Indo Farm Equipment Share Price Target From 2025 to 2030

Indo Farm Equipment Share Price Target From 2025 to 2030: It demands judicious scrutiny of the fundamentals, technicals, and industry trends of a company prior to investment in the share market. Indo Farm Equipment Ltd., a leader in the business of manufacturing agricultural machinery and equipment, has recently been attracting the interest of investors with its see-saw pattern of prices and growth prospects. With growing mechanization of Indian agriculture and growing government attention to develop rural economies, firms such as Indo Farm Equipment are bound to experience a positive impact strongly in the coming years.

This report gives a detailed analysis of the performance of Indo Farm Equipment, technical direction, fundamentals, and future prospects for the years 2025 to 2030. We try to assist investors in making the decision to buy or sell this stock for their long term as well as short term investment plan.

Company Overview and Market Presence

Indo Farm Equipment Ltd. is a major producer of tractors, cranes, engines, and other agri-machinery. Indo Farm was initiated with the aim of empowering Indian farmers, and over a period of years, it has also built a stronger rural and semi-urban Indian base through the distribution of robust and affordable mechanization of farming.

The major drivers of Indo Farm are:

- Mechanization of Indian agriculture: While a majority proportion of Indian workforce continues to participate in agriculture work, the shift from labor-oriented to mechanized agriculture is leading to humongous demand for farm implements and tractors.

- Government initiatives and rural development projects: Farmers’ incentives to invest in tractors and equipment are directly mirrored in Indo Farm’s sales.

- International markets: The company has been looking into global markets, particularly developing countries, for its budget-friendly agricultural solutions.

- Growing attention to food security: As the need for greater farm outputs increases, so does the need for efficient farm machinery.

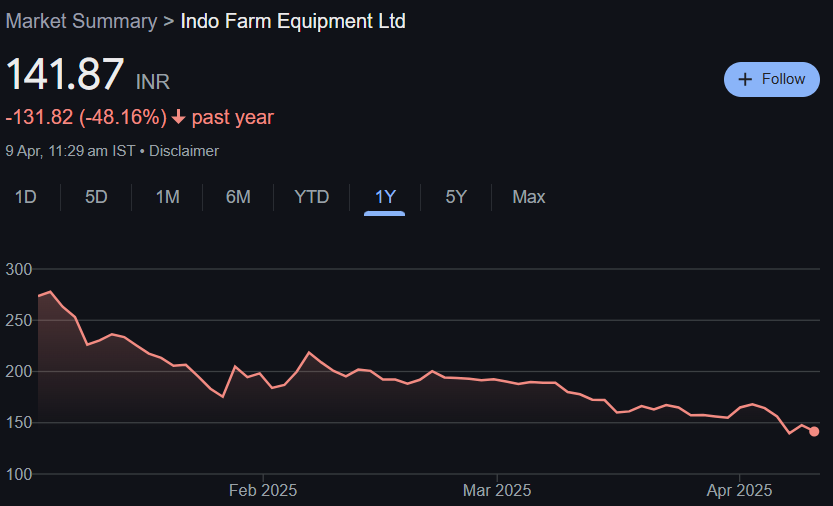

Current Stock Performance and Market Figures

As of the recent trading session, Indo Farm Equipment’s major market figures are given below:

