IFCI Share Price Target Tomorrow 2025 To 2030

IFCI Limited is one of India’s oldest financial institutions, established in 1948 to support industrial growth in the country. Over the years, it has played an important role in funding big infrastructure and development projects like roads, power plants, and airports. IFCI mainly provides loans and financial services to companies involved in such sectors. It is backed by the Government of India, which gives it a strong base of trust. IFCI Share Price on NSE as of 24 May 2025 is 54.96 INR.

IFCI Share Market Overview

- Open: 50.00

- High: 56.30

- Low: 49.26

- Previous Close: 49.92

- Volume: 114,020,115

- Value (Lacs): 63,007.52

- VWAP: 54.77

- UC Limit: 59.90

- LC Limit: 39.93

- 52 Week High: 91.40

- 52 Week Low: 36.20

- Mkt Cap (Rs. Cr.): 14,888

- Face Value: 10

IFCI Share Price Chart

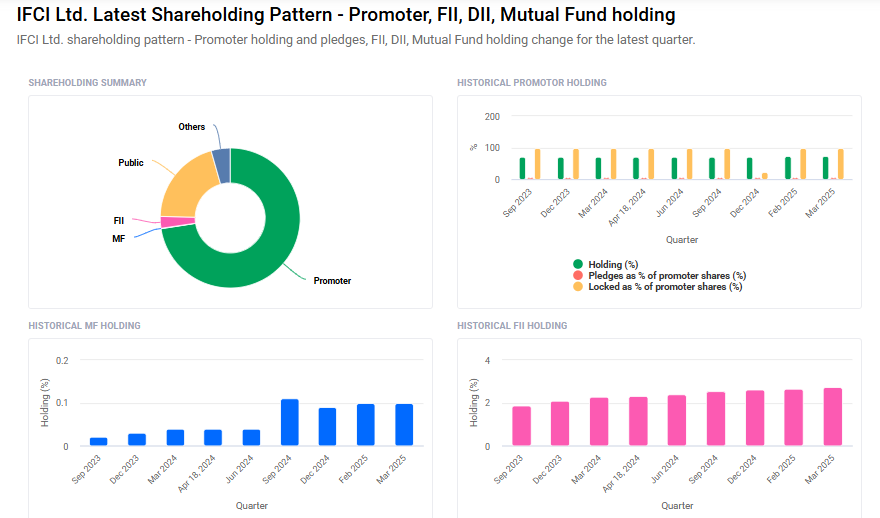

IFCI Shareholding Pattern

- Promoters: 72.6%

- FII: 2.7%

- DII: 4.5%

- Public: 20.2%

IFCI Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹95 |

| 2026 | ₹110 |

| 2027 | ₹130 |

| 2028 | ₹150 |

| 2029 | ₹170 |

| 2030 | ₹190 |

IFCI Share Price Target 2025

IFCI share price target 2025 Expected target could ₹95. Here are five key factors that could influence IFCI Limited’s share price growth by 2025:

1. Improved Financial Performance

In the fourth quarter of FY2024-25, IFCI reported a net profit of ₹227.28 crore, marking a 70.46% increase compared to the same period last year. This significant growth in profitability indicates a positive trend in the company’s financial health, which could bolster investor confidence and positively impact the share price.

2. Strategic Leadership Changes

The appointment of Rahul Bhave as Managing Director and CEO in March 2025 is expected to bring fresh strategic direction to IFCI. Leadership changes at the top level can influence company policies and operational efficiency, potentially leading to improved performance and investor sentiment.

3. Increased Promoter and FII Holdings

As of March 2025, promoter holding in IFCI increased to 72.57%, up from 71.72% in June 2024. Additionally, Foreign Institutional Investors (FIIs) raised their stake from 2.4% to 2.73% during the same period. Such increases in holdings by promoters and FIIs often reflect confidence in the company’s future prospects, which can positively influence the share price.

4. Positive Market Momentum

In May 2025, IFCI’s share price surged by up to 13% in a single day, with a 48% increase over two weeks. This upward momentum, driven by heavy trading volumes, suggests growing investor interest and could contribute to sustained share price growth if supported by fundamental improvements.

5. Government Support and Infrastructure Focus

As a government-backed financial institution, IFCI stands to benefit from India’s continued emphasis on infrastructure development. Government initiatives aimed at boosting infrastructure can lead to increased demand for project financing, potentially enhancing IFCI’s business opportunities and revenue streams.

IFCI Share Price Target 2030

IFCI share price target 2030 Expected target could ₹190. Here are 5 key risks and challenges that could impact IFCI Limited’s share price and overall performance by 2030:

1. High Exposure to Stressed Assets

IFCI has historically dealt with a large number of stressed and non-performing assets (NPAs), especially due to its exposure to long-term infrastructure projects. If recovery remains weak or new defaults arise, it could severely impact profitability and investor sentiment.

2. Limited Revenue Diversification

Unlike many diversified financial institutions, IFCI has a narrower business model that primarily focuses on project financing and investment banking. This makes it vulnerable to sector-specific risks and limits its ability to absorb shocks from economic downturns.

3. Competition from Private Players

The rise of well-capitalized private financial institutions and NBFCs could put pressure on IFCI in terms of interest margins, market share, and client retention. These players often offer faster, tech-enabled solutions that can outpace traditional lenders like IFCI.

4. Dependence on Government Policies

As a government-backed entity, IFCI’s performance is closely tied to public policy decisions and funding allocations. Any shift in government priorities, reduction in support, or regulatory changes could limit its growth prospects.

5. Management and Governance Concerns

Although leadership changes can bring improvement, inconsistent leadership or governance issues can hinder execution of long-term strategies. Investor confidence may waver if clear and transparent corporate governance practices are not maintained.

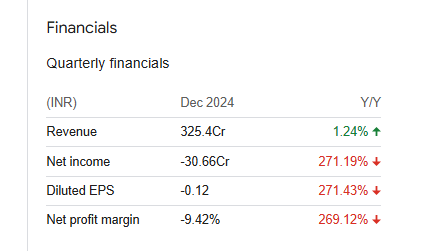

IFCI Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 17.50B | 81.16% |

| Operating expense | 9.65B | 19.44% |

| Net income | 1.04B | 149.88% |

| Net profit margin | 5.92 | 127.51% |

| Earnings per share | — | — |

| EBITDA | — | — |

| Effective tax rate | 67.90% | — |

Read Also:- Bandhan Bank Share Price Target Tomorrow 2025 To 2030