HPCL Share Price Target From 2025 to 2030

HPCL Share Price Target From 2025 to 2030: Stock investment requires good understanding of a company’s technicals, finances, and future potential. Stocks like Hindustan Petroleum Corporation Limited (HPCL) have grown highly sought after by investors in recent past years. HPCL, part of India’s energy infrastructure, is involved in refining and marketing petroleum products, an operation that remains in vogue amidst the ever-shifting mix within the energy industry.

This article presents a comprehensive HPCL analysis comprising share performance during the recent few weeks, pattern of ownership, technical pattern, finances, and share price prediction between 2025 to 2030. Once you go through this article, you would have a clear idea about what the future would be for HPCL as a long-term investment opportunity.

Company Overview

Hindustan Petroleum Corporation Ltd. is India’s largest oil and gas corporation controlled by the government with leadership in petroleum product refining and marketing. HPCL, being a unit of ONGC (Oil and Natural Gas Corporation), has government backing and vertical integration in the energy value chain.

Segments of interest:

- Refining of crude

- Marketing of petroleum lubricants and fuels

- Operations of LPG bottling plant

- Foray into petrochemicals and renewable energy

With growing fuel demand in India, ongoing infrastructure development, and foraying into alternative energy, HPCL is set for long-term growth.

Share Price Movement and Market Statistics Today

- Open: ₹373.00

- Day High: ₹377.85

- Day Low: ₹350.60

- Market Cap: ₹76,200 Cr

- P/E Ratio (TTM): 12.68

- Dividend Yield: 5.84%

- 52-Week High: ₹457.15

- 52-Week Low: ₹287.55

- Volume: 1,28,74,209

- Total Traded Value: ₹481 Cr

- Upper Circuit Limit: ₹394.15

- Lower Circuit Limit: ₹322.55

The HPCL share price has gone up by 16.86% in the last one year, closing at ₹359.30, indicating increased investor confidence. The stock has remained steady amidst market fluctuations and global crude prices.

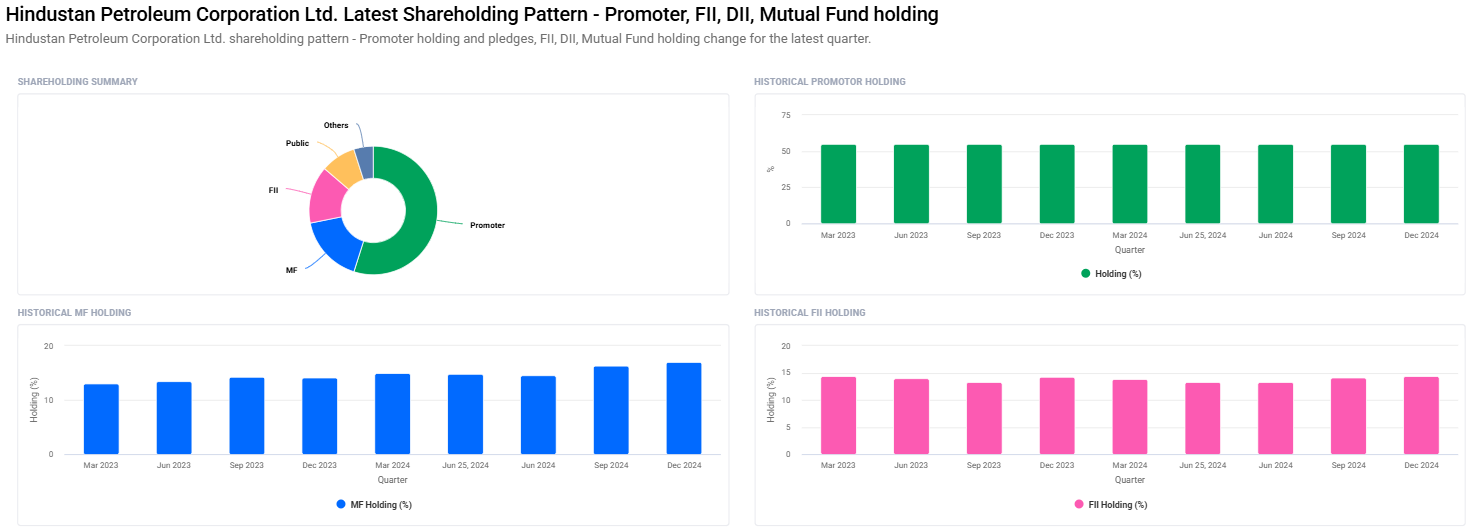

Ownership Structure and Institutional Confidence

- Promoters: 54.90%

- Mutual Funds: 16.97%

- Foreign Institutional Investors (FIIs): 14.44%

- Retail and Others: 8.84%

- Other Domestic Institutions: 4.85%

Key Trends:

- Promoter holding remained unchanged at 54.90%.

- Mutual Funds raised holdings from 16.29% to 16.97%.

- FIIs held back slightly on holdings from 14.11% to 14.44%, but FII holders fell from 676 to 664.