- Current Open Price: ₹148.20

- High: ₹148.69

- Low: ₹141.08

- 52-week High: ₹293.20

- 52-week Low: ₹136.80

- Market Capitalization: ₹678.85 Crores

- P/E Ratio (TTM): 45.42

- EPS (TTM): ₹3.25

- Book Value: ₹109.47

- Dividend Yield: 0.00%

- Industry P/E: 18.94

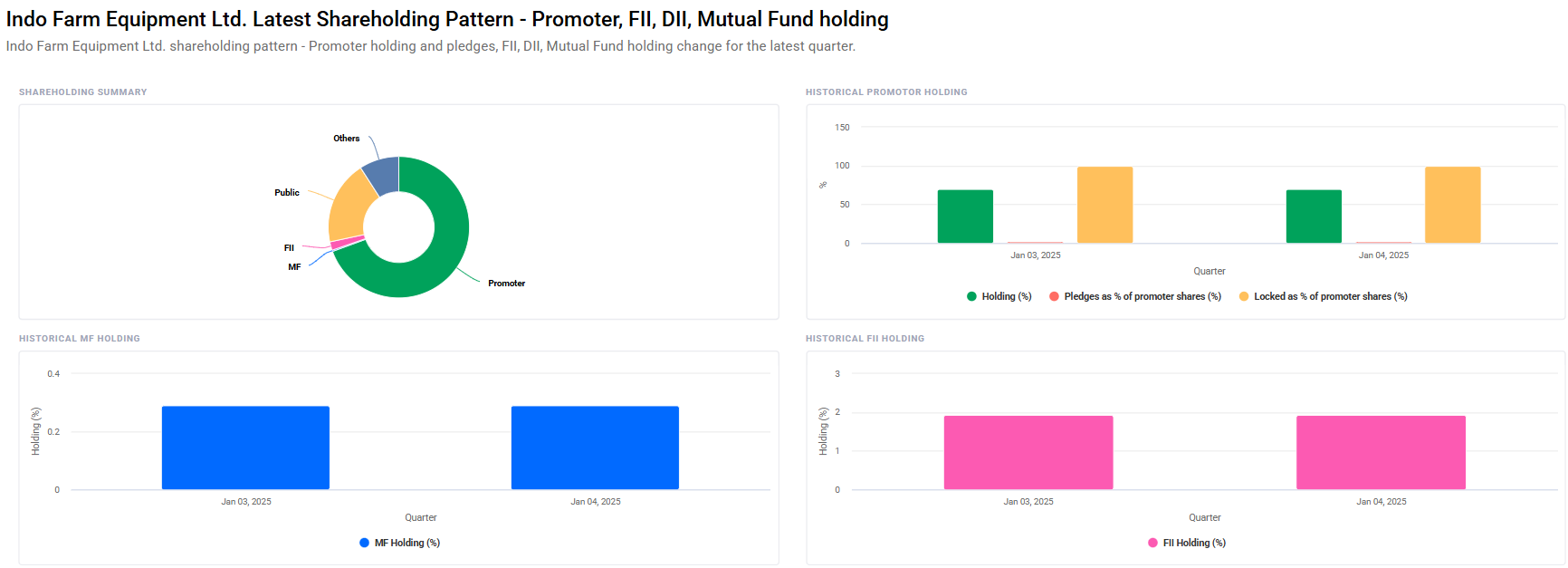

- Promoter Holding: 69.44%

- Retail & Others: 19.24%

- FII Holding: 1.94%

- Mutual Funds: 0.29%

- Daily Volume: ₹1.01 Crore

- Traded Value: 71,276

- Lower Circuit: ₹118.12

- Upper Circuit: ₹177.19

Despite its precipitous fall from its 52-week high, the company has good promoter confidence and moderate institutional holding.

Technical Analysis – What Do the Indicators Say?

Technically, Indo Farm Equipment Ltd. seems to be in bearish mood as some of the indicators suggest short-term weakness.

Day Technical Indicators:

- Momentum Score: 14.3 (reflects technical weakness)

- MACD (12, 26, 9): -9.9 (bearish)

- MACD Signal Line: -9.6

- ADX: 31.4 (moderate trend strength)

- RSI (14): 35.0 (almost at oversold level)

- ROC (21): -21.9 (negative momentum)

- MFI: 46.5 (neutral)

- ATR: 10.4 (high volatility)

Technical Conclusion:

- The near 30 level of RSI indicates the stock is at oversold level and could be due for a rally.

- The negative MACD is a confirmation of bearish momentum.

