ITC Share Price Target Tomorrow 2025 To 2030

ITC is a well-known Indian company that started mainly as a tobacco business but has grown into a large group with many different businesses. Today, ITC works in areas like packaged foods, personal care products, paper, and hotels. The company is famous for its popular brands and focuses on providing good quality products to its customers. ITC also cares about the environment and works on sustainable business practices. ITC Share Price on NSE as of 26 May 2025 is 436.00 INR.

ITC Share Market Overview

- Open 434.00

- High 439.00

- Low 429.00

- Previous Close 426.10

- Volume 18,536,884

- Value (Lacs) 80,876.42

- 52 Week High 528.50

- 52 Week Low 390.15

- Mkt Cap (Rs. Cr.) 545,991

- Face Value 1

ITC Share Price Chart

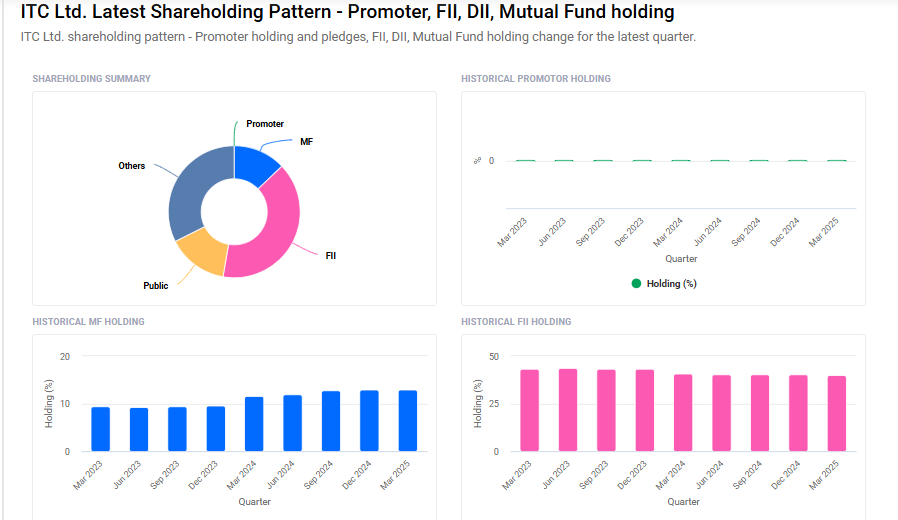

ITC Shareholding Pattern

- Promoters: 0%

- FII: 39.9%

- DII: 45.2%

- Public: 14.9%

ITC Share Price Target Tomorrow 2025 To 2030

| Hindustan Motors Share Price Target Years | Hindustan Motors Share Price |

| 2025 | ₹530 |

| 2026 | ₹550 |

| 2027 | ₹570 |

| 2028 | ₹590 |

| 2029 | ₹610 |

| 2030 | ₹630 |

ITC Share Price Target 2025

ITC share price target 2025 Expected target could ₹530. Here are 5 key factors affecting the growth of ITC’s share price target for 2025:

-

Diversification Beyond Cigarettes

ITC’s efforts to grow its FMCG, agribusiness, and hotel segments are crucial. Strong performance in these areas can reduce reliance on tobacco revenue and boost long-term valuation. -

Cigarette Business Stability

The cigarette segment remains ITC’s largest revenue contributor. Stable taxation, consistent volume growth, and regulatory support will play a vital role in maintaining profit margins. -

FMCG Margin Expansion

Improving profitability in the FMCG segment through scale, branding, and supply chain efficiency can drive earnings growth and investor confidence. -

Capital Allocation and De-merger Plans

Investor sentiment is also influenced by ITC’s capital strategy, including plans to demerge its hotel business. Clear communication and execution can unlock shareholder value. -

Macroeconomic and Rural Demand Trends

As a consumer-facing company, ITC is sensitive to inflation, rural consumption, and economic recovery. Strong rural demand and stable input costs can support volume growth across segments.

ITC Share Price Target 2030

ITC share price target 2030 Expected target could ₹630. Here are 5 key risks and challenges that could impact ITC’s share price target by 2030:

-

Regulatory and Taxation Pressure on Tobacco

Being heavily dependent on cigarettes, ITC faces risks from increasing government regulations, higher taxes, and stricter anti-tobacco policies, which could hurt sales and profits. -

Intense Competition in FMCG

The FMCG market is highly competitive with many established players and new entrants. ITC must continuously innovate and invest in branding to maintain and grow market share. -

Economic Slowdown and Consumer Spending

A slowdown in the economy, especially in rural and semi-urban areas, can reduce consumer spending power, affecting demand for ITC’s diverse product portfolio. -

Raw Material Price Volatility

Fluctuations in prices of raw materials like agri-commodities, packaging materials, and fuel can increase production costs and squeeze margins. -

Execution Risks in Diversification Strategy

ITC’s success depends on how well it executes its diversification into FMCG, hotels, and agribusiness. Any delay or failure in scaling these businesses can impact overall growth and investor confidence.

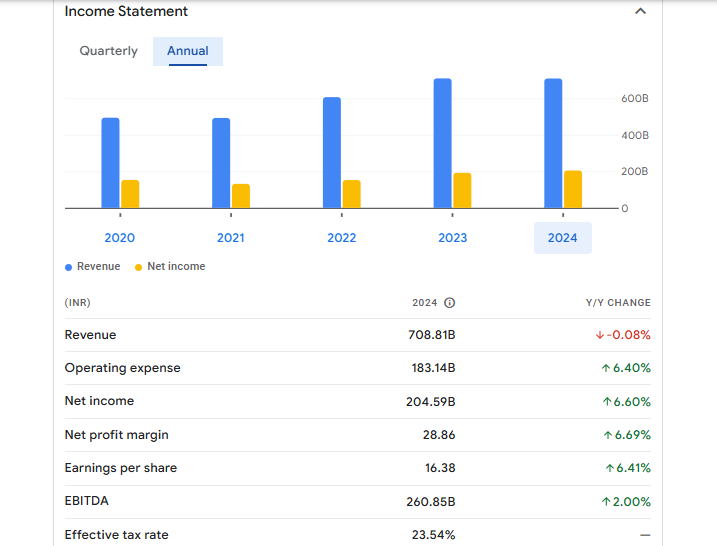

ITC Financials Statement

| (INR) | 2024 | Y/Y change |

| Revenue | 708.81B | -0.08% |

| Operating expense | 183.14B | 6.40% |

| Net income | 204.59B | 6.60% |

| Net profit margin | 28.86 | 6.69% |

| Earnings per share | 16.38 | 6.41% |

| EBITDA | 260.85B | 2.00% |

| Effective tax rate | 23.54% | — |

Read Also:- Infosys Share Price Target Tomorrow 2025 To 2030