GTL Share Price Target Tomorrow 2025 To 2030

GTL Limited is an Indian company that was once a key player in the telecom infrastructure and network services sector. It provided services like network planning, installation, and maintenance to telecom operators. Over the years, GTL faced several financial difficulties, including high debt and changes in the telecom industry, which affected its business operations. GTL Share Price on NSE as of 19 May 2025 is 8.76 INR.

GTL Share Market Overview

- Open: 8.88

- High: 8.89

- Low: 8.71

- Previous Close: 8.74

- Volume: 551,267

- Value (Lacs): 48.24

- 52 Week High: 19.45

- 52 Week Low: 5.90

- Mkt Cap (Rs. Cr.): 137

- Face Value: 10

GTL Share Price Chart

GTL Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹18 |

| 2026 | ₹22 |

| 2027 | ₹26 |

| 2028 | ₹30 |

| 2029 | ₹35 |

| 2030 | ₹40 |

GTL Share Price Target 2025

GTL share price target 2025 Expected target could ₹18. Here are five key factors influencing Orient Green Power’s share price target for 2025:

1. Renewable Energy Expansion and Diversification

Orient Green Power is actively expanding its portfolio beyond wind energy to include solar and biomass projects, aligning with India’s push towards renewable energy. This diversification positions the company to capitalize on the growing demand for clean energy sources.

2. Financial Performance and Profitability

In FY2025, Orient Green Power reported a revenue increase of 4.4% year-over-year, reaching ₹2.83 billion. However, net income declined by 8% to ₹335.9 million, and the profit margin decreased to 12% from 14% the previous year. These figures indicate challenges in maintaining profitability despite revenue growth.

3. Debt Reduction Efforts

The company has made progress in reducing its debt levels, which can lead to lower interest expenses and improved financial health. A stronger balance sheet may attract investors seeking stability in the renewable energy sector.

4. Market Valuation Concerns

Analyses suggest that Orient Green Power’s stock may be overvalued by approximately 22% compared to its intrinsic value. This discrepancy could impact investor decisions and share price movements if not addressed through enhanced performance or strategic initiatives.

5. Policy Support and Sector Growth

India’s commitment to achieving 500 GW of non-fossil fuel-based power by 2030, supported by substantial financial investments, creates a favorable environment for renewable energy companies like Orient Green Power. This policy support can drive sector growth and potentially benefit the company’s share price.

GTL Share Price Target 2030

GTL share price target 2030 Expected target could ₹40. Here are five key risks and challenges that could influence GTL Infrastructure’s share price by 2030:

1. High Debt Burden and Financial Instability

GTL Infrastructure has been grappling with a substantial debt load, which poses a significant risk to its financial stability. Despite efforts to reduce debt from a peak of US$3 billion to approximately US$700 million, the company continues to face challenges in servicing its obligations. This financial strain could limit its ability to invest in growth opportunities and impact investor confidence.

2. Declining Revenue and Profit Margins

The company has experienced a consistent decline in net sales over recent quarters, with a reported low of ₹331.09 crore in Q4 2024. Additionally, operating profit margins have deteriorated, reaching 12.17% in the same period. Such trends indicate operational inefficiencies and raise concerns about the company’s ability to sustain profitability.

3. Regulatory and Policy Risks

Changes in government policies and regulations related to telecommunications infrastructure can significantly impact GTL Infrastructure’s operations. Any unfavorable regulatory shifts could affect the company’s revenue streams and operational viability.

4. Technological Obsolescence

The rapid evolution of telecommunications technology necessitates continuous upgrades to infrastructure. GTL Infrastructure faces the risk of its existing assets becoming obsolete, requiring substantial capital expenditure to remain competitive.

5. Intense Industry Competition

The telecommunications infrastructure sector is highly competitive, with numerous players vying for market share. Increased competition can lead to pricing pressures and reduced profitability for GTL Infrastructure, especially if it fails to differentiate its services effectively.

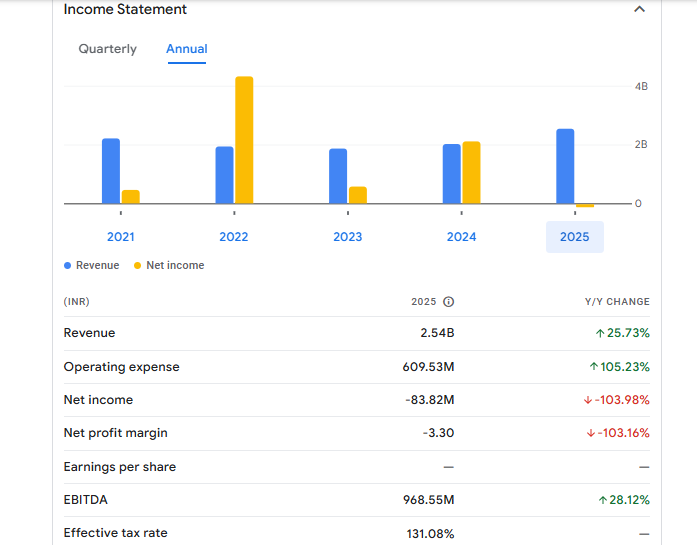

GTL Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 2.54B | 25.73% |

| Operating expense | 609.53M | 105.23% |

| Net income | -83.82M | -103.98% |

| Net profit margin | -3.30 | -103.16% |

| Earnings per share | — | — |

| EBITDA | 968.55M | 28.12% |

| Effective tax rate | 131.08% | — |

Read Also:- Orient Green Power Share Price Target Tomorrow 2025 To 2030