Indian Overseas Bank Share Price Target From 2025 to 2030

Indian Overseas Bank Share Price Target From 2025 to 2030: Investment in the government sector bank is typically a strategic investment if the bank has history, promoter backing, and large retail distribution. One of the PSU stocks that have been popular with investors in the recent past is Indian Overseas Bank (IOB). With its vast network, government backing, and plans for digital banking, IOB is one of the leading mid-cap banking stocks leaders.

Here, we are discussing Indian Overseas Bank’s fundamentals, technicals, shareholders, and share price targets for the years 2025-2030. We also talk about market trend, growth drivers, and investors’ FAQs so that you are properly informed in taking a decision to invest.

Company Overview and Market Position

Indian Overseas Bank, established in 1937, is a major public sector bank with its headquarters in Chennai. It has established deep roots in rural and urban India over years. IOB has played a key role in extending banking services to unbanked corners and empowering MSMEs (Micro, Small and Medium Enterprises) through lending and money products.

Pillars behind the growth of IOB:

- Strong government support: As a PSU, the Government of India has a promoter shareholding of 94.61%, and this provides comfort and capital support.

- Adoption of digital banking: IOB has adopted digital growth with mobile banking facilities, net banking services, and computerized loan sanctioning processes.

- Focus on retail and MSME lending: With the diversified portfolio, the bank offers agricultural, housing, and SME loans that help the economy grow.

- Improved asset quality: In recent years, IOB has been making efforts to reduce NPAs (Non-Performing Assets), and increased recoveries, which improve profitability.

Current Market Performance and Financial Overview

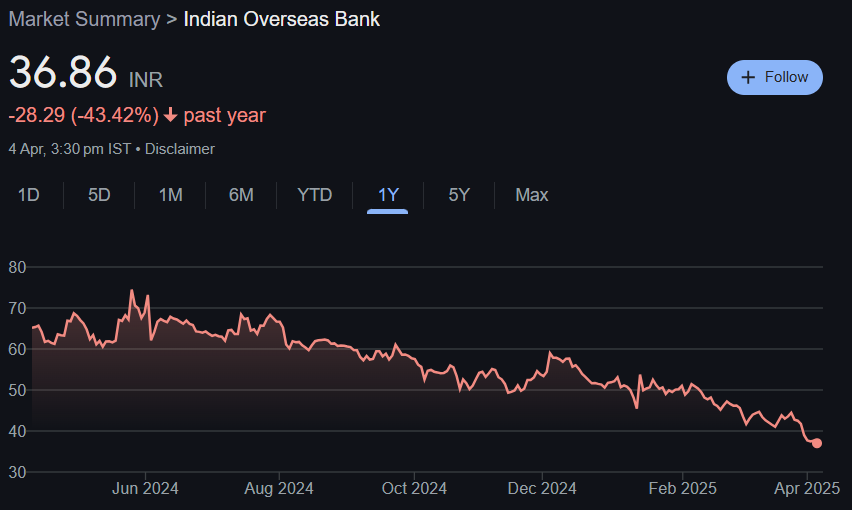

Indian Overseas Bank has experienced roller-coaster trading periods over the past year. From a 52-week high of ₹75.55 to a low of ₹35.80, the stock corrected a lot but is now at a point where long-term investors can possibly find value.

Key Market Indicators (As of latest available data):

- Current Open Price: ₹37.90

- Day High / Low: ₹38.40 / ₹36.62

- Market Capitalization: ₹71,060 Cr

- P/E Ratio: 22.77

- Industry P/E: 12.72

- Debt to Equity Ratio: 2.57

- Return on Capital Employed (RoCE): 11.27%

- Earnings per Share (EPS – TTM): ₹1.62

- Book Value: ₹14.35

- Dividend Yield: 0.00%

- 52-Week Performance: -43.42%

Share price has corrected significantly in the past year, having declined by almost 28.29 points (-43.42%). It is still a good time to buy for long-term investors in view of the fact that the stock is technically oversold.

