Jayatma Enterprises Share Price Target Tomorrow 2025 To 2030

Jayatma Enterprises Ltd is a publicly listed company based in Ahmedabad, Gujarat, India. Established on December 31, 1979, it is primarily engaged in warehousing rental services and trading in raw cotton bales and other textile products . The company operates under the ticker symbol 539005 on the Bombay Stock Exchange (BSE). Jayatma Enterprises Share Price on BOM as of 12 May 2025 is 12.70 INR.

Jayatma Enterprises Share Market Overview

- Current Price: ₹12.7

- High / Low: ₹24.1 / 12.7

- Market Cap: ₹3.81 Cr.

- Stock P/E: 8.28

- Book Value: ₹25.3

- Dividend Yield: 0.00 %

- ROCE: 0.41 %

- ROE: 0.14 %

- Face Value: ₹10.0

Jayatma Enterprises Share Price Chart

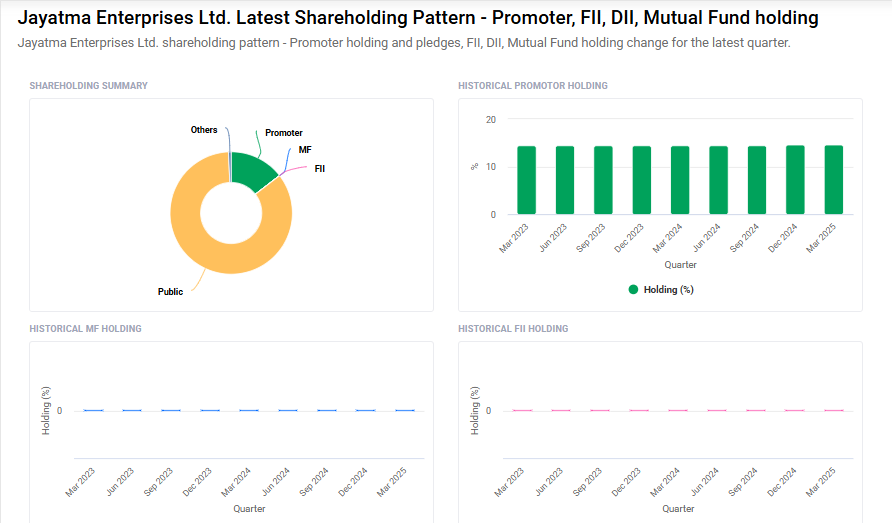

Jayatma Enterprises Shareholding Pattern

- Promoters: 14.6%

- FII: 0%

- DII: 0.7%

- Public: 84.8%

Jayatma Enterprises Share Price Target Tomorrow 2025 To 2030

| Jayatma Enterprises Share Price Target Years | Jayatma Enterprises Share Price |

| 2025 | ₹25 |

| 2026 | ₹35 |

| 2027 | ₹45 |

| 2028 | ₹55 |

| 2029 | ₹70 |

| 2030 | ₹80 |

Jayatma Enterprises Share Price Target 2025

Jayatma Enterprises share price target 2025 Expected target could ₹25. Here are four key factors affecting the growth of Jayatma Enterprises Ltd. and its share price target for 2025:

-

Revenue Growth from Warehousing Rentals: Jayatma Enterprises primarily generates income through warehousing rental services. An increase in demand for storage space, especially in e-commerce and logistics sectors, could boost rental income and positively impact share performance.

-

Fluctuations in Cotton Trading: The company’s involvement in trading raw cotton bales and other textile products exposes it to commodity price volatility. Significant price changes in cotton can affect profit margins and overall financial stability.

-

Operational Efficiency and Profitability: Improving operational efficiency and maintaining healthy profit margins are crucial for sustaining growth. Any decline in profitability could negatively impact investor confidence and stock performance.

-

Market Perception and Investor Sentiment: The stock’s valuation is influenced by market perception and investor sentiment. Currently, the stock is considered overvalued by approximately 23%, which may affect future investment decisions and share price movement.

Jayatma Enterprises Share Price Target 2030

Jayatma Enterprises share price target 2030 Expected target could ₹80. Here are four risks and challenges that could impact the share price target of Jayatma Enterprises Ltd. by 2030:

-

Revenue Volatility and Declining Performance: Jayatma Enterprises has experienced significant revenue fluctuations, including a 59.43% quarter-on-quarter decline in the latest financial period—the steepest drop in the past three years. Such volatility raises concerns about the company’s ability to maintain consistent earnings growth, which is crucial for long-term investor confidence and share price appreciation.

-

Exposure to Commodity Price Fluctuations: The company’s involvement in trading raw cotton bales and other textile products exposes it to the inherent volatility of commodity markets. Significant price swings in cotton can adversely affect profit margins and financial stability, potentially leading to unpredictable earnings and affecting stock performance.

-

Operational Efficiency and Profitability Concerns: In the fiscal year ending March 31, 2024, Jayatma Enterprises allocated 22.1% of its operating revenues to employee costs and 4.26% to interest expenses. Such high operational expenditures, coupled with declining revenues, may strain profitability and hinder the company’s ability to reinvest in growth initiatives, impacting long-term value creation.

-

Market Perception and Valuation Risks: Currently, Jayatma Enterprises is considered overvalued by approximately 23%, based on its current stock price relative to earnings and industry benchmarks. This overvaluation, combined with inconsistent financial performance, could lead to investor skepticism and potential downward pressure on the share price if the company fails to meet growth expectations.

Read Also:- Radhagobind Comm Share Price Target Tomorrow 2025 To 2030