GRSE Share Price Target Tomorrow 2025 To 2030

Garden Reach Shipbuilders & Engineers Ltd. (GRSE), established in 1884 and based in Kolkata, is one of India’s premier shipbuilding companies. Operating under the Ministry of Defence, GRSE has a rich history of constructing a diverse range of vessels, including frigates, corvettes, and patrol boats, primarily for the Indian Navy and Coast Guard. Notably, GRSE has delivered over 100 warships, marking a significant milestone in India’s maritime capabilities. Beyond shipbuilding, the company is involved in engine production and the manufacturing of prefabricated steel bridges, showcasing its diversified engineering expertise. GRSE Share Price on NSE as of 5 May 2025 is 1,879.60 INR.

GRSE Share Market Overview

- Open: 1,917.00

- High: 1,947.00

- Low: 1,873.00

- Previous Close: 1,917.00

- Volume: 3,501,740

- Value (Lacs): 65,930.76

- 52 Week High: 2,833.80

- 52 Week Low: 881.00

- Mkt Cap (Rs. Cr.): 21,567

- Face Value: 10

GRSE Share Price Chart

GRSE Shareholding Pattern

- Promoters: 74.5%

- FII: 3.9%

- DII: 1.9%

- Public: 19.8%

GRSE Share Price Target Tomorrow 2025 To 2030

| GRSE Share Price Target Years | GRSE Share Price |

| 2025 | ₹2840 |

| 2026 | ₹3200 |

| 2027 | ₹3600 |

| 2028 | ₹4000 |

| 2029 | ₹4400 |

| 2030 | ₹4800 |

GRSE Share Price Target 2025

GRSE share price target 2025 Expected target could ₹2840. Here are four key factors that could influence the growth of Garden Reach Shipbuilders & Engineers Ltd. (GRSE):

1. Robust Order Book

GRSE has secured a substantial order book valued at ₹24,221.37 crore, encompassing diverse projects such as naval vessels and green energy initiatives. This strong pipeline provides revenue visibility and underpins the company’s growth prospects.

2. Strategic International Collaborations

The company has expanded its global footprint by signing a contract with German firm Carsten Rehder for the construction and delivery of multi-purpose vessels. Such international collaborations diversify revenue streams and enhance GRSE’s market presence.

3. Favorable Industry Growth Outlook

GRSE’s revenue is forecasted to grow at an average annual rate of 20% over the next three years, outpacing the 15% growth forecast for the broader Aerospace & Defense industry in India. This indicates a strong position within a growing sector.

4. Government Support for Defense Manufacturing

The Indian government’s emphasis on indigenization and increased defense spending bolsters GRSE’s prospects. Policies promoting local manufacturing of defense equipment are likely to provide sustained opportunities for the company.

GRSE Share Price Target 2030

GRSE share price target 2030 Expected target could ₹4800. Here are four key risks and challenges that could affect Garden Reach Shipbuilders & Engineers Ltd. (GRSE):

1. High Dependence on Government Contracts

GRSE’s business largely relies on orders from the Indian Navy and other government entities. Any delays in defense budgets, policy changes, or shift in procurement strategies can impact the company’s revenue pipeline.

2. Project Execution Risks

Shipbuilding is a time-consuming and complex process. Delays in delivery, cost overruns, or technical failures can not only increase operational expenses but also affect client trust and future order prospects.

3. Limited Diversification

GRSE’s core focus remains in defense shipbuilding, with limited exposure to commercial or global maritime sectors. This lack of diversification may pose a risk during downturns or budget cuts in the defense sector.

4. Intensifying Competition and Technological Upgradation

As both domestic and international shipbuilders invest in advanced technologies and automation, GRSE must continuously modernize its infrastructure to stay competitive. Falling behind in innovation may reduce its competitiveness over the long term.

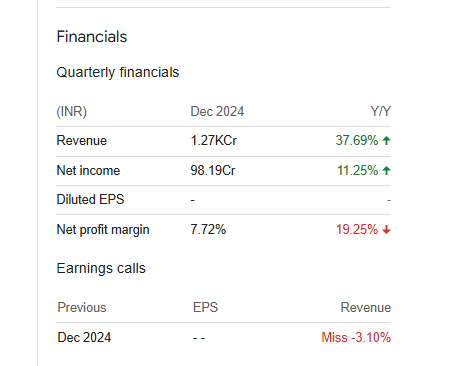

GRSE Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 35.93B | 40.27% |

| Operating expense | 4.84B | 11.97% |

| Net income | 3.57B | 56.61% |

| Net profit margin | — | — |

| Earnings per share | 31.19 | 56.65% |

| EBITDA | 2.38B | 58.68% |

| Effective tax rate | 25.71% | — |

Read Also:- Cochin Shipyard Share Price Target Tomorrow 2025 To 2030