IOC Share Price Target Tomorrow 2025 To 2030

Indian Oil Corporation (IOC) is one of India’s largest and most trusted government-owned energy companies. It plays a key role in supplying fuel and energy to millions of people across the country. IOC operates a wide network of refineries, fuel stations, and pipelines, making it a major player in India’s oil and gas sector. Over the years, it has also started looking at cleaner energy options like electric charging stations and green fuels to support the environment. IOC Share Price on NSE as of 30 May 2025 is 143.75 INR.

IOC Share Market Overview

- Open: 144.25

- High: 144.83

- Low: 142.62

- Previous Close: 144.20

- Volume: 7,054,326

- Value (Lacs): 10,137.07

- 52 Week High: 185.97

- 52 Week Low: 110.72

- Mkt Cap (Rs. Cr.): 202,922

- Face Value: 10

IOC Share Price Chart

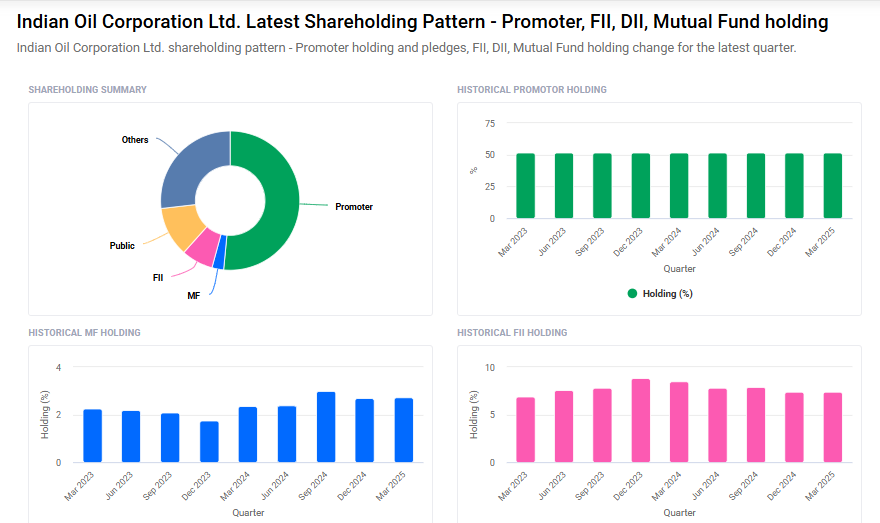

IOC Shareholding Pattern

- Promoters: 51.5%

- FII: 7.4%

- DII: 29.5%

- Public: 11.6%

IOC Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹190 |

| 2026 | ₹230 |

| 2027 | ₹270 |

| 2028 | ₹310 |

| 2029 | ₹350 |

| 2030 | ₹390 |

IOC Share Price Target 2025

IOC share price target 2025 Expected target could ₹190. Here are five key factors influencing the growth of Indian Oil Corporation (IOC) share price target for 2025:

-

Strong Financial Performance and Dividend Yield

In Q4 FY25, IOC reported a standalone net profit of ₹7,264.85 crore, marking a 50% year-on-year increase, driven by inventory gains. This robust performance has led to positive investor sentiment, further supported by a generous dividend payout, making IOC an attractive option for long-term investors. -

Refinery Expansion Projects

IOC is undertaking significant expansion of its Panipat, Gujarat, and Barauni refineries, aiming to increase capacity and integrate petrochemical production. These projects, expected to be completed by December 2025, are poised to enhance IOC’s refining capabilities and revenue potential. -

Diversification into Emerging Sectors

To align with future energy trends, IOC plans to diversify its operations beyond traditional oil and gas. The company is exploring entry into sectors like data centres, nuclear power, battery manufacturing, and critical mineral mining, aiming for a revenue target of $1 trillion by 2047. -

Analyst Ratings and Price Targets

Analysts have provided varied price targets for IOC, with a median 12-month target of ₹158.09, a high estimate of ₹214.00, and a low estimate of ₹85.00. The consensus rating is “Buy,” reflecting confidence in IOC’s growth prospects. -

Government Policies and Energy Demand

India’s legislative efforts to boost oil and gas exploration, including policy stabilization and extended lease periods, aim to reduce reliance on imported crude oil. Such initiatives can positively impact IOC’s operations and profitability, given its significant role in India’s energy sector.

IOC Share Price Target 2030

IOC share price target 2030 Expected target could ₹390. Here are 5 key risks and challenges that could impact Indian Oil Corporation’s (IOC) share price target by 2030:

-

Transition to Renewable Energy:

The global shift toward clean and renewable energy sources poses a long-term risk to IOC’s core fossil fuel-based business. Reduced demand for petroleum products could affect refinery utilization and overall revenue growth. -

Regulatory and Environmental Pressures:

Stricter environmental regulations, both in India and internationally, may lead to higher compliance costs. Delays in meeting carbon emission targets or transitioning to greener operations could result in penalties or reputational damage. -

Volatility in Crude Oil Prices:

IOC’s profitability is closely tied to global crude oil prices. High volatility due to geopolitical tensions or supply-demand imbalances can lead to inventory losses and margin pressure, affecting investor confidence. -

Subsidy Burden and Government Intervention:

As a public sector undertaking, IOC may be required to absorb fuel subsidies or sell products below market price to manage inflation. Such interventions can hurt profitability and restrict investment capacity. -

Slowdown in Capex Execution and Diversification:

If IOC fails to timely execute its refinery expansions or diversification into non-core areas like data centers and clean energy, it may lag behind private peers and lose market share, limiting future growth potential.

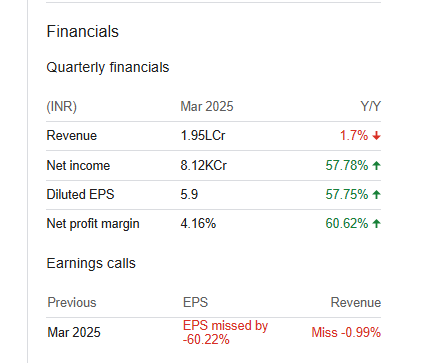

IOC Financials Statement

| (INR) | 2025 | Y/Y change |

| Revenue | 7.58T | -2.35% |

| Operating expense | 820.60B | 16.81% |

| Net income | 135.98B | -67.41% |

| Net profit margin | 1.79 | -66.73% |

| Earnings per share | 8.32 | -71.08% |

| EBITDA | 360.37B | -53.12% |

| Effective tax rate | 19.19% | — |

Read Also:- SNL Bearings Share Price Target Tomorrow 2025 To 2030