Granules India Share Price Target Tomorrow 2025 To 2030

Granules India Limited is a well-established pharmaceutical company headquartered in Hyderabad, India. Founded in 1984, the company has grown into a vertically integrated manufacturer, producing high-quality Active Pharmaceutical Ingredients (APIs), Pharmaceutical Formulation Intermediates (PFIs), and Finished Dosages (FDs). Granules India specializes in large-scale production of off-patent drugs such as Paracetamol, Ibuprofen, Metformin, and Guaifenesin, serving over 300 customers across more than 80 countries, including key markets in the United States, Canada, Europe, and India. Granules India Share Price on NSE as of 21 April 2025 is 465.00 INR.

Granules India Share Market Overview

- Open: 462.00

- High: 470.90

- Low: 457.15

- Previous Close: 463.05

- Volume: 1,134,381

- Value (Lacs): 5,303.23

- 52 Week High: 721.00

- 52 Week Low: 389.35

- Mkt Cap (Rs. Cr.): 11,338

- Face Value: 1

Granules India Share Price Chart

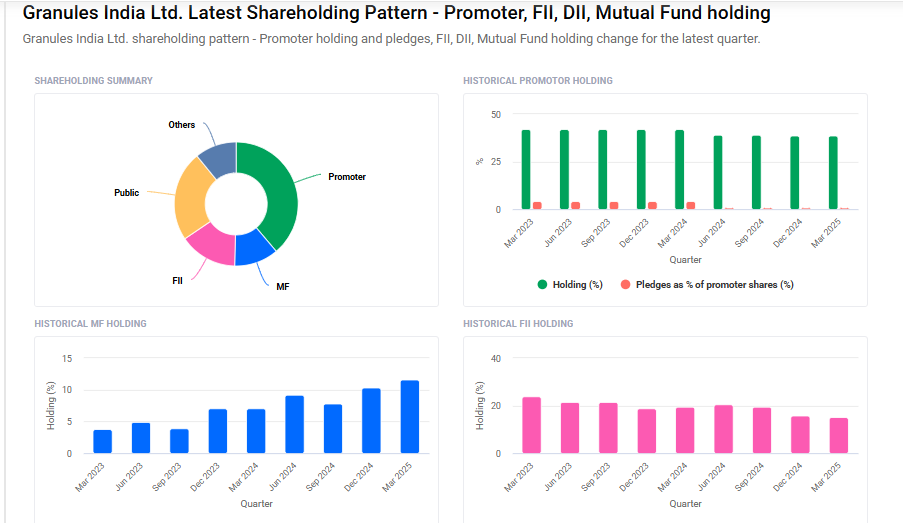

Granules India Shareholding Pattern

- Promoters: 38.8%

- FII: 15.1%

- DII: 22.5%

- Public: 23.6%

Granules India Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹725

- 2026 – ₹780

- 2027 – ₹830

- 2028 – ₹875

- 2030 – ₹930

Major Factors Affecting Granules India Share Price

Here are six key factors that can influence the share price of Granules India Limited:

1. Regulatory Compliance and Quality Control

Granules India operates in a highly regulated pharmaceutical industry. Any lapses in maintaining quality standards can lead to regulatory actions. For instance, the U.S. Food and Drug Administration (FDA) issued a warning letter to Granules India’s Gagillapur facility, highlighting concerns about data integrity and contamination. Such regulatory issues can delay product approvals and negatively impact investor confidence, leading to a decline in the share price.

2. Financial Performance and Profit Margins

The company’s financial health plays a significant role in determining its stock value. While Granules India reported a 7.8% increase in net profit in a recent quarter, a 17% rise in total expenses offset some of this growth. Rising costs can pressure profit margins, and if not managed effectively, may lead to concerns among investors about the company’s profitability.

3. Market Valuation and Investor Sentiment

Investor perception of a company’s value can influence its stock price. Granules India’s intrinsic value was recently assessed to be slightly higher than its market price, suggesting it might be undervalued. However, if investors believe the stock is overvalued or if market sentiment turns negative, it can lead to a decrease in the share price.

4. Promoter and Institutional Shareholding

Changes in the shareholding pattern can affect investor confidence. For example, if promoters reduce their stake or if institutional investors like mutual funds alter their holdings significantly, it may signal changes in the company’s perceived stability or growth prospects, influencing the stock price.

5. Global Market Dynamics and Currency Fluctuations

As Granules India exports its products to various countries, global economic conditions and currency exchange rates can impact its revenues. A stronger Indian rupee can make exports less competitive, potentially reducing earnings from international markets and affecting the share price.

6. Research and Development (R&D) Investments

Continuous investment in R&D is crucial for pharmaceutical companies to innovate and stay competitive. If Granules India fails to invest adequately in developing new products or improving existing ones, it may lag behind competitors, leading to concerns about future growth and impacting the stock’s performance.

Risks and Challenges for Granules India Share Price

Here are six important risks and challenges that may affect the share price of Granules India:

1. Regulatory Risks

Granules India operates in a highly regulated industry. Any warning letters, observations, or product recalls from global health authorities like the USFDA or EU regulators can seriously impact the company’s reputation and earnings. Delays in approvals or regulatory hurdles may also affect future growth, leading to a fall in share price.

2. Quality and Compliance Issues

Maintaining strict quality standards is very important in the pharmaceutical sector. If there are concerns related to manufacturing practices, contamination, or data integrity, it can damage the company’s image and result in loss of customer trust. This can directly hurt revenues and lower investor confidence.

3. Rising Input and Operational Costs

The cost of raw materials, energy, and transportation continues to fluctuate. If Granules India faces increasing expenses and cannot pass them on to customers, it could lead to reduced profit margins. Lower earnings may worry shareholders and negatively impact the share price.

4. Currency Exchange Fluctuations

Granules India exports a large part of its products to international markets. This makes the company vulnerable to changes in currency exchange rates. A stronger Indian rupee can reduce the value of earnings from exports, which may affect overall profits and investor outlook.

5. Dependence on a Few Key Products

If the company relies too heavily on a limited number of products or markets, it becomes more exposed to risk. Any decline in demand, pricing pressure, or competition in those key areas can have a strong impact on the company’s financial performance and stock value.

6. Competitive Market Environment

The pharmaceutical industry is very competitive, with many companies offering similar medicines. If Granules India is not able to keep up with new product development or faces price competition, it may lose market share. This could limit growth opportunities and affect the share price.

Read Also:- Rallis India Share Price Target Tomorrow 2025 To 2030