HUDCO Share Price Target From 2025 to 2030

HUDCO Share Price Target From 2025 to 2030: Investment in stocks requires a sharp eye on the finance, technical standing, market potential, and future growth chances of a company. One such stock that has become extremely popular in recent years is Housing and Urban Development Corporation Ltd. (HUDCO), a government undertaking that funds housing and infrastructure projects all over India.

With the Indian government’s consistent push for affordable housing and smart cities, and the increasing urbanization across the country, HUDCO’s role becomes even more prominent. In this article, we’ll explore HUDCO’s recent stock performance, its financial and technical indicators, shareholding patterns, and provide share price targets from 2025 to 2030. This guide aims to help investors understand whether HUDCO is a promising long-term investment.

Company Overview and Market Position

HUDCO (Housing and Urban Development Corporation Ltd.) is a large techno-financing public sector undertaking undertaking urban infrastructure development finance and housing. HUDCO finances low-cost housing schemes, infrastructure growth, and aids flagship government schemes like Housing for All, PMAY, and Smart Cities Mission.

Strengths of HUDCO:

- Highest support from the Indian government (Promoters retain 75% interest)

- Highest support from domestic institutions and mutual funds

- Supports strategic contribution towards the development of infrastructure in India all over the nation

- More government budget investment in urban housing and infrastructure

The role of HUDCO in urban development places it at the very forefront of the country’s developmental action, yielding stability and opportunity for long-term development for investors.

Latest Share Price and Key Statistics

Here is a compilation of HUDCO share price and finance based on latest data:

- Open: ₹209.00

- High: ₹209.93

- Low: ₹201.80

- Previous Close: ₹209.93

- Current Market Price: ₹204.35

- 52-week High: ₹353.70

- 52-week Low: ₹158.85

- Market Cap: ₹42,000 Crores

- P/E Ratio (TTM): 15.66

- EPS (TTM): ₹13.40

- Book Value: ₹85.53

- P/B Ratio: 2.45

- Dividend Yield: 1.98%

- ROE: 14.40%

- Debt to Equity Ratio: 5.46

HUDCO is still in good health despite recent price revisions with healthy earnings, dividend yield, and profitability.

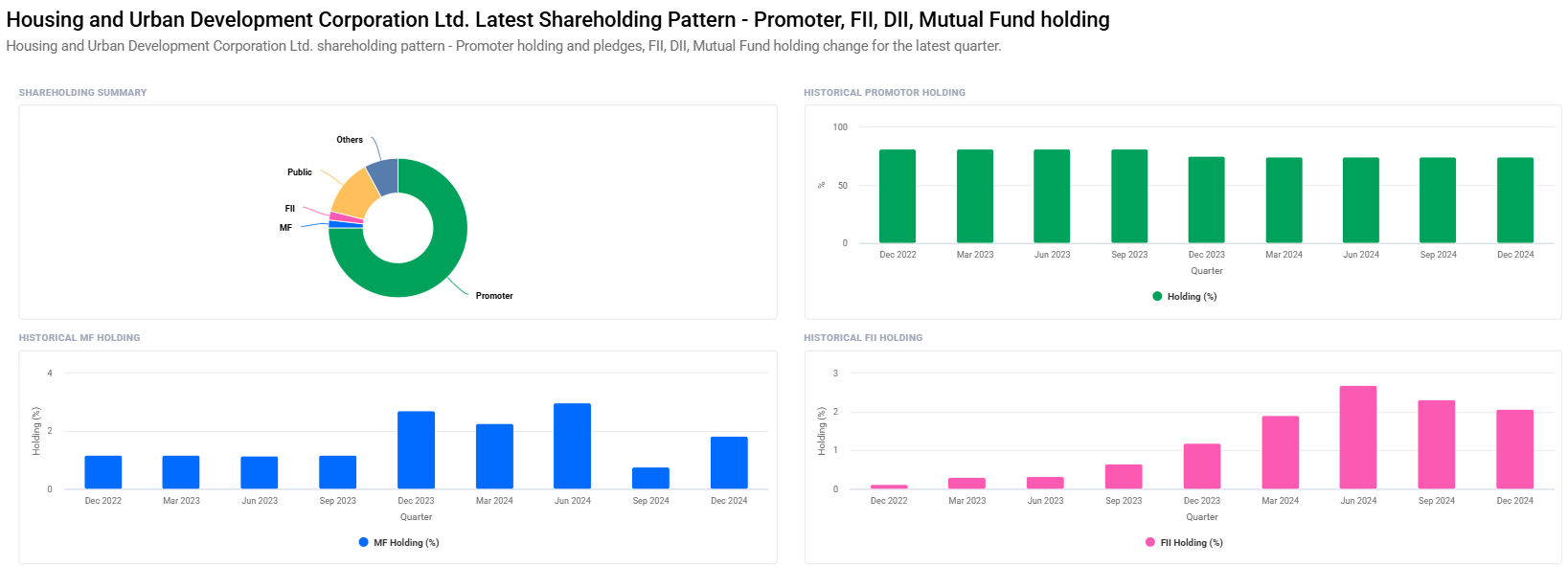

Ownership Structure and Institutional Confidence

Promoter holding trends by HUDCO promoters reflect promoters’ positive support along with increasing interest by mutual funds and other domestic institutions.

