Genus Power Share Price Target From 2025 to 2030

Genus Power Share Price Target From 2025 to 2030: Investment in the stock market requires wide knowledge of the fundamentals of the company, market position, and long-term growth potential of a company. Among those companies that have been generating huge interest over the last few years is Genus Power Infrastructures Ltd., a prominent company in India’s power infrastructure segment.

With smart metering gaining momentum, with the thrust towards energy efficiency and growing demand for smart metering, improved government efforts towards energy reforms, and organizations such as Genus Power being well-positioned to gain from possible opportunities. India’s government’s ‘Revamped Distribution Sector Scheme (RDSS)’ has also given a strong thrust towards smart meter installations, directly improving Genus Power’s business model.

This article discusses Genus Power’s recent share performance, technical and fundamental indicators, institutional shareholding, and share price projections between 2025-2030.

Company Overview and Market Position

Genus Power Infrastructures Ltd. comprises the manufacturing of electricity meters, smart meter technology, and value-added technologies that support India’s efficient and digital power revolution. With one of the industry leaders in the particular domain, the company is in line with large-scale government initiatives like the deployment of smart grids, AMI (Advanced Metering Infrastructure), and energy monitoring systems.

The major promoters of Genus Power’s successful market position are:

- Government-sponsored schemes of digital power distribution.

- Blossoming of rural electrification.

- Growing demand for energy monitoring on account of stepped-up usage of electricity.

- Prospects of exports with smart grid technologies gaining ground in other sectors.

- The aforesaid trends indicate Genus Power to have every chance of further development in the ensuing decade.

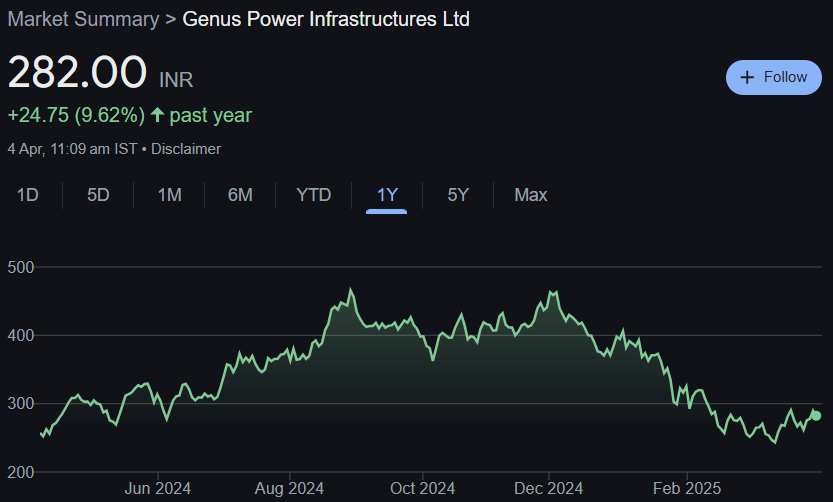

Latest Stock Market Performance

The following is an overview of recent trading history of the company:

- Open Price: ₹288.00

- High: ₹289.80

- Low: ₹278.10

- Previous Close: ₹289.90

- Current Price: ₹281.75

- 52-week High: ₹486.05

- 52-week Low: ₹236.85

- Market Cap: ₹8,570 Cr

- P/E Ratio: 36.80

- Dividend Yield: 0.21%

The stock has declined by almost 42% from 52-week high, which may either be a period of correction or consolidation. However, it is trading much above its year-low, reflecting the long-term investor interest.