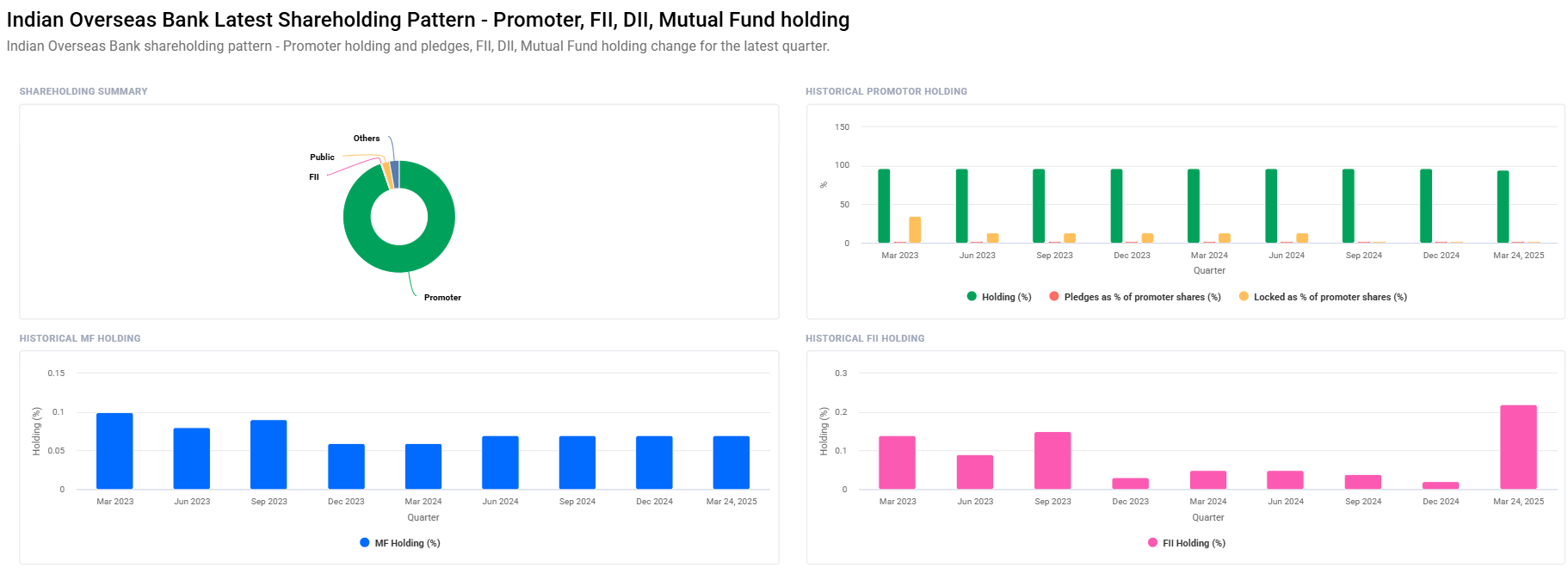

Ownership Pattern

The ownership pattern is characterized by high government holding and zero foreign institutional holding.

- Promoters: 94.61%

- Other Domestic Institutions: 2.88%

- Retail & Others: 2.25%

- Foreign Institutions: 0.22%

- Mutual Funds: 0.07%

This strong promoter holding provides cover and policy-level action in case of financial stress. Low FII and mutual fund investment indicate stifled institutional optimism currently, however.

Technical Analysis – Is IOB in a Buy Zone?

Technicals indicate Indian Overseas Bank to be in risky territory from a technical perspective currently, and there may be a reversal on the cards.

Day-Wise Technical Indicators:

- RSI (14): 27.8 – Oversold (below 30)

- MACD: -2.1 – Bearish (below center line as well as signal)

- MACD Signal: -1.7

- ADX: 29.7 – Suggesting that a possible trend can be constructed

- Rate of Change (ROC – 21 days): -14.3

- Money Flow Index (MFI): 21.9 – Oversold (below 30)

- ROC (125 days): -33.81

- Average True Range (ATR): 1.8 – Reflects high volatility

Interpretation:

All indicators are pointing in the direction of IOB being oversold, which in a majority of situations indicates a possible bounce-back. Bearish momentum remains high. Short-term reversal of trend could be expected in the event of a rise in volume and sentiment.