- Promoters: 75.00% (no change)

- Retail & Others: 13.17%

- Other Domestic Institutions: 7.92%

- Foreign Institutions: 2.08% (down from 2.32%)

- Mutual Funds: 1.83% (versus 0.77%)

The following are observations of note:

- Number of mutual fund schemes increased from 20 to 25.

- Institutional holding increased from 11.37% to 11.82%.

This is a reflection of rising domestic institutional confidence, specifically more so of mutual funds, and is overall a positive indicator for long-term investors.

Technical Analysis – Identifying the Present Trend

Technical Indicators Summary:

- Momentum Score: 46.0 Neutral

- MACD: 4.3 Bullish – Above center and signal line

- RSI (14): 62.4 Neutral to slightly overbought

- ADX: 18.1 Weak Trend

- MFI: 83.0 Overbought – Short-term pullback likely

- ROC (21): 26.0 Positive Momentum

- ATR: 8.5 Suggests volatility in the off-topics

- ROC (125): -8.1 Negative long-term momentum

In spite of the bullish signals of MACD and short ROC, the higher MFI suggests the stock is possibly entering overbought territory and care should be taken. RSI around 62 justifies this with the stock far from being too oversold or overbought but possibly moving towards a near-term resistance level.

Market Depth and Order Book Insights

- Buy Order Quantity: 45.10%

- Sell Order Quantity: 54.90%

- Bid Total: 7,18,213

- Ask Total: 8,74,133

The marginal supply of sell orders may be due to a short-run cautionary environment, especially keeping in view the stock price is at proximity to resistance levels.

HUDCO Share Price Target 2025-2030

Based on the core strength, consistent revenue flow from infrastructure and housing projects, and increasing investor interest, the following are the price targets of HUDCO’s shares for the subsequent six years:

Year Target Price (INR) Reason

2025 ₹350 Government housing scheme, correction recovery

2026 ₹550 New infrastructure order, rising earnings

2027 ₹750 Urbanization and expansion of earnings

2028 ₹950 Massive government expenditure in infrastructure

2029 ₹1150 PPP growth and smart city projects

2030 ₹1350 Leader in housing finance market, enhancing ROE

With Indian infrastructure development as anticipated, and HUDCO’s profitability ratios improving or holding steady, the above estimates are arrived at.

Investment Strategy – To Invest in HUDCO or Not?

Short-Term Investors (1-2 Years)

- Risk Level: Moderate

- Strategy: Buy dips at ₹200; sell gains at ₹350

- Potential Exit: ₹350

Medium-Term Investors (3-5 Years)

- Risk Level: Low to Moderate

- Strategy: Hold and accumulate; take advantage of sectoral tailwinds

- Potential Exit: ₹750 to ₹950

Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: Reinvest and hold dividends; target capital appreciation and passive income

- Possible Exit: ₹1150 to ₹1350

Challenges and Risks

While the long-term position of HUDCO is good, there are a few concerns investors should note:

- Market Volatility: Being any PSU stock, HUDCO is subject to overall market sentiment.

- Policy Changes: Being a government undertaking, changes in the regulations or provisions in the budget can influence operations.

- Debt Levels: A relatively high debt-to-equity ratio of 5.46 must be observed for sustainability.

- Institutional Selling: Current decline in FII positions will cause near-term troughs.

Final Verdict – HUDCO Good for Investment?

HUDCO is an appropriately government-sponsored sound-at-heart entity that would benefit from India’s uncompromising urbanisation and infrastructure momentum. Though nearer-term price re-rating and proportionally overbought technical points prevail, long-term prospects look healthy, particularly for those hunting housing finance as well as infra development segments plays.

The added interest of mutual funds and institutional investors makes the retail investors bold. For holding individuals for medium and long periods, HUDCO can give them huge returns till 2030.

FAQs – HUDCO Share Price Target

Q1. Is HUDCO a good growth stock for the long run?

Yes, HUDCO is government-guaranteed, is stable at its core, and has the benefit of growth in India’s urban infrastructure and thus is a good long-run investment.

Q2. What will be HUDCO’s share price target in 2025?

The share price target of 2025 can be approximated at ₹350 based on current fundamentals and expectations regarding the growth in infrastructure.

Q3. What are the risks of investment in HUDCO?

Risks involve market volatility, regulatory fluctuations, high leverage, and shift in the mood of foreign institutional investors.

Q4. What is HUDCO’s dividend yield?

HUDCO is offering a dividend yield of approximately 1.98% according to the current data available, providing a fair passive return to the investors.

Q5. What is HUDCO’s technical position today?

HUDCO is technically in neutral gear with solid short-term indications. But indicators like extreme MFI indicate there could be a probable short-term correction.

Q6. Will HUDCO benefit from the Smart Cities Mission?

Yes, HUDCO will benefit from Smart Cities Mission-related projects due to its experience and contact with the government.

HUDCO remains a solid, long-term value play for investors who want exposure to India’s infrastructure story. Volatility in the short term will offer opportunities to buy, but there will be stunning returns by 2030 if the trend continues to run with long-term patient investors.