Igarashi Motors Share Price Target From 2025 to 2030

Igarashi Motors Share Price Target From 2025 to 2030: Investment in the share market is a serious consideration of the company’s finances, its market position, and prospects for long-term growth. A few of the shares that have been under the spotlight are Igarashi Motors India Ltd., involved in the production of small-sized electric motors for automobile use mainly.

With growing needs for electric vehicles (EVs), auto parts manufacturing, and relentless technological advancements in motor power, Igarashi Motors holds enormous long-term growth potential. The report is a comprehensive study of Igarashi Motors, which includes current share price movement, intrinsic value, technical value, and share prices projected from 2025 to 2030.

Company Overview and Market Position

Igarashi Motors India Ltd. is a dominant player in the small electric motor industry serving mainly the automobile industry. The company enjoys a strong market share in domestic and global markets and relies on the following:

- Electric Vehicle (EV) expansion: Increased adoption of EVs is fuelling demand for more powerful electric motors and power-saving electric motors.

- Expanding Automotive Sector: With the rise in automation and smart vehicle technologies, the need for advanced motor solutions is growing.

- Global Demand for Energy-Efficient Motors: Industries worldwide are shifting towards energy-efficient components, boosting demand for Igarashi’s products.

- Strong Financial Backing: The company has a steady promoter holding and institutional confidence, which supports its long-term growth potential.

