Good Luck Share Price Target Tomorrow 2025 To 2030

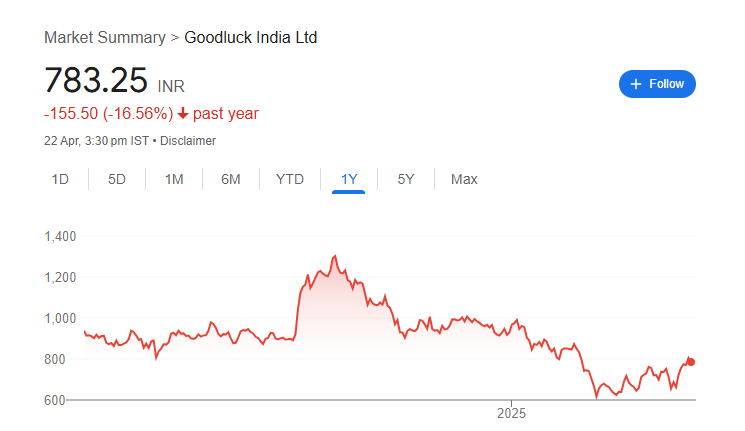

Goodluck India Limited, established in 1986 and headquartered in Ghaziabad, Uttar Pradesh, is a prominent manufacturer and exporter of a diverse range of steel products. The company’s offerings include ERW precision and CDW tubes, forged flanges, galvanized pipes, CR coils, and custom forgings, catering to sectors such as automotive, infrastructure, defense, and aerospace. Goodluck India operates state-of-the-art manufacturing facilities in Sikandrabad and Kutch, equipped with advanced machinery and skilled personnel. Good Luck Share Price on NSE as of 22 April 2025 is 783.25 INR.

Good Luck Share Market Overview

- Open: 810.00

- High: 815.85

- Low: 780.65

- Previous Close: 805.05

- Volume: 91,373

- Value (Lacs): 719.43

- VWAP: 800.77

- UC Limit: 966.05

- LC Limit: 644.05

- 52 Week High: 1,330.00

- 52 Week Low: 567.75

- Mkt Cap (Rs. Cr.): 2,577

- Face Value: 2

Good Luck Share Price Chart

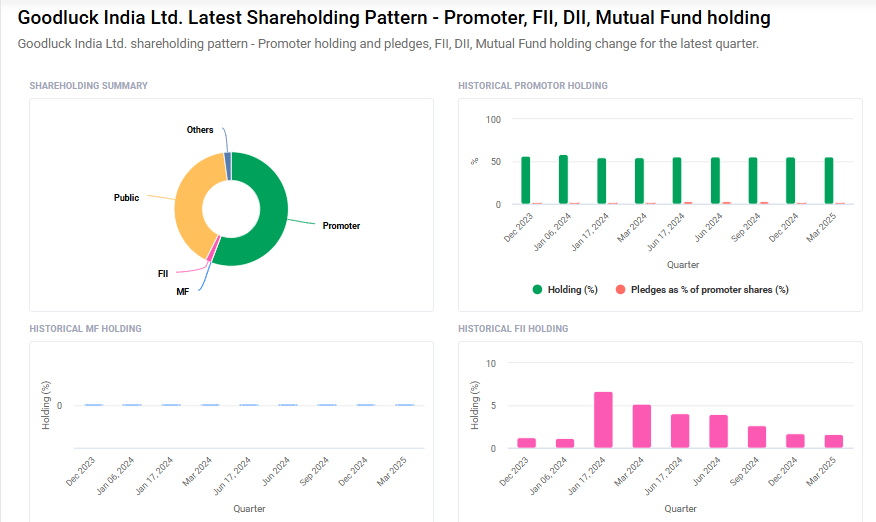

Good Luck Shareholding Pattern

- Promoters: 55.8%

- FII: 1.6%

- DII: 2.1%

- Public: 40.5%

Good Luck Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹1330

- 2026 – ₹1400

- 2027 – ₹1500

- 2028 – ₹1600

- 2030 – ₹1700

Major Factors Affecting Good Luck Share Price

Here are six key factors that can influence the share price of Goodluck India Limited:

1. Financial Performance and Profitability

Goodluck India has demonstrated strong financial growth, with a compound annual growth rate (CAGR) of 32.9% in profit over the last five years. This consistent profitability can boost investor confidence and positively impact the share price.

2. Expansion into High-Value Sectors

The company’s strategic move into the defense and aerospace sectors through its subsidiary, Goodluck Defence and Aerospace Limited, is expected to generate significant revenue, potentially between ₹300–350 crore at peak utilization. Such diversification can enhance growth prospects and influence the stock’s valuation.

3. Market Volatility and Stock Performance

Despite strong fundamentals, Goodluck India’s share price has experienced volatility, with a 52-week high of ₹1,330 and a low of ₹567.75. Such fluctuations can be attributed to broader market conditions and investor sentiment.

4. Promoter Shareholding Trends

A decline in promoter holding by 5.77% over the last three years may raise concerns among investors about the promoters’ confidence in the company’s future, potentially affecting the share price.

5. Debt Levels and Financial Leverage

Concerns over high debt levels have been noted, which can impact the company’s financial stability and investor perception. Managing debt effectively is crucial for maintaining a healthy balance sheet and supporting share price growth.

6. Dividend Policy and Shareholder Returns

Goodluck India declared a final dividend of ₹1 per share in May 2024, representing a 50% payout on the face value of ₹2. While dividends can attract income-focused investors, the relatively modest yield may influence investment decisions.

Risks and Challenges for Good Luck Share Price

Here are six key risks and challenges that could influence the share price of Goodluck India Limited:

1. Recent Share Price Decline

Goodluck India’s stock has experienced a significant drop, falling 26% in the past month and 35% over the past year. This decline may indicate investor concerns about the company’s performance or broader market conditions.

2. Overvaluation Concerns

Analysts have assessed that Goodluck India’s intrinsic value is approximately ₹666.88, while the current market price is around ₹805.05. This suggests the stock may be overvalued by about 17%, which could lead to a price correction if market sentiments shift.

3. Operational Challenges

The company has reported a decline in EBITDA per ton to approximately ₹8,100, indicating reduced profitability. Additionally, challenges in ramping up new plant operations and supply chain issues have been noted, potentially impacting production efficiency and costs.

4. Market Volatility

As a small-cap company in the iron and steel industry, Goodluck India is susceptible to market fluctuations. For instance, the stock saw a 7.18% decline on a single day, underperforming its sector, which can affect investor confidence.

5. Declining Institutional Holdings

Foreign Institutional Investors (FIIs) have reduced their stake in Goodluck India from 3.92% to 1.64% over recent quarters. Such a decrease may signal waning confidence among institutional investors, potentially influencing the stock’s performance.

6. Competitive Industry Landscape

Goodluck India operates in a highly competitive sector, facing challenges from peers like Surya Roshni, JTL Infra, and Hi-Tech Pipes. Maintaining market share and profitability amidst such competition requires continuous innovation and efficiency.

Read Also:- Kims Share Price Target Tomorrow 2025 To 2030