Gopal Iron Stl Share Price Target Tomorrow 2025 To 2030

Gopal Iron & Steel is a company that specializes in the production of high-quality steel products for various industries, including construction, automotive, and manufacturing. With a focus on innovation and reliability, the company plays an important role in meeting the growing demand for steel in both domestic and international markets. Gopal Iron & Steel is committed to using the latest technology to improve efficiency and deliver durable products. Gopal Iron Stl Share Price on BOM as of 13 May 2025 is 7.70 INR.

Gopal Iron Stl Share Market Overview

- Open: 7.86

- High: 7.86

- Low: 7.70

- Previous Close: 7.49

- Volume: 10,099

- Value (Lacs): 0.78

- VWAP: 7.81

- 52 Week High: 9.33

- 52 Week Low: 6.00

- Mkt Cap (Rs. Cr.): 3

- Face Value: 10

Gopal Iron Stl Share Price Chart

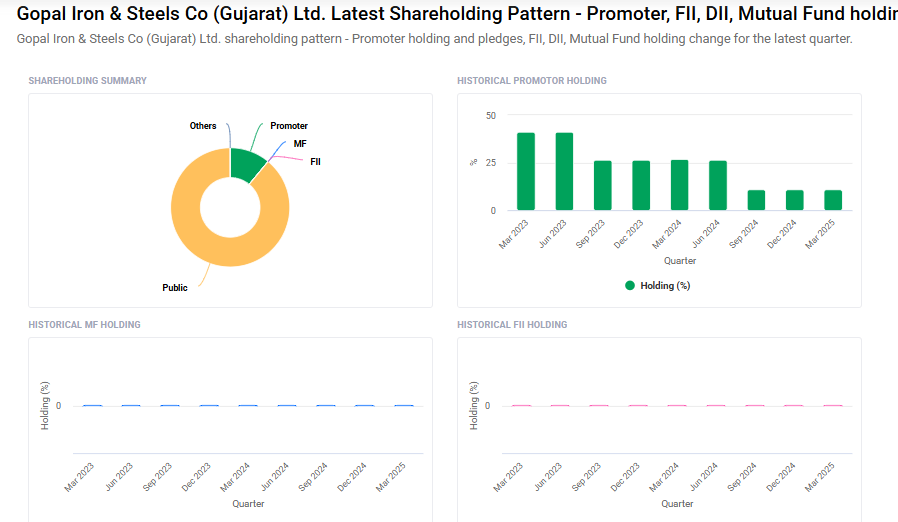

Gopal Iron Stl Shareholding Pattern

- Promoters: 11%

- FII: 0%

- DII: 0%

- Public: 89%

Gopal Iron Stl Share Price Target Tomorrow 2025 To 2030

| Gopal Iron Stl Share Price Target Years | Gopal Iron Stl Share Price |

| 2025 | ₹10 |

| 2026 | ₹12 |

| 2027 | ₹15 |

| 2028 | ₹18 |

| 2029 | ₹20 |

| 2030 | ₹22 |

Gopal Iron Stl Share Price Target 2025

Gopal Iron Stl share price target 2025 Expected target could ₹10. Here are 4 key factors affecting growth for Gopal Iron & Steel share price target in 2025:

-

Demand for Steel and Metal Products: The growth of industries like construction, automotive, and manufacturing drives the demand for steel. An increase in infrastructure projects and industrial activity can directly boost Gopal Iron’s sales and revenue.

-

Raw Material Prices and Supply Chain Management: The cost of raw materials like iron ore and coal can influence production costs. Efficient sourcing and supply chain management will be crucial for maintaining profitability.

-

Technological Advancements and Product Diversification: The company’s ability to innovate and introduce new steel products, such as high-strength or specialized steels, will help it stay competitive and cater to evolving market needs.

-

Government Policies and Infrastructure Development: Government initiatives in the form of infrastructure spending, policy support for manufacturing, or subsidies for the steel sector can create favorable conditions for Gopal Iron to expand and grow.

Gopal Iron Stl Share Price Target 2030

Gopal Iron Stl share price target 2030 Expected target could ₹22. Here are 4 key risks and challenges that could affect Gopal Iron & Steel share price target for 2030:

-

Volatility in Raw Material Prices: Fluctuating prices of essential raw materials like iron ore and coal can lead to unpredictable production costs, potentially reducing profit margins if the company cannot manage these variations effectively.

-

Environmental Regulations: Stricter environmental laws and regulations regarding emissions, waste management, and sustainability could lead to higher compliance costs or require expensive upgrades to facilities.

-

Global Economic Downturns: Economic slowdowns or recessions can reduce demand for steel in key sectors such as construction, automotive, and manufacturing, negatively impacting sales and growth prospects.

-

Intense Industry Competition: The steel industry is highly competitive, with many domestic and international players. Increased competition could lead to pricing pressures, reduced market share, and squeezed profit margins for Gopal Iron & Steel.

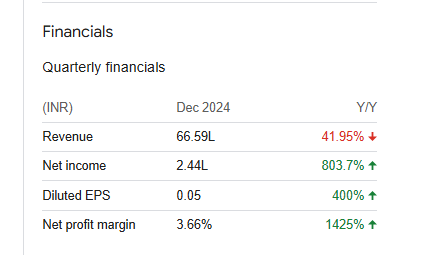

Gopal Iron Stl Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 41.94M | 282.26% |

| Operating expense | 76.00K | 111.26% |

| Net income | 552.00K | -58.47% |

| Net profit margin | 1.32 | -89.10% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | — | — |

Read Also:- Karnimata Cold Share Price Target Tomorrow 2025 To 2030