- Institutional investors as a group increased holdings from 35.79% to 36.26%.

It reflects enhancing institutional investor confidence in HPCL’s long-term growth prospects.

Fundamental Analysis

- Market Cap: ₹76,187 Cr

- P/E Ratio (TTM): 12.83

- Return on Capital Employed (ROCE): 1.68%

- Industry P/E: 21.21

- Debt to Equity Ratio: 1.58

- EPS (TTM): ₹28.34

- Dividend Yield: 5.87%

- Book Value: ₹215.70

- Face Value: ₹10

HPCL basics reveal a solid dividend-paying stock with a healthy earnings base. Why the lower P/E multiple in relation to its industry peer reveals the stock to be undervalued and value buyers’ heaven.

Technical Analysis

- Momentum Score: 49.7, Neutral

- MACD: 8.5, Bullish (Above center/signal line)

- RSI (14): 59.9, Neutral (Not overbought/oversold)

- ADX: 23.3 Weak Trend

- MFI: 63.3 Nneutral to Slightly Overbought

- ATR: 14.4 SHigh Volatility

- ROC (21 Days): 13.7 Positive Momentum

- ROC (125 Days): -11.9 Long-Term Underperformance

What This Means?

HPCL is showing short-term bullishness with MACD and ROC(21) in positive zones. Long-term ROC, however, is indicating earlier underperformance. RSI and MFI are indicating that the stock is poised to touch overbought levels and caution must be exercised for the short term.

HPCL Share Price Target (2025-2030)

With current performance, HPCL diversification into petrochemicals and renewables, government policies, and expected industry growth, the share price is predicted as follows:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹500 |

| 2026 | ₹670 |

| 2027 | ₹840 |

| 2028 | ₹1010 |

| 2029 | ₹1180 |

| 2030 | ₹1350 |

These figures are an estimate based on HPCL being able to enhance refining margins, build capacity, and pay off debt while complying with clean energy standards.

Investment Strategy – Who Should Invest?

Short-Term Investors (1-2 Years)

- Risk Level: Medium to High

- Strategy: Buy on technical signals. Look for breakouts above ₹400.

- Target: ₹500 (2025)

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Buy on dips. Monitor crude oil price movements and refining margins.

- Target: ₹840-₹1,010 (2027-2028)

Long-Term Investors (5+ Years)

- Risk Level: Low to Moderate

- Strategy: Hold for stable dividend yield and capital growth.

- Target: ₹1,350 (2030)

Opportunities and Growth Catalysts

Energy Security Initiatives: India’s drive towards energy self-sufficiency via increased refining capacity is in the interest of HPCL.

- Government Support: As a PSU, HPCL has benevolent policies and subsidies favoring it.

- Dividend Income: HPCL’s dividend yield of almost 6% makes it a good stock for income investors.

- Petrochemical Expansion: New green fuel and petrochemical projects can help in revenue diversification.

- EV and Green Hydrogen Investments: HPCL is investing in electric vehicle charging stations and green hydrogen, which shows forwardness.

Risks and Challenges

- Volatility in Crude Oil: As HPCL is dealing in the oil and gas industry, its margin is extremely volatile to international crude prices.

- Debt Levels: The 1.58 debt equity ratio currently is excessive and must be regulated.

- Transition to Energy: International shift from fossil fuels can affect HPCL’s core business far in the future.

- Regulatory Overhang: Being a PSU, it is prone to change in policy at the governmental level and regulation of price.

FAQs about Investing in HPCL Stock

Q1: Is HPCL a good dividend stock?

Yes, with a dividend yield of close to 6%, HPCL is one of the more diversified energy stocks.

Q2: What is HPCL’s P/E ratio compared to the industry average?

The P/E ratio for HPCL is about 12.83, which is much lower than the industry average of 21.21, suggesting undervaluation.

Q3: Would HPCL’s share price be affected by the shift towards renewable energy?

In the longer term, the switch may be difficult. But HPCL is already investing in green hydrogen and EV infrastructure to offset this risk.

Q4: How well-placed is HPCL relative to industry peers like BPCL and IOCL?

HPCL’s business model is the same and is subject to the same industry-level headwinds. But its high dividend yield and fast growth story give it a slight advantage.

Q5: Is now the right time to buy HPCL stock?

With its technicals and fundamentals aligned, long-term investors can consider adding HPCL at these levels. Short-term investors can wait for a clear break above ₹400.

HPCL is a cash-rich oil and gas company with healthy finances, government support, and expansion. It has prospects despite concerns on the sector as well as near-term volatility for long-term investors who will be able to look forward to appreciation in capital as well as receive dividend yields.

At unashamed price projections of ₹1,350 for 2030, HPCL is a fascinating bet as a money-making opportunity, especially to those who expect the long-term viability of the energy sector of India.

The investors have to turn to a postponed buying strategy if they desire maximum returns, learn about global crude oil deals, and also keep an eye on HPCL’s diversification into petrochemical and non-traditional ventures closely.