- Since ADX is more than 30, it is a trend, but from the other indicators, it is generally downward.

Investors will have to wait until technical verification comes to go short-term. Watch out for a crossover above ₹150 with volume support in favour of reversal.

Indo Farm Equipment Share Price Target 2025-2030

On the basis of present fundamentals, technical facts, and industrial projections, below are the share price targets of Indo Farm Equipment Ltd. over the next five years:

| YEAR | SHARE PRICE TARGET (₹) |

| 2025 | ₹300 |

| 2026 | ₹450 |

| 2027 | ₹600 |

| 2028 | ₹750 |

| 2029 | ₹900 |

| 2030 | ₹1050 |

Basis for Projections

- 2025: Anticipated sector turnaround and higher rural demand can spur the stock to recover from levels seen now to ₹300 levels.

- 2026: With persistent capex and sales expansion, the stock can see another rebound to ₹450 levels.

- 2027-2028: Export market growth and new product expansions can spur enhanced profits, and the price climbs to ₹600–750.

- 2029-2030: If growth sustains and profitability increases, Indo Farm can be a mid-cap winner, crossing ₹1,000 maybe.

Investment Strategy

Short-Term Investors (Less than 2 Years)

- Risk Level: High

- Strategy: Watch closely. Let price move above ₹150 for a break on the upside.

- Target: ₹300 by end-2025.

Medium-Term Investors (3-5 Years)

- Risk Level: Moderate

- Strategy: Ride dips around ₹140 or lower. Hold for strong sector recovery.

- Target: ₹600-₹750 by 2028.

Long-Term Investors (5+ Years)

- Risk Level: Low to Moderate

- Strategy: Invest in small pieces over the long term. Strong fundamentals and rural mechanization trends underpin long-term growth.

- Target: ₹1,000+ in 2030.

Risks and Challenges

All investments carry risks. For Indo Farm Equipment Ltd., the key concerns are:

- Sector Cyclicality: Farm equipment demand is weather- and season-based on monsoon cycles.

- Regulatory Headwinds: Governmental shifts in subsidy and import/export policies can impact margins.

- Input Cost Volatility: Increases in fuel and steel prices can affect profitability.

- Technological Competition: Foreign competition using more efficient machinery can decimate margins.

- Bearish Technicals: Technicals are now weak; reversal yet to be established.

Indo Farm Equipment Ltd. has demonstrated world-class long-term potential since it is favorably placed in the rural machinery space. Short-term indicators suggest weakness and consolidation, but long-term script intact for long-term investors.

Multibagger return expectation seekers in the period of 5-6 years might find Indo Farm Equipment Ltd. as an appropriate opportunity depending upon their short-term and market volatility risk appetite.

FAQs For Indo Farm Equipment Share Price

1. Indo Farm Equipment Ltd. can it be bought now?

The stock is technically in bearish trend. Short-term investor may wait for the breakout at ₹150. Long-term investors may observe accumulation at present levels for owners of time horizon of 5+.

2. What is the target share price of Indo Farm Equipment in 2025?

The target share price of the share in 2025 would be approximately ₹300, with sectoral rebound and improved demand.

3. Will Indo Farm Equipment touch ₹1,000?

Yes, due to future growth potential, improving profitability, and plans to expand, the stock can touch ₹1,050 in 2030.

4. What are the investment risks in Indo Farm Equipment?

Material risks are cyclical nature of the industry, fluctuation in raw material prices, international competition, and regulatory complexities.

5. What is the promoter’s stake in the company?

There is a highly controlling 69.44% with the promoters, reflecting the faith it has in business.

6. Is Indo Farm Equipment a dividend-paying company?

The company is not paying dividends at present, reflecting that it’s plowing back the profits to expand.

7. How is Indo Farm performing compared to industry players?

Its P/E ratio of 45.42 is higher than the industry average price, indicating that the investors are keen to see growth in future earnings. But its low Return on Capital (ROC) indicates potential for improvement in the efficiency front.