INDIGO Share Price Target Tomorrow 2025 To 2030

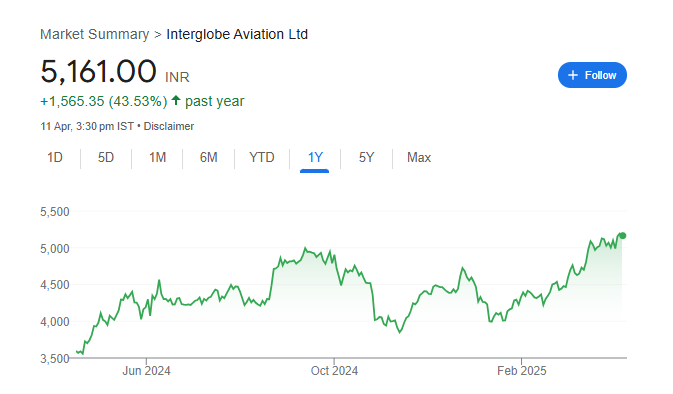

IndiGo, officially known as InterGlobe Aviation Limited, is one of India’s largest and most popular airline companies. Known for its punctual service, low fares, and wide network, IndiGo has become a trusted name in domestic and international travel. The company has grown steadily over the years and has a strong fleet of aircraft, which helps it serve millions of passengers every year. INDIGO Share Price on NSE as of 14 April 2025 is 5,161.00 INR.

INDIGO Share Market Overview

- Open: 5,214.90

- High: 5,234.35

- Low: 5,115.00

- Previous Close: 5,193.75

- Volume: 1,131,912

- Value (Lacs): 58,305.92

- VWAP: 5,175.12

- UC Limit: 5,713.10

- LC Limit: 4,674.40

- 52 Week High: 5,265.00

- 52 Week Low: 3,441.05

- Mkt Cap (Rs. Cr.): 199,050

- Face Value: 10

INDIGO Share Price Chart

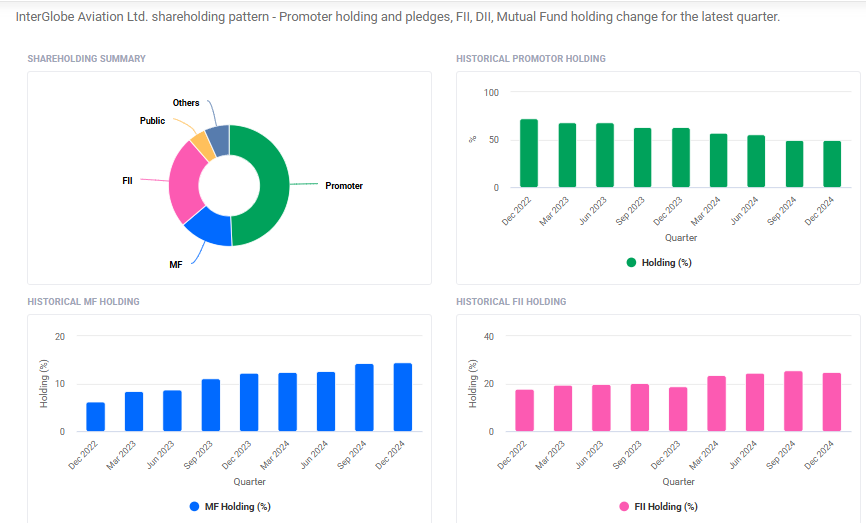

INDIGO Shareholding Pattern

- Promoters: 49.3%

- FII: 24.8%

- DII: 21.2%

- Public: 4.7%

INDIGO Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹5265

- 2026 – ₹6670

- 2027 – ₹7000

- 2028 – ₹9500

- 2029 – ₹11,000

- 2030 – ₹12,500

Major Factors Affecting INDIGO Share Price

Here are 6 major factors that influence the share price of IndiGo (InterGlobe Aviation Ltd.

