Decorous Investment Share Price Target Tomorrow 2025 To 2030

Decorous Investment and Trading Company Limited, established in 1982 and headquartered in New Delhi, operates in the real estate and financial services sectors. The company offers a range of services, including real estate project management, consultancy, and support services. It also engages in the development, collaboration, and trading of real estate properties, and acts as a commission agent, broker, service provider, and underwriter for the purchase and sale of flats, plots, farms, and commercial spaces. Additionally, Decorous Investment is involved in the trading, commission, agency, distribution, import, and export of bullion, commodities, gems, and jewelry. Decorous Investment Share Price on BOM as of 12 May 2025 is 11.62 INR.

Decorous Investment Share Market Overview

- Open: 11.91

- High: 11.91

- Low: 11.62

- Previous Close: 12.13

- Volume: 1,224

- Value (Lacs): 0.14

- VWAP: 11.79

- 52 Week High: 17.89

- 52 Week Low: 7.90

- Mkt Cap (Rs. Cr.): 4

- Face Value: 10

Decorous Investment Share Price Chart

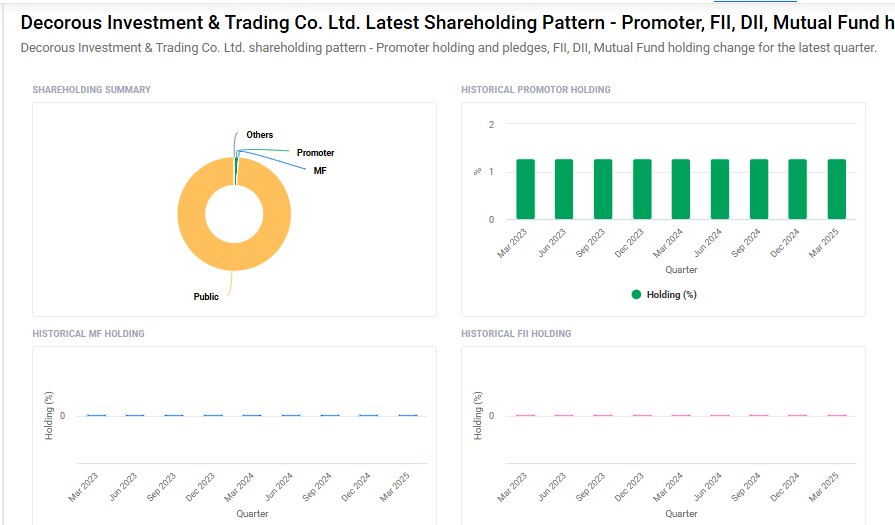

Decorous Investment Shareholding Pattern

- Promoters: 1.3%

- FII: 0%

- DII: 0%

- Public: 98.7%

Decorous Investment Share Price Target Tomorrow 2025 To 2030

| Decorous Investment Share Price Target Years | Decorous Investment Share Price |

| 2025 | ₹20 |

| 2026 | ₹23 |

| 2027 | ₹26 |

| 2028 | ₹29 |

| 2029 | ₹32 |

| 2030 | ₹35 |

Decorous Investment Share Price Target 2025

Decorous Investment share price target 2025 Expected target could ₹20. Here are four key factors that could affect the growth and share price target of Decorous Investment by 2025:

-

Portfolio Performance: As a financial or investment company, the performance of Decorous Investment’s asset portfolio—such as returns on equities, real estate, or other investments—will be a major driver of its revenue and investor confidence.

-

Market Conditions: Overall economic and market conditions, including interest rates, inflation, and market sentiment, will influence investment returns and the company’s ability to attract new investors or clients.

-

Regulatory Environment: Any changes in financial regulations, tax laws, or investment-related policies can impact Decorous Investment’s operations and profitability, especially if they lead to increased compliance costs or restrictions.

-

Management Strategy and Expansion Plans: The company’s future growth will also depend on its strategic decisions—such as launching new financial products, entering new markets, or forming key partnerships—which can enhance investor trust and long-term value.

Decorous Investment Share Price Target 2030

Decorous Investment share price target 2030 Expected target could ₹35. Here are four potential risks and challenges that could impact the Decorous Investment share price target by 2030:

-

Market Volatility and Economic Downturns: Being an investment-focused company, Decorous Investment is highly exposed to market fluctuations. Global or domestic economic slowdowns, recessions, or stock market crashes can negatively affect its returns and investor sentiment.

-

Poor Asset Allocation or Investment Decisions: If the company makes risky or poorly researched investment choices, it may face significant losses, reducing profitability and trust among shareholders.

-

Regulatory and Compliance Risks: Changes in financial regulations, taxation policies, or investment laws may increase compliance burdens and limit the company’s flexibility in managing its investment strategies.

-

Liquidity and Fund Management Issues: Inability to manage liquidity efficiently, especially during times of high redemptions or financial stress, could impact the company’s operations and limit its growth potential.

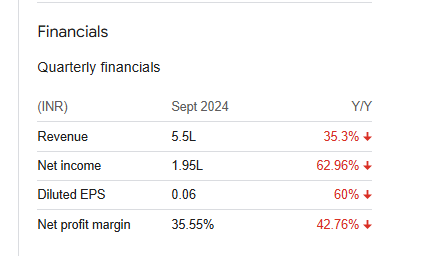

Decorous Investment Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 5.54M | 39.95% |

| Operating expense | 1.41M | -46.95% |

| Net income | 1.44M | 46.61% |

| Net profit margin | 25.97 | 4.76% |

| Earnings per share | — | — |

| EBITDA | 1.93M | 48.07% |

| Effective tax rate | 25.26% | — |

Read Also:- SDC Techmedia Share Price Target Tomorrow 2025 To 2030