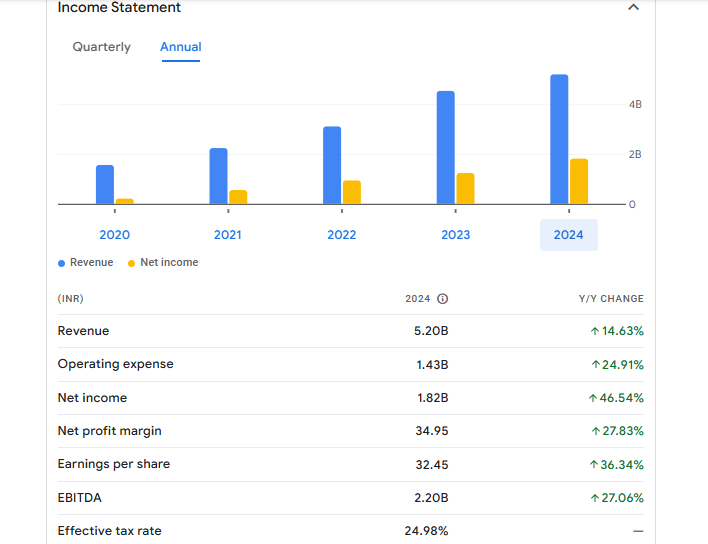

Data Patterns Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 5.20B | 14.63% |

| Operating expense | 1.43B | 24.91% |

| Net income | 1.82B | 46.54% |

| Net profit margin | 34.95 | 27.83% |

| Earnings per share | 32.45 | 36.34% |

| EBITDA | 2.20B | 27.06% |

| Effective tax rate | 24.98% | — |

Read Also:- NESCO Share Price Target Tomorrow 2025 To 2030