Hira Automobile Share Price Target Tomorrow 2025 To 2030

Hira Automobile is a growing company in the automobile industry that focuses on producing and selling different types of vehicles. The company aims to offer quality vehicles that are both reliable and affordable for customers. Over time, Hira has built a name for itself by staying committed to good customer service, innovation, and consistent performance. It works hard to keep up with the latest trends in technology and design, helping it compete in the fast-changing auto market. Hira Automobile Share Price on BOM as of 17 April 2025 is 176.40 INR.

Hira Automobile Share Market Overview

- Open: 176.40

- High: 176.40

- Low: 176.40

- Previous Close: 176.40

- UC Limit: 179.90

- LC Limit: 172.90

- 52 Week High: 176.40

- 52 Week Low: 60.89

- Mkt Cap (Rs. Cr.): 48.57Cr

- Face Value: 10

Hira Automobile Share Price Chart

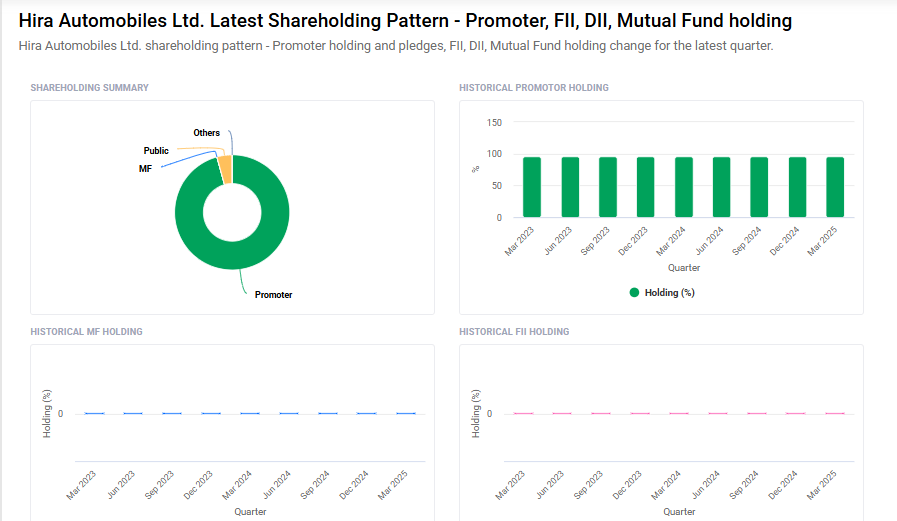

Hira Automobile Shareholding Pattern

- Promoters: 95.7%

- FII: 0%

- DII: 0%

- Public: 4.3%

Hira Automobile Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹180

- 2026 – ₹300

- 2027 – ₹400

- 2028 – ₹500

- 2030 – ₹600

Major Factors Affecting Hira Automobile Share Price

Here are 6 Factors Affecting Hira Automobile Share Price:

-

Company Performance and Profits

One of the most important things that affects the share price of Hira Automobile is how well the company is doing. If the company is making good profits, managing costs well, and showing steady growth, investors feel confident and the share price usually goes up. On the other hand, if the company’s performance drops, the share price might also fall. -

Market Demand for Automobiles

When more people are buying vehicles, especially the ones made by Hira Automobile, it creates higher revenue and profit. This growing demand encourages investors to invest more, which helps increase the share price. If the demand slows down, it can affect sales and pull the price down. -

Raw Material Costs

The cost of materials like steel, rubber, and plastic can impact how much it costs to make each vehicle. If raw material prices go up, the company might earn less profit. This can worry investors and lead to a drop in share price. Lower raw material costs, however, can help improve profits and push the share price higher. -

Government Policies and Regulations

Any changes in government rules — like taxes, fuel policies, or electric vehicle support — can influence Hira Automobile’s business. For example, tax cuts or benefits for electric vehicles might help the company grow, leading to a rise in share price. Strict rules or higher taxes might have a negative impact. -

Competition in the Auto Industry

Hira Automobile operates in a highly competitive market. If other car companies launch better or cheaper vehicles, it might reduce Hira’s sales and profits. Strong competition can put pressure on the share price. However, if Hira launches innovative or popular models, it can give them an edge and boost the stock value. -

Investor Sentiment and Market Trends

Sometimes, the share price is affected by how investors feel about the overall market or economy. If there is good news about the economy or auto sector, people may feel more confident and buy shares, pushing the price up. But during uncertain times, investors may sell shares, even if the company is doing okay, which can bring the price down.

Risks and Challenges for Hira Automobile Share Price

Here are 6 Risks and Challenges for Hira Automobile Share Price:

-

Economic Slowdowns

When the overall economy is not doing well, people tend to cut back on big purchases like cars. This can lead to lower sales for Hira Automobile. As a result, the company might earn less profit, which can worry investors and lead to a fall in the share price. Economic slowdowns often affect the entire auto industry, not just one company. -

Rising Input Costs

If the prices of important materials like steel, aluminum, and fuel increase, it becomes more expensive for Hira to manufacture vehicles. This reduces profit margins. If the company can’t pass on the extra cost to customers, it might hurt earnings, which can negatively impact the stock price. -

Technological Changes

The automobile industry is changing fast, especially with electric vehicles (EVs) and smart technologies. If Hira fails to keep up with these changes or doesn’t invest enough in research and innovation, it might fall behind competitors. This can create doubt among investors and affect the company’s future growth, leading to share price pressure. -

Regulatory and Policy Uncertainty

Sometimes, sudden changes in government policies—like stricter emission rules or changes in tax rates—can affect how Hira operates. Adapting to new rules might require extra costs or changes in production. Such unexpected changes can create uncertainty and impact investor confidence. -

Dependence on Specific Markets or Products

If Hira Automobile depends heavily on one type of vehicle or one region for most of its sales, it can be risky. Any problem in that market, like lower demand or tough local competition, can cause a big drop in sales. This over-dependence can make the company vulnerable, affecting the share price. -

Global Events and Supply Chain Disruptions

Events like pandemics, wars, or global shipping delays can disrupt the supply of parts and materials. These challenges may slow down production or increase costs. Even if the demand remains strong, such issues can impact the company’s ability to meet that demand, which may hurt its stock performance.

Read Also:- ITD Cementation Share Price Target Tomorrow 2025 To 2030