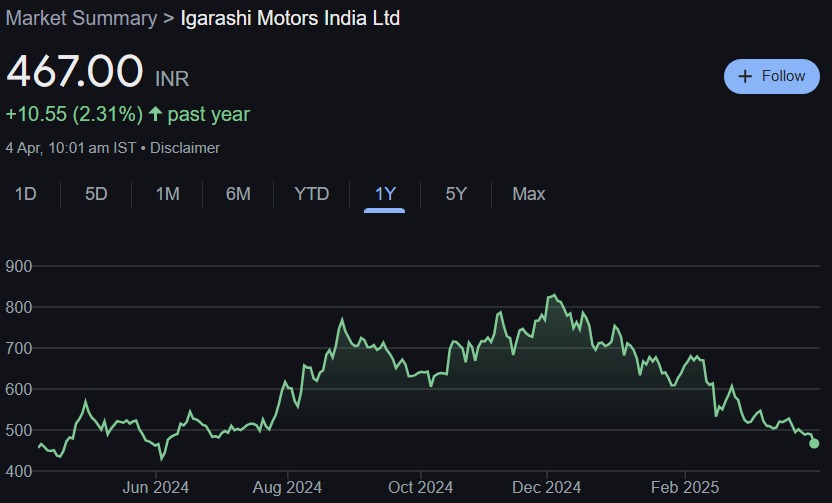

Recent Stock Performance

- Current Price: ₹493.85

- 52-Week High: ₹848.95

- 52-Week Low: ₹410.00

- Market Capitalization: ₹1.47K Cr

- P/E Ratio: 55.99

- Dividend Yield: 0.21%

- Debt-to-Equity Ratio: 0.33

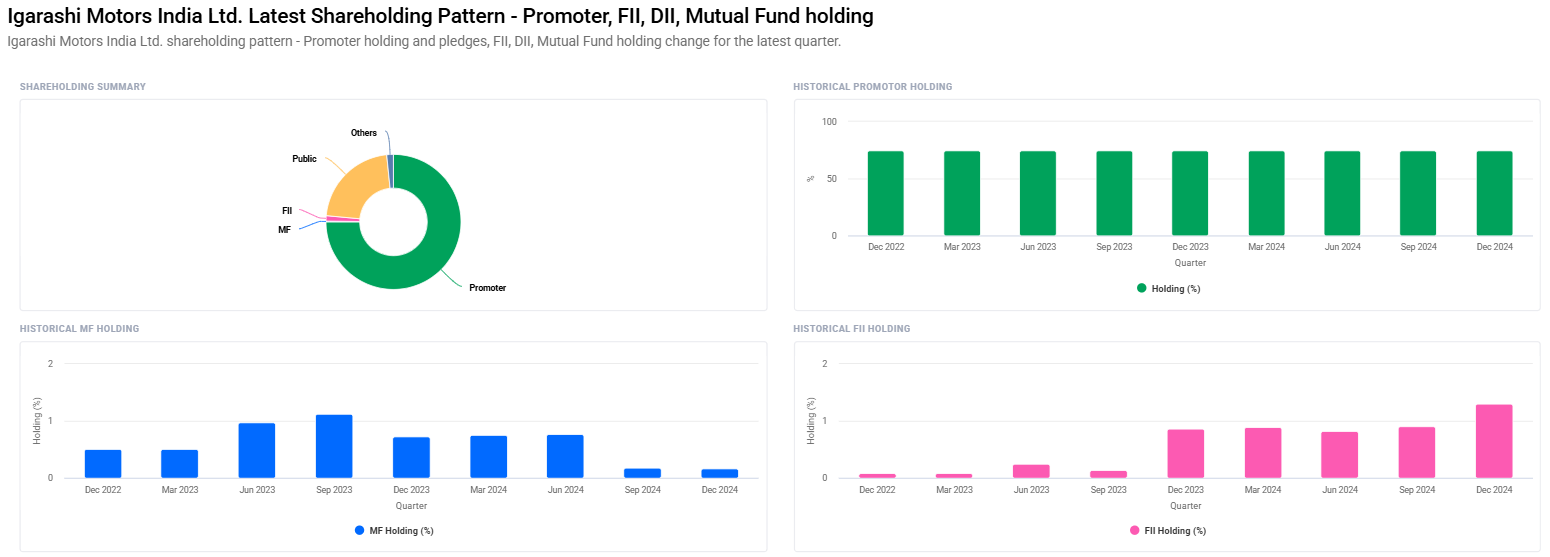

Ownership Pattern and Institutional Faith

- Promoters Holding: 75.00% (unchanged)

- Foreign Institutional Investors (FII/FPI): FII/FPI increased from 0.90% to 1.30%

- Domestic Institutions: Domestic Institutions increased holdings from 2.63% to 3.09%

- Mutual Fund Holdings: Mutual Fund Holdings decreased from 0.18% to 0.17%

Technical Analysis

Momentum and Trend Indicators

- Relative Strength Index (RSI) was at 35.3 (Neutral)

- MACD (Moving Average Convergence Divergence) was at -21.9 (Bearish Signal)

- ADX (Average Directional Index) was at 38.6 (Strong trend formation)

- Rate of Change (ROC 21 Days): -5.5 (Weak Momentum)

- Money Flow Index (MFI): 57.2 (Neutral)

What Does This Mean?

MACD below centerline, and that is typically bearish momentum. Yet ADX indicates trend forming on the cards. RSI and MFI indicate that the stock is neutral, hence any breakout either way is on the cards.

Igarashi Motors Share Price Target from 2025 to 2030

On technical as well as fundamental rationale, the targets of share prices have been derived as follows:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹850 |

| 2026 | ₹1300 |

| 2027 | ₹1750 |

| 2028 | ₹2200 |

| 2029 | ₹2650 |

| 2030 | ₹3100 |

Investment Strategy – Buy or Not?

Short-Term Investors (1-2 Years)

- Risk Level: High

- Strategy: Watch closely price action; purchase if stock violates above ₹588.90 (upper circuit price).

- Exit Target: ₹850-₹1300 (2025-2026)

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Take advantage of falling prices and remain invested for expansion in business.

- Exit Target: ₹1750-₹2200 (2027-2028)

Long-Term Investors (5+ Years)

- Risk Level: Low

- Strategy: Long-term growth fueled by EV cycles and automation.

- Exit Target: ₹3100+ (2030)

Risks and Challenges

Igarashi Motors has strong growth potential whereas, investors need to consider some risks:

- Market Volatility: The firm has experienced high volatility, and short-term investors need to be cautious.

- Dependence on Car Industry: Any loss in the automobile industry affects the revenue growth.

- Competition: The competition in the industry is high and, in addition to domestic players, even foreign players are increasing the market share too.

- Regulatory Changes: Government policy that determines the regulation for electric vehicle parts and production levels can create future growth for the firm.

Frequently Asked Questions (FAQ)

1. Is Igarashi Motors a good long-term investment?

Yes, with its position in the electric motor business, growing demand for effectively electrically finished products, and cautious finance, Igarashi Motors is a growth story of the long term.

2. What are the most important drivers for the share price of Igarashi Motors?

The most important drivers for the stock are electric vehicle business gains pace, effective motor demands gaining pace all over the world, cautious financial backing, and growing plans and in markets.

3. What would be Igarashi Motors’ portion in 2026?

Fundamental and technical analysis estimates the year 2026 to be ₹1300.

4. Is global economic trend affecting Igarashi Motors?

Yes, being a conglomerate business, the company is globally integrated. Economic downtrends, supply chain effects, and trade policies may affect its stock market behavior.

5. Should intraday trading investment be invested in Igarashi Motors?

The stock is in the stable phase, i.e., intraday investment will be speculative. Long-term players would gain, however, by investment at price lows.

Igarashi Motors India Ltd. is one of the leaders in the industry in the business of electric motors, well-supported by growth in the EV and automation business. While its share has fluctuated, its overall long-term growth trend still seems healthy. For the short-term investor, patience is needed because the stock is consolidating. For 3-5 year horizon and more investors, however, these prices can mean mammoth returns to them in the long term.

Igarashi Motors is a good long-term investment with huge growth potential for the next couple of years, and it is a good buy to put in an investor’s portfolio.