Gujarat Winding Share Price Target Tomorrow 2025 To 2030

Gujarat Winding Systems Limited, established in 1988 and based in Ahmedabad, India, specializes in manufacturing and distributing paper-based packaging materials such as cones, tubes, drums, and boxes. The company serves various industries, including textiles and consumer goods. Despite facing challenges like declining revenues in recent years, Gujarat Winding Systems has demonstrated resilience by maintaining a debt-free status and reporting modest profits in recent quarters. Gujarat Winding Share Price on BOM as of 14 May 2025 is 7.65 INR.

Gujarat Winding Share Market Overview

- Open: 7.65

- High: 7.65

- Low: 7.65

- Previous Close: 7.80

- Volume: 7,583

- Value (Lacs): 0.58

- VWAP: 7.65

- 52 Week High: 8.95

- 52 Week Low: 6.47

- Mkt Cap (Rs. Cr.): 3.72Cr

- Face Value: 10

Gujarat Winding Share Price Chart

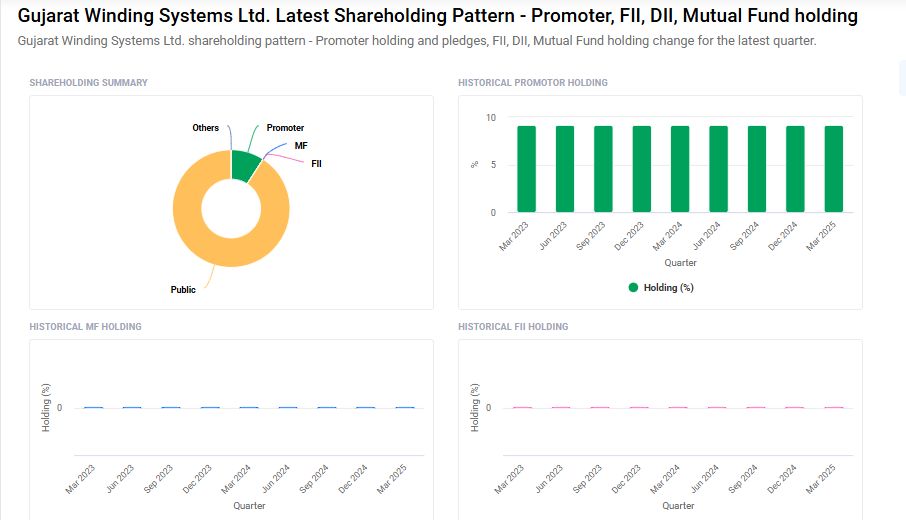

Gujarat Winding Shareholding Pattern

- Promoters: 9.2%

- FII: 0%

- DII: 0%

- Public: 90.8%

Gujarat Winding Share Price Target Tomorrow 2025 To 2030

| Gujarat Winding Share Price Target Years | Gujarat Winding Share Price |

| 2025 | ₹10 |

| 2026 | ₹12 |

| 2027 | ₹14 |

| 2028 | ₹16 |

| 2029 | ₹18 |

| 2030 | ₹20 |

Gujarat Winding Share Price Target 2025

Gujarat Winding share price target 2025 Expected target could ₹10. Here are four key factors that could influence the growth of Gujarat Winding Systems Ltd.’s share price target for 2025:

-

Significant Stock Appreciation: Over the past year, Gujarat Winding Systems’ stock has appreciated by approximately 189%, indicating strong investor interest and positive market sentiment.

-

Debt-Free Status: The company maintains a debt-free balance sheet, providing financial stability and flexibility to invest in growth opportunities without the burden of interest obligations.

-

Low Price-to-Book Ratio: With a price-to-book ratio of 0.92, the stock is trading below its book value, potentially making it attractive to value investors seeking undervalued opportunities.

-

Improved Profitability: In recent quarters, the company has reported positive net profits, signaling a potential turnaround in its financial performance.

Gujarat Winding Share Price Target 2030

Gujarat Winding share price target 2030 Expected target could ₹20. Here are four key risks and challenges that could impact Gujarat Winding Systems Ltd.’s share price target by 2030:

-

Low Promoter Holding: As of March 2025, the company’s promoter holding stands at a modest 9.17%. Such a low stake can raise concerns about the promoters’ commitment and may lead to increased stock price volatility due to potential lack of strategic direction.

-

Stagnant Revenue Growth: The company has reported negligible revenue over recent quarters, indicating challenges in generating consistent income. This stagnation can hinder the company’s ability to invest in growth opportunities and affect investor confidence.

-

High Valuation Metrics: With a Price-to-Earnings (P/E) ratio of 47.34 and a Price-to-Book (P/B) ratio of 0.92, the stock appears to be trading at high valuation multiples relative to its earnings and book value. Such valuations may not be sustainable if the company doesn’t achieve significant earnings growth.

-

Operational Inefficiencies: The company’s Return on Equity (ROE) and Return on Capital Employed (ROCE) have been reported at 0.00% over the last three years, suggesting inefficiencies in utilizing shareholders’ funds and capital to generate profits.

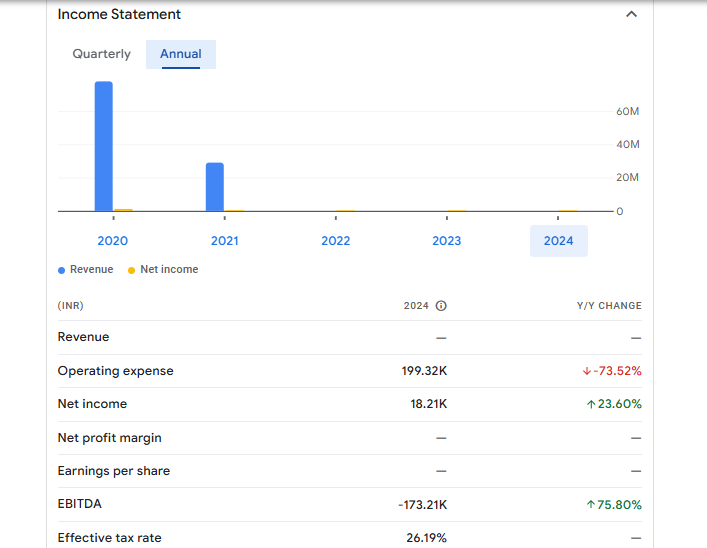

Gujarat Winding Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | — | — |

| Operating expense | 199.32K | -73.52% |

| Net income | 18.21K | 23.60% |

| Net profit margin | — | — |

| Earnings per share | — | — |

| EBITDA | -173.21K | 75.80% |

| Effective tax rate | 26.19% | — |

Read Also:- Abhishek Infra Share Price Target Tomorrow 2025 To 2030