ITD Cementation Share Price Target Tomorrow 2025 To 2030

ITD Cementation India Limited is a well-established engineering and construction company with a rich history dating back to 1931. Headquartered in Mumbai, the company has been instrumental in building India’s infrastructure, specializing in heavy civil and infrastructure projects. Their expertise spans a wide range of areas, including maritime structures, mass rapid transit systems, airports, highways, bridges, tunnels, dams, and industrial buildings. ITD Cementation Share Price on NSE as of 17 April 2025 is 522.85 INR.

ITD Cementation Share Market Overview

- Open: 530.00

- High: 534.60

- Low: 520.35

- Previous Close: 528.35

- Volume: 127,044

- Value (Lacs): 663.74

- VWAP: 525.67

- UC Limit: 634.00

- LC Limit: 422.70

- 52 Week High: 694.30

- 52 Week Low: 337.05

- Mkt Cap (Rs. Cr.): 8,975

- Face Value: 1

ITD Cementation Share Price Chart

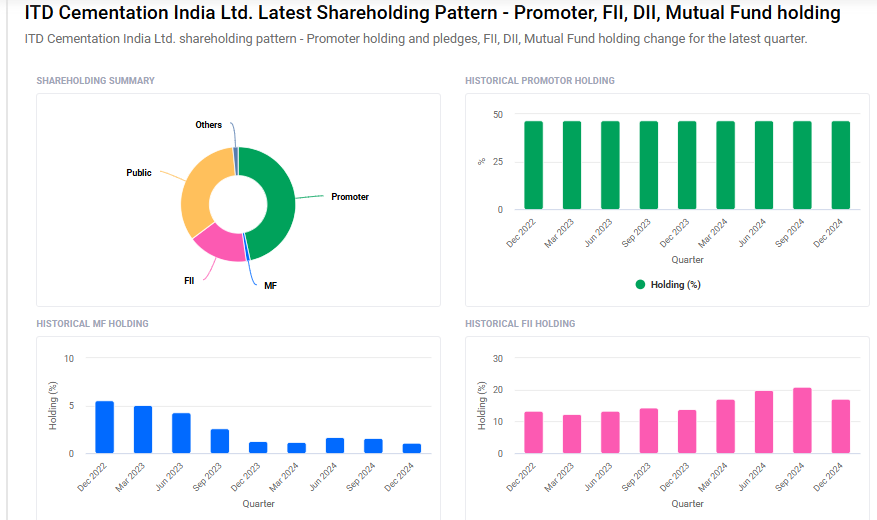

ITD Cementation Shareholding Pattern

- Promoters: 46.6%

- FII: 17%

- DII: 2.6%

- Public: 33.7%

ITD Cementation Share Price Target Tomorrow 2025 To 2030

- 2025 – ₹700

- 2026 – ₹900

- 2027 – ₹1100

- 2028 – ₹1300

- 2030 – ₹1500

Major Factors Affecting ITD Cementation Share Price

Here are six key factors that influence the share price of ITD Cementation India Ltd:

1. Strong Financial Performance

ITD Cementation has demonstrated consistent financial growth, with net sales increasing at an annual rate of 26.77% and operating profit growing by 39.23%. Additionally, the company has reported positive results for nine consecutive quarters, reflecting robust operational efficiency.

2. Potential Acquisition by Adani Group

In September 2024, reports emerged that the Adani Group is a leading contender to acquire a 46.6% promoter stake in ITD Cementation. This potential acquisition, valued at ₹5,890 crore, has generated significant investor interest, as it could enhance the company’s growth prospects and market reach.

3. Moderate Valuation Metrics

The company’s stock is currently trading at a price-to-earnings (P/E) ratio of approximately 26.03 and a price-to-book (P/B) ratio of 5.56. These metrics suggest that the stock is moderately valued, which can influence investor decisions based on perceived growth potential.

4. Low Market Volatility

With a beta of 0.52, ITD Cementation’s stock exhibits lower volatility compared to the broader market. This stability can be appealing to risk-averse investors seeking steady returns.

5. Seasonal Stock Performance

Historically, the company’s stock has shown positive returns in April, delivering gains in 12 out of the past 17 years. This seasonal trend may influence short-term trading strategies and investor sentiment during this period.

6. Technical Indicators and Market Trends

Recently, ITD Cementation’s stock price crossed below its 200-day moving average, a technical indicator often interpreted as a bearish signal. Such movements can affect investor confidence and lead to increased market scrutiny.

Risks and Challenges for ITD Cementation Share Price

Here are six key risks and challenges that could impact the share price of ITD Cementation India Ltd:

1. Project Execution Delays

ITD Cementation has faced delays in completing some of its projects, which affected revenues by approximately 15% compared to projections. Such delays can lead to increased costs and reduced profitability, potentially impacting investor confidence.

2. High Debt Levels

The company reported a debt-to-equity ratio of 1.2 as of March 2023, which is above the industry average. High debt levels can make the company more vulnerable to interest rate fluctuations and limit its financial flexibility.

3. Dependence on Government Contracts

Approximately 70% of ITD Cementation’s revenues were derived from government contracts in the year 2022-2023. This heavy reliance means that any changes in government policies or budget allocations could significantly affect the company’s revenue stream.

4. Environmental and Regulatory Risks

Construction activities are subject to environmental regulations and potential disruptions. ITD Cementation is exposed to risks related to environmental compliance, which can lead to project delays and increased costs if not managed properly.

5. Competitive Market Pressures

The construction industry is highly competitive, with many players vying for limited projects. This competition can lead to price undercutting and reduced profit margins, posing a challenge to maintaining profitability.

6. Challenges in Securing Financing

The company faces challenges in securing financing, especially in a high-interest-rate environment. Increased cost of capital can reduce profitability and limit the company’s ability to invest in new projects.

Read Also:- Emcure Share Price Target Tomorrow 2025 To 2030