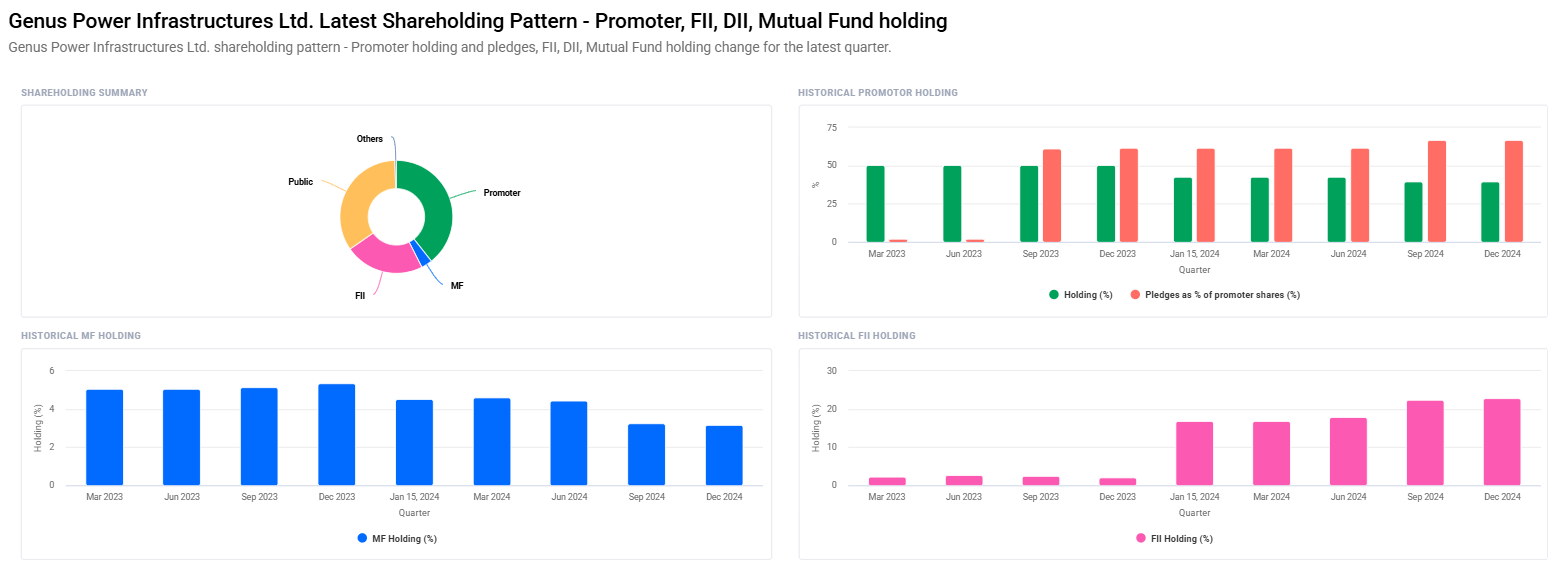

Ownership Structure & Institutional Sentiment

Ownership structure of Genus Power reflects consistent performance:

- Promoters: 39.39% (Rise modestly from last quarter)

- Retail & Others: 34.26%

- Foreign Institutions: 22.79% (up from 22.49%)

- Mutual Funds: 3.18% (down marginally from 3.26%)

- Other Domestic Institutions: 0.39%

Key:

- Promoters have increased holding marginally while maintaining pledge level high at 66.70%.

- Institutional Investors have increased holdings from 26.03% to 26.36%, which shows confidence.

- FII investors have decreased from 94 to 88, which shows marginal cut in positions.

Whereas promoter pledgeing may be provocative, overall institutional growth is welcome news for long-term stability.

Where Is Genus Power Technically?

Day Momentum Score: 36.83

- (Technically neutral; above 70 = strong, below 35 = weak)

Key Technical Indicators:

- RSI (14-day): 25.4 → Oversold region

- MACD: -1.0, below the middle line (bearish)

- MACD Signal: -5.2

- ADX: 56.6 → Strong trend

- Rate of Change (ROC 21-day): 15.25

- Rate of Change (ROC 125-day): -24.6

- Money Flow Index (MFI): 66.5 → Moving towards overbought

- ATR (Average True Range): 17.0 → High volatility

Interpretation:

- The RSI of less than 30 says that the stock is oversold and may be ready for a bounce.

- Despite bearish MACD signals, high ADX and bullish ROC (short term) suggest trend reversal is happening.

- With excessive volatility, one can expect to see quick move in either direction in the near term.

Genus Power Share Price Target (2025 to 2030)

On the basis of a combination of technical indicators, fundamentals, government policy support, and sector potential, here’s a year-by-year price projection:

Year(Target Price (₹))Reason

2025 ₹500 Restoration phase; anticipated rebound from oversold levels; government meter contracts.

2026 ₹750 A sustained drive of smart meter projects; improved earnings.

2027 ₹1,000 Market dominance; improved ROC and EPS.

2028 ₹1,250rowth in export market; fresh government tenders.

2029 ₹1,500 Full integration of smart grid; profit margin expansion.

2030 ₹1,750 Industry consolidation; high investor confidence.

Investment Strategy – Is Genus Power a Buy?

Short-Term (1-2 years)

- Risk Level: High

- Action Plan: Follow closely for a breakout above ₹300. If it holds at this level, it can rally up to ₹500.

- Caution: Pledging of promoters remains an issue.

Medium-Term (3-5 years)

- Risk Level: Moderate

- Action Plan: Buy on dips, especially if the stock continues to stick in the ₹250–₹300 band.

- Expected Reward: ~3x returns in case 2027 targets are achieved.

Long-Term (5+ years)

- Risk Level: Low (on account of government-supported industry)

- Action Plan: Invest in moves with a SIP plan; hold for judicious energy transition in India.

- Potential: Multibagger returns, especially if overseas expansion is the catalyst.

Risks and Challenges

Although Genus Power has immense growth potential, investors need to be aware of the following risks:

- Unbridled pledging by promoters may be a sign of funding trouble.

- Volatility in government policy may lead to delays in projects.

- Indian and global competition may impact margins.

Execution Risk: Disruptions in payment or delivery cycles of government projects can impact earnings.

Final Verdict – Is Genus Power Worth Investing In?

Genus Power Infrastructures Ltd. is leading India’s smart energy revolution. The company’s established market position, back-end positioning to government schemes, and stable institutional patronage make it a good candidate for long-term investment.

Though technically susceptible to short-term corrections, the fundamentals are sound. With rising order flows and demand for smart metering, Genus Power can deliver multi-bagger returns by 2030. For medium to long-term investors with some short-term volatility tolerance.

Most Asked Questions (FAQs)

Q1. Should one buy Genus Power stock now?

A1. Technically, the stock is oversold and may witness a bounce. For long-term investors, the levels are positive for accumulation.

Q2. Genus Power share fell from its 52-week high. Why?

A2. It may be due to general market volatility, profit booking, and promoter pledging issues. But no material change in fundamentals has occurred.

Q3. How is high promoter pledging impacting the company?

A3. High pledging (66.70%) is risky if the market crashes. But marginal promoter holding increases show commitment. Watch this parameter on a regular basis.

Q4. Drivers of growth of Genus Power

A4. RDSS-based smart meter schemes, foreign growth, need for energy efficiency, and government digital spending on infrastructure.

Q5. Can Genus Power emerge as a multibagger in 2030?

A5. Yes, due to projected industry growth, positive policies, and an expanded product portfolio, the share can deliver multi-fold returns within the next 5-6 years.