Indian Overseas Bank Share Price Targets (2025 to 2030)

Considering a mix of fundamental strength, technical overselling, macroeconomic reasons, and digital banking initiatives, the following targets can be projected:

Year Target Price (₹) Growth Catalysts

2025 80 NPA recovery strengthened, retail loan expansion, capital infusion by the government

2026 120 Enhanced digital banking expansion, profitability enhanced, better net interest margins

2027 160 Growth in the economy, return ratios strengthening, entry into institutional portfolios

2028 200 Improved asset quality, excellent MSME performance

2029 240 PSU bank re-rating and announcement of dividends

2030

280

Mid-sized PSB market leadership, foreign interest gathering momentum, P/E re-rating enhanced

These are the gains following IOB’s consistent return to profitability, banking reform, and enhanced digital financial inclusion.

Investment Strategy: Is it a good decision to invest in Indian Overseas Bank Stock?

Short-Term Strategy (1-2 years)

- Risk: High

- Outlook: Volatile

- Strategy: Wait for breakout above ₹45-50 on strong volume. Otherwise, avoid heavy entries.

- Exit Point: ₹80 (2025 target)

Mid-Term Strategy (3-5 years)

- Risk: Moderate

- Outlook: Accumulate on dips

- Strategy: Buy in phased manner, particularly if stock gets traded around ₹35–40

- Exit Point: ₹160–₹200 (horizon 2027–2028)

Long-Term Strategy (5+ years)

- Risk: Lower

- Outlook: Strong potential upside

- Strategy: Long-term investors who will stay the course in India’s financial inclusion scheme

- Exit Point: ₹280+ (horizon 2030)

Growth Drivers in IOB

- Digital Banking Initiative – Mobile and UPI-based products bring new customers to the banking mainstream.

- Government Recapitalization – Any imminent budget statement or PSU banking recast can be a trigger.

- Shifting Profit Margins – Cost rationalization and acceleration of net interest income.

- Economic Recovery – As the demand for credit from SME and retail borrowers is on the rise, loan books will increase.

- Privatization Talk – Rumor itself, any discussion about PSU bank privatization can propel stock price high.

Risks and Challenges

- High Govt. Holding – Lacks flexibility and strategic decision-making.

- Low Institutional Interest – Weak analyst coverage and low FII/MF holding.

- No Dividend Yield – Investors in search of constant income might not like this stock.

- Regulatory Pressures – RBI norms or government regulations can restrict profit margins.

- Volatile Stock Movements – High beta stocks, strictly for high-risk appetite only.

FAQs – Indian Overseas Bank Share Price Target (2025 to 2030)

Q1. Is Indian Overseas Bank a good stock to buy now?

A: With its over-sold technicals coupled with its improving fundamentals, IOB can be a good long-term wager. Volatility in the near term may still prevail.

Q2. Indian Overseas Bank’s price target by the year 2025 is what?

A: IOB’s share price target by 2025 will be approximately ₹80, subject to credit growth and NPA recovery.

Q3. IOB stock’s long-term goals are what?

A: IOB’s stock can reach ₹280 by 2030, provided it grows at a steady rate, turns around NPAs, and receives policy support.

Q4. Why is the IOB share price declining?

A: The share has corrected because of overall market sentiments, absence of institutional buying, and weak technical indicators such as MACD and RSI.

Q5. Does IOB pay dividends?

A: The dividend yield percentage is 0.00%. The bank doesn’t pay dividends, at least not yet.

Q6. Is Indian Overseas Bank a good investment?

A: Being a PSU with government support, IOB is relatively less credit-risky. However, price volatility is high, so it’s better for medium to long-term investors.

Indian Overseas Bank is a clever investment risk for the investor willing to embrace short-term uncertainty in the hopes of eventual benefits. With a stable administration ruling, a renewed emphasis on digitalization, and a banking sector poised on the cusp of growth, IOB can be a fruitful long-term investor by 2030.

While short-term traders will be left waiting for confirmation of momentum, long-term traders can try to build the stock bit by bit and observe crucial events as they take place. The ride from ₹37.90 to ₹280 will not be easy—but with strategy and patience, it may well be worth it.