DOMS Share Price Target Tomorrow 2025 To 2030

DOMS Industries Limited is a well-known Indian company that makes and sells stationery and art products. Established in 2006, DOMS has become a trusted name, especially among students, teachers, and artists. The company offers a wide range of products like pencils, erasers, sharpeners, crayons, notebooks, and other school and office supplies. DOMS is known for its focus on quality, innovation, and appealing designs, which helps it stand out in a competitive market. DOMS Share Price on NSE as of 24 April 2025 is 2,948.40 INR.

DOMS Share Market Overview

- Open: 2,907.50

- High: 2,981.60

- Low: 2,890.50

- Previous Close: 2,925.40

- Volume: 88,253

- Value (Lacs): 2,602.05

- VWAP: 2,944.25

- UC Limit: 3,510.40

- LC Limit: 2,340.40

- 52 Week High: 3,115.00

- 52 Week Low: 1,696.25

- Mkt Cap (Rs. Cr.): 17,893

- Face Value: 10

DOMS Share Price Chart

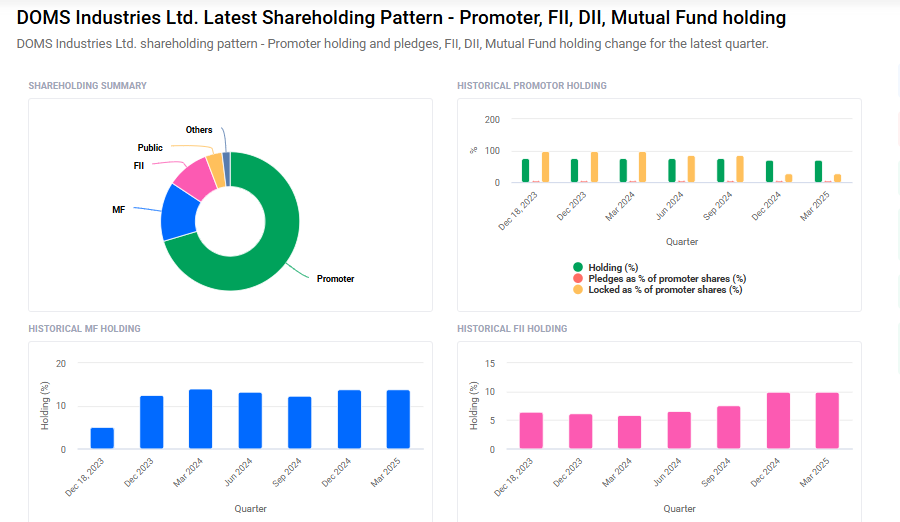

DOMS Shareholding Pattern

- Promoters: 70.4%

- FII: 9.9%

- DII: 15.8%

- Public: 3.9%

DOMS Share Price Target Tomorrow 2025 To 2030

| DOMS Share Price Target Years | DOMS Share Price |

| 2025 | ₹3115 |

| 2026 | ₹4250 |

| 2027 | ₹5385 |

| 2028 | ₹6140 |

| 2029 | ₹7235 |

| 2030 | ₹8370 |

DOMS Share Price Target 2025

Here are four key factors that could influence the growth of DOMS Industries Ltd. and its share price target for 2025:

1. Strong Brand Presence and Market Expansion

DOMS has established itself as a trusted name in the stationery sector, particularly among students and professionals. The company is actively expanding its distribution network, aiming to reach Tier 2 and Tier 3 cities across India. This expansion is expected to tap into new customer bases and drive sales growth.

2. Product Diversification and Innovation

To reduce reliance on a single product line, DOMS has diversified its offerings by acquiring a majority stake in Uniclan Healthcare, a producer of baby hygiene products. This strategic move allows DOMS to enter new markets and cater to a broader customer base, potentially boosting revenue streams.

3. Robust Financial Performance

The company’s earnings per share (EPS) have shown significant growth, increasing from ₹24.62 to ₹32.80, marking a 33% rise. Additionally, DOMS reported a 23% increase in revenue, reaching ₹18 billion. These figures indicate strong financial health, which can positively influence investor confidence and share price.

4. Positive Analyst Outlook

Several analysts have a favorable view of DOMS’s future performance. For instance, Prabhudas Lilladher has set a target price of ₹3,370 for the stock, reflecting optimism about the company’s growth prospects.

DOMS Share Price Target 2030

Here are four key risks and challenges that could influence DOMS Industries Ltd.’s share price trajectory by 2030:

1. High Dependence on Core Products

DOMS derives a significant portion of its revenue from a limited range of products. For instance, approximately 60% of its gross product sales in recent fiscal years have come from key products, with more than 30% attributable to wooden pencils. Any decline in demand or sales of these core products could adversely affect the company’s financial performance and, consequently, its share price.

2. Intense Market Competition

The stationery and art materials industry is highly competitive, with numerous players vying for market share. Competitors offering similar products at lower prices or introducing innovative alternatives could erode DOMS’s market position, impacting its growth prospects and share valuation.

3. Economic Uncertainties

Economic downturns or fluctuations can influence consumer spending patterns, particularly in discretionary segments like stationery and art supplies. Reduced consumer spending during such periods could lead to lower sales volumes for DOMS, affecting its revenue and profitability.

4. Regulatory and Compliance Risks

Changes in regulations related to manufacturing standards, environmental norms, or trade policies can pose challenges for DOMS. Non-compliance or the need to adapt to new regulations may result in increased operational costs or disruptions, potentially impacting the company’s financial health and investor confidence.

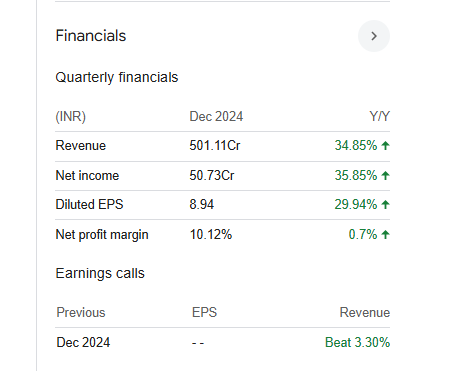

DOMS Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 15.37B | 26.84% |

| Operating expense | 4.18B | 39.63% |

| Net income | 1.53B | 59.84% |

| Net profit margin | 9.96 | 25.92% |

| Earnings per share | 27.75 | — |

| EBITDA | 2.62B | 47.29% |

| Effective tax rate | 25.56% | — |

Read Also:- Raitel Share Price Target Tomorrow 2025 To 2030