Force Motors Share Price Target Tomorrow 2025 To 2030

Force Motors is an Indian automotive company known for making reliable commercial and utility vehicles like vans, minibuses, and ambulances. Founded in 1958, the company has built a strong reputation for durability and performance, especially in rural and heavy-duty transport segments. It also manufactures engines for major global brands like Mercedes-Benz and BMW in India, which adds to its credibility. Force Motors Share Price on NSE as of 9 May 2025 is 9,645.00 INR.

Force Motors Share Market Overview

- Open: 10,366.00

- High: 10,444.00

- Low: 9,552.00

- Previous Close: 10,291.00

- Volume: 113,478

- Value (Lacs): 11,023.82

- 52 Week High: 10,598.50

- 52 Week Low: 6,125.00

- Mkt Cap (Rs. Cr.): 12,800

- Face Value: 10

Force Motors Share Price Chart

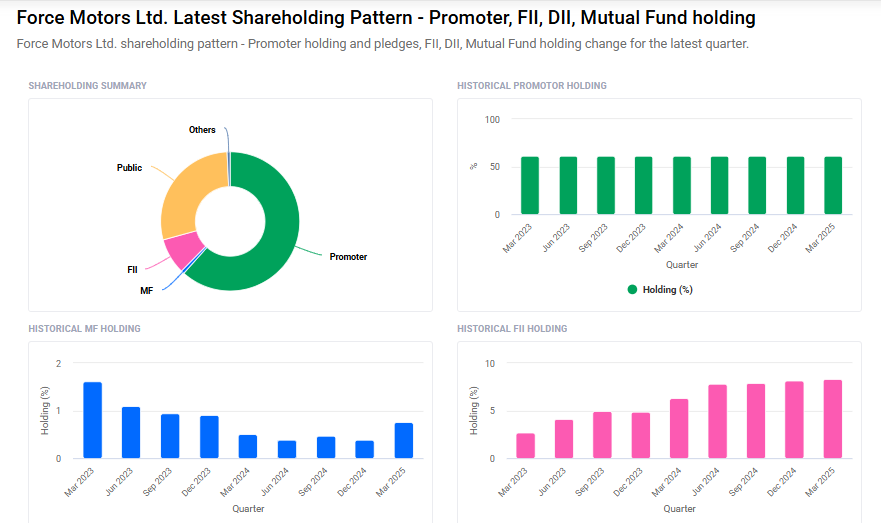

Force Motors Shareholding Pattern

- Promoters: 61.6%

- FII: 8.4%

- DII: 1.4%

- Public: 28.6%

Force Motors Share Price Target Tomorrow 2025 To 2030

| Force Motors Share Price Target Years | Force Motors Share Price |

| 2025 | ₹10,600 |

| 2026 | ₹12,000 |

| 2027 | ₹13,500 |

| 2028 | ₹15,000 |

| 2029 | ₹16,500 |

| 2030 | ₹18,000 |

Force Motors Share Price Target 2025

Force Motors share price target 2025 Expected target could ₹10,600. Here are 4 key factors affecting the growth of Force Motors’ share price target for 2025:

-

Commercial Vehicle Demand: Force Motors heavily relies on the demand for commercial vehicles such as vans, ambulances, and utility vehicles. Any surge in infrastructure development, government procurement, or rural transportation demand can positively impact its sales and share price.

-

Electric Vehicle (EV) Transition: The company’s pace of adapting to EV trends and launching competitive electric models could influence investor sentiment and long-term valuation. Delay or lag behind competitors in EV development may negatively affect growth projections.

-

Input Cost and Supply Chain Stability: Rising raw material costs (like steel and rubber) or disruptions in the global supply chain can affect margins. Efficient cost management and stable production will be crucial to maintaining profitability and investor confidence.

-

Strategic Partnerships and Export Growth: Expansion into international markets, joint ventures (especially in defense or automotive tech), and increased export volumes can be strong catalysts for revenue growth and a higher share price target.

Force Motors Share Price Target 2030

Force Motors share price target 2030 Expected target could ₹18,000. Here are four key risks and challenges that could impact Force Motors’ share price target by 2030:

-

High Debt Levels and Financial Leverage

Despite strong profit growth, Force Motors has a Debt to EBITDA ratio of 4.10, indicating potential challenges in debt servicing. This high leverage could strain financial stability, especially if interest rates rise or cash flows fluctuate. -

Delayed Transition to Electric Vehicles (EVs)

While the company plans to invest ₹200–₹300 crore in electric models over the next few years, the slow pace of EV adoption and infrastructure development may hinder competitiveness in the evolving automotive market. -

Export Market Volatility

Force Motors experienced a significant decline in export sales, with exports dropping over 78% in January 2025 compared to the previous year. Such volatility in international markets could adversely affect revenue diversification and growth prospects. -

Intensifying Industry Competition

The automotive sector is witnessing increased competition from both established players and new entrants, particularly in the EV segment. Force Motors’ inconsistent earnings growth and lower-than-market-average P/E ratio suggest challenges in maintaining market share and investor confidence.

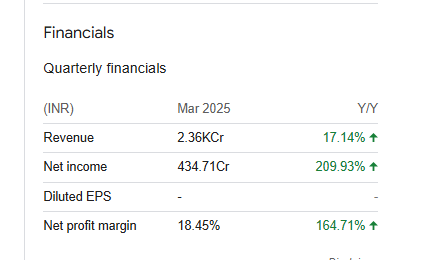

Force Motors Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 80.72B | 15.44% |

| Operating expense | 13.73B | 9.81% |

| Net income | 8.01B | 106.33% |

| Net profit margin | 9.92 | 78.74% |

| Earnings per share | — | — |

| EBITDA | 11.49B | 23.56% |

| Effective tax rate | 35.32% | — |

Read Also:- Sonata Software Share Price Target Tomorrow 2025 To 2030