Geekay Wire Share Price Target Tomorrow 2025 To 2030

Geekay Wires Limited, established in 1989 and headquartered in Hyderabad, India, is a prominent manufacturer of galvanized steel wires, stainless steel fasteners, and collated nails. The company caters to various industries, including power transmission, construction, automotive, and general engineering, both domestically and internationally. Geekay Wire Share Price on NSE as of 21 April 2025 is 80.88 INR.

Geekay Wire Share Market Overview

- Open: 79.00

- High: 81.65

- Low: 78.00

- Previous Close: 79.29

- Volume: 59,878

- Value (Lacs): 47.68

- UC Limit: 0.00

- LC Limit: 0.00

- 52 Week High: 147.80

- 52 Week Low: 64.00

- Mkt Cap (Rs. Cr.): 416

- Face Value: 10

Geekay Wire Share Price Chart

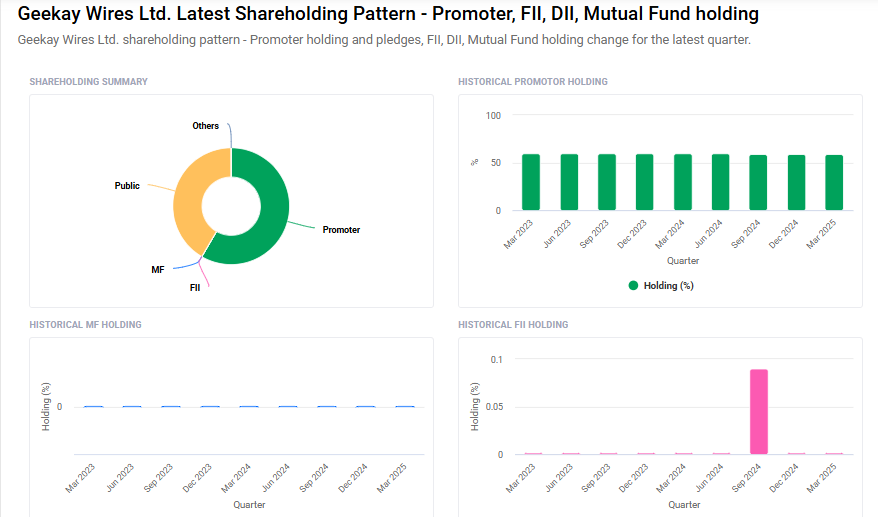

Geekay Wire Shareholding Pattern

- Promoters: 58.4%

- FII: 0%

- DII: 0%

- Public: 41.6%

Geekay Wire Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹150

- 2026 – ₹170

- 2027 – ₹190

- 2028 – ₹210

- 2030 – ₹230

Major Factors Affecting Geekay Wire Share Price

Here are six key factors that can influence the share price of Geekay Wires Limited:

1. Financial Performance and Profitability

Geekay Wires has demonstrated strong financial growth, with a revenue of ₹440.66 crore and a net profit of ₹38.53 crore for the year ending March 2024 Over the past three years, the company has achieved a profit growth of approximately 83% and a revenue growth of around 34%. Such consistent financial performance can boost investor confidence and positively impact the share price.

2. Return on Equity (ROE) and Capital Efficiency

The company has maintained a healthy Return on Equity (ROE) of 32.53%, which is significantly higher than the industry median of 6.23%. This indicates efficient utilization of shareholders’ funds to generate profits, making the stock more attractive to investors.

3. Debt Levels and Financial Stability

Geekay Wires has a debt-to-equity ratio of 67.0%, suggesting a moderate level of debt. While manageable, investors often monitor such ratios to assess the company’s financial stability. A significant increase in debt levels could raise concerns and potentially affect the share price.

4. Market Valuation and Intrinsic Value

As of April 2025, the intrinsic value of Geekay Wires’ stock is estimated at ₹56.8, while the market price stands at ₹79.63, indicating an overvaluation of approximately 29% . Perceptions of overvaluation may lead to cautious investor behavior, influencing the stock’s market performance.

5. Promoter Shareholding and Insider Activity

Promoters hold a significant stake in the company at 58.42% . Notably, the Managing Director purchased 15,000 shares valued at ₹11.4 lakhs in March 2025 . Such insider buying can be interpreted as a positive signal, reflecting confidence in the company’s future prospects.

6. Industry Demand and Expansion Plans

Geekay Wires serves various sectors, including power, construction, and automobile industries . The company anticipates an 8–10% sales growth in FY25 and plans to invest ₹35 crore in expanding its wire manufacturing capacity. These initiatives align with industry demand and can contribute to the company’s growth, potentially enhancing its share value.

Risks and Challenges for Geekay Wire Share Price

Here are six key risks and challenges that could influence the share price of Geekay Wires Limited:

1. Declining Earnings and Revenue Growth

While Geekay Wires has shown impressive growth over the past three years, recent financial data indicates a slowdown. The company reported a quarter-on-quarter revenue decline of 9.1%, marking its lowest in the last three years. Additionally, earnings have deteriorated over the last year, which may concern investors about the company’s future profitability and impact its share price.

2. Cash Flow Concerns

Despite reporting profits, there are concerns about Geekay Wires’ cash flow. Analysts have noted that the company’s earnings are not adequately supported by free cash flow, suggesting that its underlying earnings power might be lower than its reported profits. This discrepancy can raise questions about the sustainability of its earnings and potentially affect investor confidence.

3. Debt and Financial Liabilities

Geekay Wires has a debt-to-equity ratio of approximately 0.6, indicating a moderate level of debt. The company’s liabilities exceed its cash and short-term receivables by ₹276.4 million. While this level of debt is manageable, any increase could raise concerns about the company’s financial stability and its ability to service debt, potentially impacting its stock performance.

4. Market Valuation and Overvaluation Risks

As of April 2025, the intrinsic value of Geekay Wires’ stock is estimated at ₹56.8, while the market price stands at ₹79.63, indicating an overvaluation of approximately 29%. Such a discrepancy between intrinsic value and market price may lead to cautious investor behavior, influencing the stock’s market performance.

5. Industry Competition and Market Dynamics

Geekay Wires operates in a competitive industry, serving sectors like power, construction, and automobile. The company faces competition from both domestic and international players. Any loss of market share or inability to keep up with industry trends and customer demands could impact its revenue and, consequently, its share price.

6. Operational Risks and Expansion Challenges

The company plans to invest ₹35 crore in expanding its wire manufacturing capacity, aiming for an 8–10% sales growth in FY25. While expansion can drive growth, it also brings operational risks. Delays or issues in scaling operations, managing increased production, or integrating new technologies could affect the company’s performance and investor sentiment.

Read Also:- Granules India Share Price Target Tomorrow 2025 To 2030