FSL Share Price Target Tomorrow 2025 To 2030

Firstsource Solutions Limited is a global business process management (BPM) company headquartered in Mumbai, India. Established in 2001, it is part of the RP-Sanjiv Goenka Group. Firstsource specializes in providing tech-enabled BPM services across various industries, including banking and financial services, healthcare, communications, media, and technology. FSL Share Price on NSE as of 29 May 2025 is 385.50 INR.

FSL Share Market Overview

- Open: 387.90

- High: 391.50

- Low: 384.20

- Previous Close: 386.50

- Volume: 778,471

- Value (Lacs): 3,008.01

- 52 Week High: 422.30

- 52 Week Low: 176.25

- Mkt Cap (Rs. Cr.): 26,931

- Face Value: 10

FSL Share Price Chart

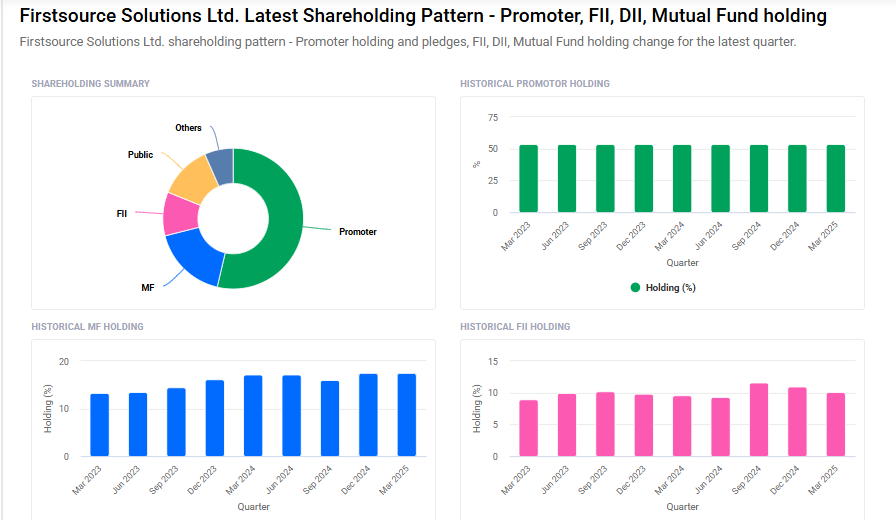

FSL Shareholding Pattern

- Promoters: 53.7%

- FII: 10.1%

- DII: 22.9%

- Public: 12.3%

- Others: 1.1%

FSL Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹430 |

| 2026 | ₹600 |

| 2027 | ₹750 |

| 2028 | ₹970 |

| 2029 | ₹1140 |

| 2030 | ₹1370 |

FSL Share Price Target 2025

FSL share price target 2025 Expected target could ₹430. Here are five key factors that could influence Firstsource Solutions Ltd (FSL)’s share price target by 2025:

-

Robust Revenue Growth and Profitability

In FY25, Firstsource reported a 25.9% year-on-year increase in revenue, reaching ₹79.8 billion, and a 21.7% rise in profit after tax, totaling ₹5.94 billion. This consistent financial performance underscores the company’s strong market position and operational efficiency. -

Strategic Deal Wins and Client Expansion

The company secured 14 large deals in FY25, including a significant Business Process as a Service (BPaaS) agreement exceeding $50 million in annual contract value. Additionally, Firstsource added 43 new clients during the year, enhancing its revenue base and market reach. -

Investment in Emerging Technologies

Firstsource is investing in artificial intelligence, automation, and machine learning to enhance its service offerings. Initiatives like the launch of UnBPO™ and the establishment of an AI Innovation Lab in Melbourne demonstrate the company’s commitment to technological advancement. -

Positive Analyst Outlook

Analysts have set a 12-month price target range for FSL between ₹336.33 and ₹446.25, with an average target of ₹386.33. This reflects confidence in the company’s growth trajectory and market performance. -

Strong Market Position in Key Sectors

Firstsource’s focus on sectors like healthcare, banking, and telecommunications positions it well to capitalize on the increasing demand for digital transformation services in these industries.

FSL Share Price Target 2030

FSL share price target 2030 Expected target could ₹1370. Here are five key risks and challenges that could affect Firstsource Solutions Ltd (FSL)’s share price target by 2030:

-

High Dependency on Overseas Markets

A large portion of Firstsource’s revenue comes from clients in the US and UK. Any economic slowdown, policy changes, or geopolitical issues in these regions could negatively impact business volumes and growth opportunities. -

Regulatory and Data Privacy Risks

As a BPO service provider, FSL handles sensitive customer data. Stricter data protection laws like GDPR and evolving regulations in the US and India could increase compliance costs and expose the company to legal risks if not managed carefully. -

Intense Industry Competition

The BPO and ITES sectors are highly competitive, with both global giants and agile startups offering similar services. Continuous pricing pressure and the need to maintain service quality can affect margins and market share. -

Technological Disruption and Automation

Rapid advancements in AI and automation could reduce the demand for traditional BPO services. If FSL fails to keep pace with innovation and shift its model toward high-tech solutions, it may face declining relevance. -

Employee Retention and Cost Pressure

The BPO industry is labor-intensive, and high attrition rates remain a concern. Rising employee costs and challenges in hiring skilled professionals could pressure profitability and impact service delivery quality.

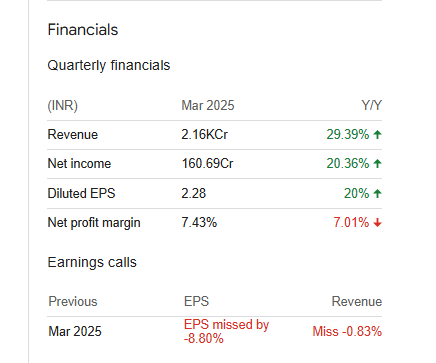

FSL Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 79.80B | 25.95% |

| Operating expense | 21.04B | 26.51% |

| Net income | 5.94B | 15.49% |

| Net profit margin | 7.45 | -8.25% |

| Earnings per share | 8.32 | 13.35% |

| EBITDA | 12.08B | 51.32% |

| Effective tax rate | 19.74% | — |

Read Also:- Bsoft Share Price Target Tomorrow 2025 To 2030