1. Fuel Prices and Currency Exchange Rates

Fuel is a significant expense for airlines. When fuel prices rise, operating costs increase, which can reduce profits and negatively impact the share price. Additionally, since many of IndiGo’s expenses, like aircraft leasing and maintenance, are paid in U.S. dollars, a weaker Indian rupee can lead to higher costs. For instance, in late 2024, the rupee’s depreciation led to a substantial increase in foreign exchange losses for IndiGo, affecting its profitability.

2. Operational Efficiency and Fleet Management

IndiGo’s ability to manage its fleet effectively plays a crucial role in its performance. Challenges like aircraft groundings due to engine issues can disrupt operations and lead to financial losses. In the second quarter of FY25, such groundings contributed to a significant loss for the company. Efficient fleet management ensures better service reliability and cost control, positively influencing investor confidence.

3. Passenger Demand and Market Share

High passenger demand boosts revenue for airlines. IndiGo holds a dominant position in India’s domestic aviation market, with a market share of around 63% as of late 2024. Events like the Maha Kumbh Mela in Uttar Pradesh have led to increased air travel demand, benefiting IndiGo’s revenues and, subsequently, its share price.

4. Infrastructure Developments

The expansion of airport infrastructure directly impacts IndiGo’s growth prospects. The upcoming operationalization of new airports in Navi Mumbai and Noida is expected to increase passenger traffic. IndiGo, with its extensive network and market dominance, is well-positioned to capitalize on this growth, which can positively affect its share price.

5. Financial Performance and Profitability

Investors closely monitor IndiGo’s financial results. Strong earnings reports can lead to increased investor confidence and a rise in share price. However, unexpected losses or declining profits, like the 18.6% drop in Q3 FY25 due to foreign exchange losses, can negatively impact investor sentiment.

6. Analyst Ratings and Market Sentiment

Analyst recommendations significantly influence stock prices. For example, Jefferies raised its target price for IndiGo, citing expectations of strong demand growth and capacity expansion. Positive analyst outlooks can boost investor confidence, leading to an increase in share price.

Risks and Challenges for INDIGO Share Price

Here are 6 key risks and challenges that may affect the IndiGo (InterGlobe Aviation Ltd.) share price:

1. Rising Fuel Costs

One of the biggest challenges for IndiGo is the high cost of aviation fuel. Since fuel makes up a large portion of an airline’s expenses, even a small increase in fuel prices can significantly affect profits. If global oil prices rise or taxes on fuel increase, IndiGo’s operational costs can go up, which may lead to lower profits and could put pressure on the share price.

2. Fluctuations in the Rupee-Dollar Exchange Rate

IndiGo pays for aircraft leases, spare parts, and maintenance in U.S. dollars. If the Indian rupee becomes weaker against the dollar, the company has to spend more money in rupee terms. This increases costs and reduces earnings. Currency volatility is a financial risk that can directly impact IndiGo’s balance sheet and investor confidence.

3. Aircraft Grounding and Technical Issues

Technical issues with aircraft engines or delays in deliveries can disrupt IndiGo’s operations. In recent times, IndiGo has faced challenges due to the grounding of planes because of engine problems. This reduces available capacity, affects flight schedules, and increases repair and maintenance costs, which can hurt both revenue and share price.

4. Tough Competition in the Airline Industry

The Indian aviation sector is very competitive, with players like Air India, Akasa Air, and Vistara offering aggressive pricing and better services. Price wars and discounting can reduce IndiGo’s profit margins. If competitors gain market share or offer better customer experience, IndiGo might face pressure on both revenues and market reputation.

5. Government Policies and Regulations

Changes in government rules, airport fees, or taxes can have a direct impact on IndiGo’s costs and operations. For example, increased airport user fees or stricter safety and environment regulations may result in higher operating expenses. Any unexpected policy changes can also create uncertainty in the market and affect investor sentiment.

6. External Events and Global Uncertainty

Global events like pandemics, geopolitical tensions, or natural disasters can affect air travel demand. For example, a war or health crisis can lead to fewer people flying, causing a drop in passenger revenue. These unpredictable events pose a serious challenge for IndiGo and can result in short-term or even long-term dips in share value.

Read Also:- Tamboli Industries Share Price Target From 2025 to 2030