Dolphin Medical Share Price Target Tomorrow 2025 To 2030

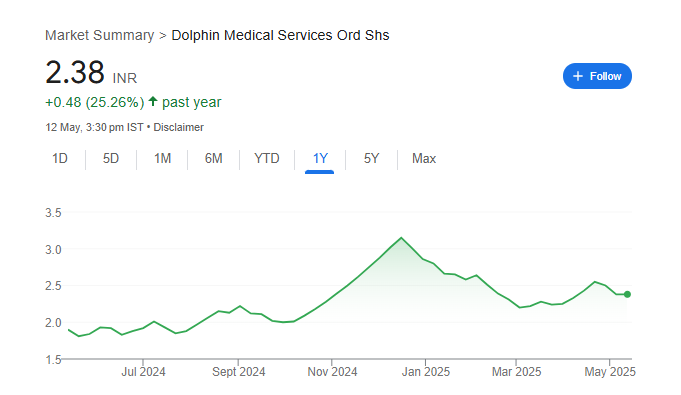

Dolphin Medical is a healthcare company that focuses on providing medical equipment and services to hospitals and healthcare centers. The company aims to improve patient care by offering reliable and advanced medical solutions. Over the years, Dolphin Medical has built a good reputation for quality and trust in the healthcare industry. Dolphin Medical Share Price on BOM as of 13 May 2025 is 2.38 INR.

Dolphin Medical Share Market Overview

- Open: 2.49

- High: 2.49

- Low: 2.27

- Previous Close: 2.38

- Volume: 15,972

- Value (Lacs): 0.38

- VWAP: 2.32

- 52 Week High: 3.30

- 52 Week Low: 1.72

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Dolphin Medical Share Price Chart

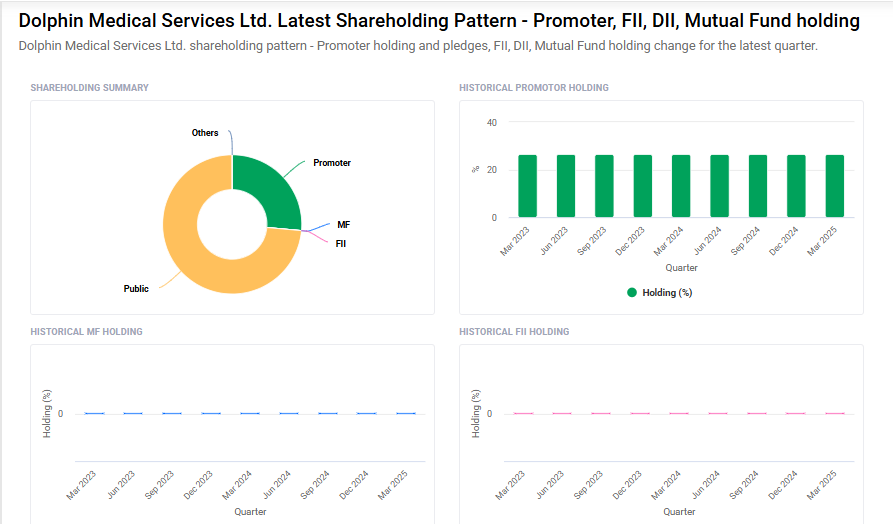

Dolphin Medical Shareholding Pattern

- Promoters: 26.4%

- FII: 0%

- DII: 0%

- Public: 73.6%

Dolphin Medical Share Price Target Tomorrow 2025 To 2030

| Dolphin Medical Share Price Target Years | Dolphin Medical Share Price |

| 2025 | ₹3.50 |

| 2026 | ₹5 |

| 2027 | ₹6.50 |

| 2028 | ₹8 |

| 2029 | ₹10 |

| 2030 | ₹12 |

Dolphin Medical Share Price Target 2025

Dolphin Medical share price target 2025 Expected target could ₹3.50. Here are 4 key factors affecting the growth for Dolphin Medical share price target in 2025:

-

Expansion of Healthcare Infrastructure: If Dolphin Medical is actively involved in supplying medical devices or services, increasing investments in hospitals, diagnostics, and clinics—especially in emerging markets—can significantly boost its revenue and investor confidence.

-

Product Innovation and Approvals: The company’s ability to develop and gain regulatory approval for new and advanced medical technologies or products will be a key driver for growth, as innovation can open up new markets and increase margins.

-

Strategic Partnerships and Global Presence: Collaborations with hospitals, governments, or other medical firms, as well as entry into new international markets, could accelerate sales and improve long-term growth potential.

-

Regulatory and Policy Support: Favorable government policies, subsidies, or increased healthcare spending can directly benefit Dolphin Medical. Conversely, strict regulatory hurdles or pricing pressures could impact its earnings and share price outlook.

Dolphin Medical Share Price Target 2030

Dolphin Medical share price target 2030 Expected target could ₹12. Here are 4 key risks and challenges that could impact Dolphin Medical’s share price target for 2030:

-

Regulatory Hurdles and Compliance Risks: Medical device and healthcare companies face strict regulations globally. Any delays in approvals, compliance violations, or changes in health policies could hinder product launches and hurt investor sentiment.

-

Technological Disruption and Competition: Rapid innovation in medical technology means Dolphin Medical must constantly evolve. Failure to keep pace with competitors or adapt to new technologies could erode market share and long-term growth potential.

-

Global Economic Uncertainty: Economic downturns, inflation, or currency volatility could reduce healthcare spending and negatively impact Dolphin Medical’s sales, especially in cost-sensitive markets.

-

Supply Chain and Manufacturing Challenges: Dependence on global suppliers for components or raw materials exposes the company to risks from geopolitical tensions, logistics disruptions, or rising input costs, potentially affecting profitability and delivery timelines.

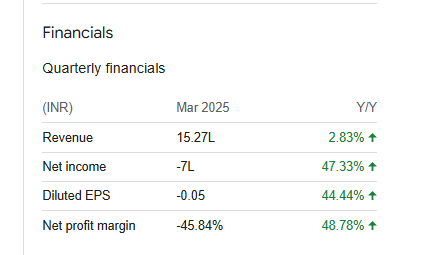

Dolphin Medical Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 8.16M | 14.09% |

| Operating expense | 6.56M | 25.00% |

| Net income | -338.00K | 67.51% |

| Net profit margin | -4.14 | 71.53% |

| Earnings per share | — | — |

| EBITDA | 417.80K | 203.62% |

| Effective tax rate | -11.18% | — |

Read Also:- Jayatma Enterprises Share Price Target Tomorrow 2025 To 2030